Analysis

August 19, 2021

Final Thoughts

Written by Tim Triplett

Lead times have shortened noticeably based on Steel Market Update’s check of the market this week. But don’t read too much into that one data point. Other factors point to more of the same for steel prices, at least for a while.

As reported elsewhere in this issue, lead times appear to have shortened by a week or more for spot orders of hot rolled, cold rolled and plate. Lead times for coated products remain about the same. Even at a week shorter, average HR lead times are still longer than nine weeks, double the delivery times in a typical market – so they have a ways to go before they normalize.

Lead times get a lot of scrutiny because where lead times go, prices follow. At least that’s the conventional wisdom. But it certainly doesn’t happen immediately, and there are many other factors to consider in terms of supply and demand.

Some experts believe steel prices are in for a sharp correction once new capacity at SDI, Nucor and elsewhere is fully up and running in the months to come and as more imports reach U.S. shores. Others believe that new capacity is needed to make up for idlings and closures announced by mills not just since the early days of the pandemic but over the last 10-20 years as well. Finished steel imports are up by 18% this year. But, so far at least, supplies remain tight and spot tons are still hard to come by.

Nearly two-thirds of the steel buyers polled by SMU this week haven’t yet seen any improvement in availability from domestic mills – about the same percentage as a month ago. And the other third reported back that any new availability is modest. Here are a few of their comments:

“Minor amounts, but at least it’s more.”

“Yes, there’s more availability, but it’s not necessarily reflected in the price – yet.”

“We still aren’t getting the full ask from any of our vendors.”

“No big price drops – just shorter lead times and small pockets of spot offers.”

“I am not seeing any more availability, but I hear from others that they expect more later this year.”

“They will throw tiny amounts out there at ridiculously high numbers. If you express some interest, they normally will say, ‘It’s gone already.’ They are just testing the waters and still playing their games.”

On the demand side, there seems to be a small, subtle shift in a negative direction. But record-high steel prices still have not cut into demand to any great degree. About 63% of buyers polled this week said demand for their products remains about the same, while 25% see demand continuing to improve. Only 12% reported that demand from their customers is declining. That compares to 9% who saw demand declining and 35% who saw demand improving a month ago.

Here’s a few of their comments:

“We are still not seeing any signs of true ‘demand destruction.’ Likewise, our customer base has stopped complaining about escalating prices, too.”

“Things are slower now due to the chip shortage in automotive, but near-term demand is very good. We’re expecting a strong 2022.”

“Demand is down ever so slightly – not sure if it’s a trend yet.”

“Demand is steady, but I see headwinds.”

“Demand remaining the same sounds bad, but it’s actually very strong. Just the same as last month.”

When Will Prices Peak?

When will prices peak? Around 35% expect it to happen sometime in the fourth quarter. About half of the remainder predict sooner, and half later. A few predict that steel prices will keep rising into the second half of next year.

Where Will Prices Peak?

