Market Data

August 26, 2021

CRU Economic Briefing: Winter is Coming

Written by Alex Tuckett

By CRU Principal Economist Alex Tuckett, from CRU’s Global Steel Trade Service, Nov. 18

The world economy is facing multiple headwinds. Supply-chain problems continue to hold back industrial sectors and elevate inflation. Meanwhile, an energy crisis is adding to the pressure on manufacturers and consumers.

On the demand side, the biggest risk remains the Chinese construction sector, although Covid-19 continues to lurk. Globally, construction has had a strong recovery from the crisis, but high energy prices and supply-chain problems threaten this.

After growth in China and the Eurozone for Q3 surprised on the upside, we have revised up our forecast for 2021 growth to 5.6% from 5.4%; however, we have cut our forecast for global growth in 2022 to 4.7% from 4.8%, and for industrial production to 4.2% from 4.3%.

Energy Squeeze Adds to Supply-Chain Woes

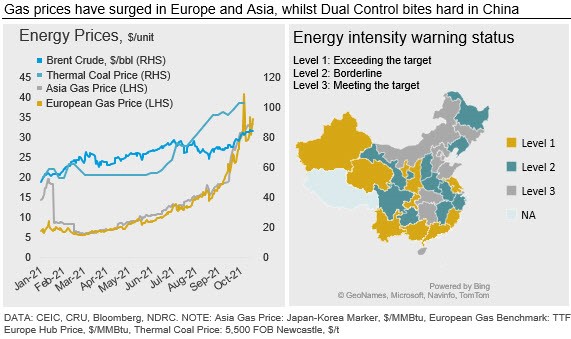

Energy prices are surging (Chart 1, left-hand side), pushed higher by a number of factors both global and local:

• In many regions, inventories for oil, gas and coal have not been rebuilt after cold winters last year.

• China and other Asian countries have shifted from coal to gas to reduce emissions.

• Hurricane Ida has disrupted oil and gas production in the U.S.

• Russian exports of gas to the EU have been lower than in previous years, perhaps to underline the case for Nord Stream 2.

• Yields from renewable power in Europe have been low.

Higher energy prices will lift inflation in Europe and other regions, causing headaches for consumers and central banks. It is having a particularly severe effect on producers in energy-intensive sectors – including aluminum and steel.

In China, the issue is not just high prices but outright shortages. A combination of coal shortages and the Dual Control regime for energy intensity is forcing manufacturers across many sectors to shut down.

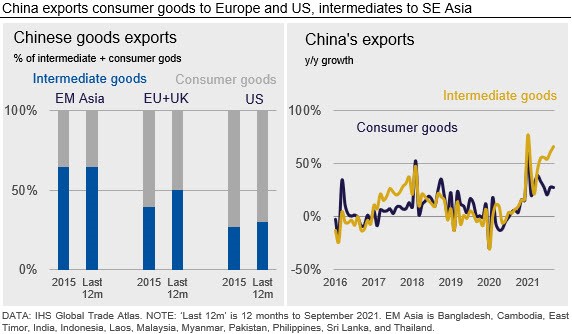

These disruptions in China will have knock-on consequences for industrial production in other countries. China tends to export more final consumer goods to advanced economies, and more intermediate goods to emerging economies in South and Southeast Asia (chart below, left-hand side). However, China’s role in global value chains generally has grown over time (chart below). And the semiconductor crisis has shown how supply shortages can have dramatic and unpredictable effects on unexpected sectors. For example, the shutdown of many magnesium producers in China – a highly energy intensive metal to produce – is already threatening the ability of Europe to produce aluminum alloys vital to the automotive sector.

We expect the power crisis to ease in China as the government responds, and as annual Dual Control targets are reset from January 2022. Globally, energy prices should fall in 2022 Q1 as supply responds and we move out of winter. However, this is another headwind for the global recovery at a time when it is struggling with supply-chain problems. The extent to which these disruptions are holding back growth in the industrial sector is shown by the gap between new orders and output in the manufacturing sector. We estimate that without these disruptions, German manufacturing output would have been around 12% higher in 2021 Q2. This would have directly boosted GDP almost 2.5%. Depending on the data for September, that figure could grow to around 20% (4% of GDP) in Q3. In other words, without these disruptions Germany would be experiencing an incredibly rapid recovery. This simple calculation does not account for the knock-on effects that manufacturing’s problems are having on other sectors through supply chains, lost income and consumer confidence.

The impact on the U.S. has – so far – been more modest; we estimate around 0.4% on the level of GDP. This is partly because manufacturing is a much smaller share of the U.S. economy, but also because – at least based on this measure of supply-chain disruption – the impact has so far been more modest. However, data for September showed an unexpected 0.7% fall in manufacturing output, suggesting that supply-chain problems are biting harder. We have downgraded our forecast for IP growth this year for all three major economies, and in 2022 for China and the Eurozone.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com