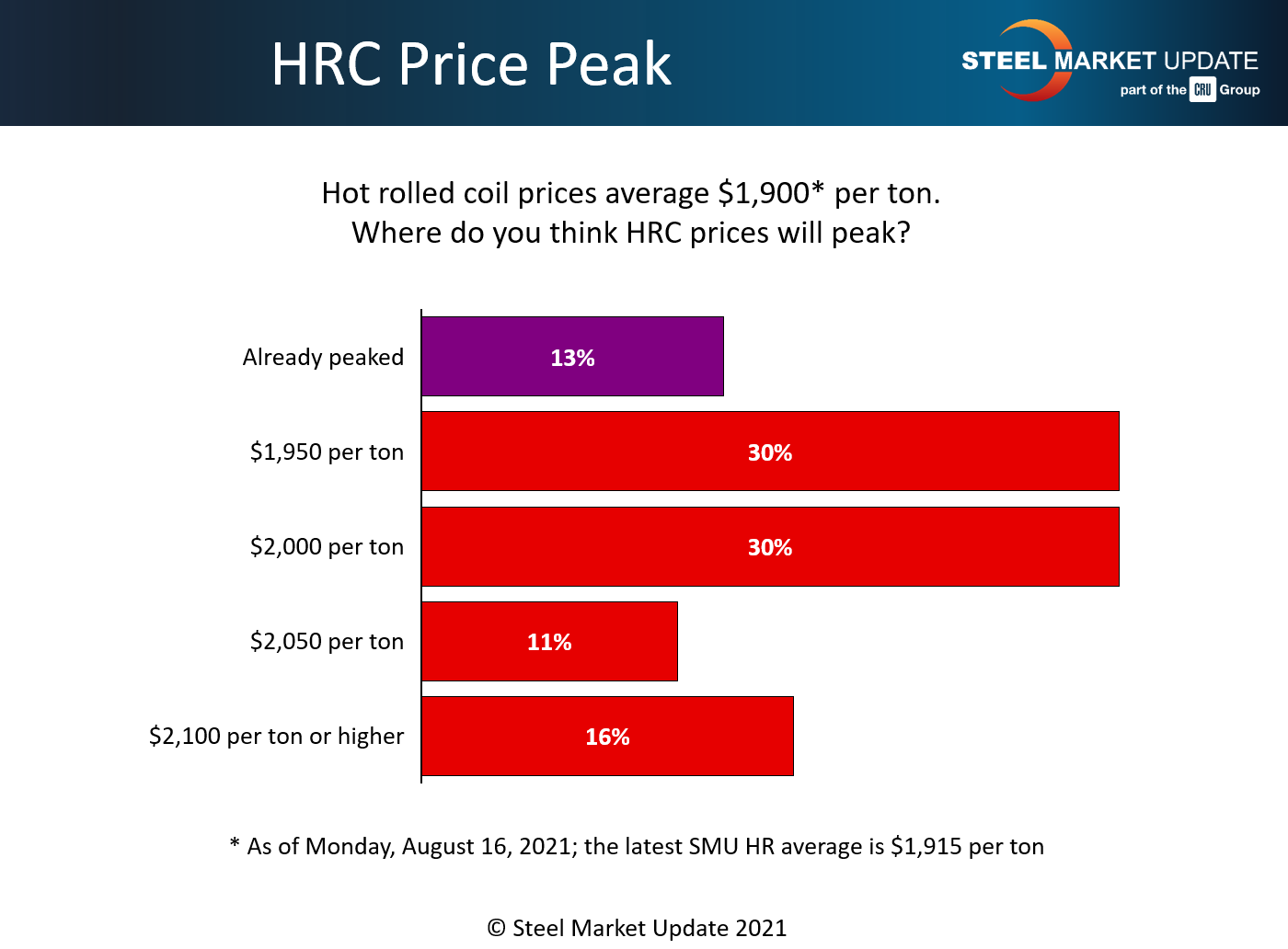

SMU’s check of the market this week puts the average price for spot orders of hot rolled at $1,915 per ton ($95.75 per cwt), the highest ever. Almost all those polled believe steel prices still have some legs. Sixty percent of respondents see the peak for hot rolled in the range from $1,950-2,000 per ton. Another 27% see HR prices going even higher.

Here’s a few of their comments:

“Prices are starting to peak, but we are still not there in the U.S.”

“Whether or not the domestic HR market has peaked is almost irrelevant. It peaked internationally two months ago, and the only thing left to happen is for the U.S. market to be impacted by the growing price gap.”

“It’ll be a slower climb from here on out. But pricing is still heading higher, without a doubt. $2,000/ton is right around the corner.”

“$2,000/ton is a lock, which is obviously ridiculous to say out loud. But the mills will maintain their upper hand well into 2022. And the dirty little secret is that service centers are still passing along these crazy numbers with ease, too.”

“Sometime later this year customers will just cut back on buys and mill order books will soften, but it will take a few months.”

SMU’s data, from lead times to demand, hints that there may be some change in the wind. But it’s a soft, gentle breeze so far. No storm clouds on the horizon yet.

SMU Events

SMU’s annual Steel Summit Conference kicks off on Monday. It’s still not too late to register for the virtual version of the event. You can learn more by clicking here.

SMU will host two workshops in October and November. On Oct. 5-6, we will virtually host our next Steel 101: Introduction to Steel Making & Market Fundamentals Workshop. You can learn more about the Steel 101 workshop by clicking here.

On Nov. 2-3 (half day each) we will virtually host the next Introduction to Steel Hedging: Managing Price Risk Workshop. You can learn more by clicking here.

As always, your business is truly appreciated by all of us here at Steel Market Update.

Tim Triplett, SMU Executive Editor, Tim@SteelMarketUpdate.com