Prices

August 17, 2021

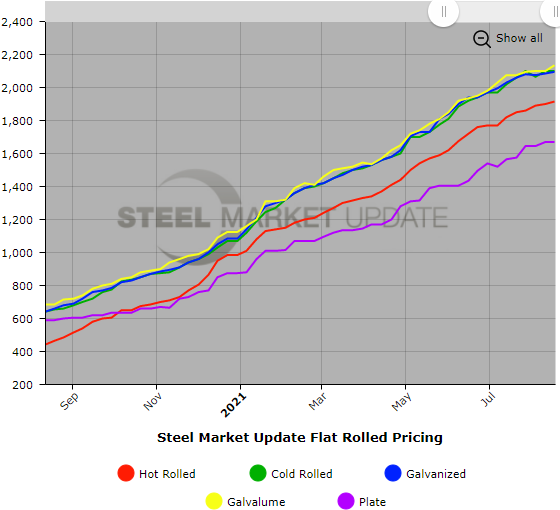

SMU Price Ranges & Indices: Slope of Increases Flattening?

Written by Brett Linton

Flat rolled and plate steel prices were flat to up modestly this week as the year-long uptrend appears to be flattening somewhat. Hot rolled hit yet another historical high mark at $1,915 per ton, according to Steel Market Update’s check of the market this week, up another $15. It’s too soon to tell if prices are nearing a real inflection point or if this is just a sign of summer doldrums. Roughly 60% of the industry executives responding to SMU’s questionnaire on Monday and Tuesday believe hot rolled prices will peak at $2,000 per ton or more before beginning to correct in the fourth quarter or first quarter next year. SMU’s Price Momentum Indicators continue to point toward higher prices over the next 30 days.

Hot Rolled Coil: SMU price range is $1,890-$1,940 per net ton ($94.50-$97.00/cwt) with an average of $1,915 per ton ($95.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago, while the upper end increased $20. Our overall average is up $15 per ton from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 7-12 weeks

Cold Rolled Coil: SMU price range is $2,010-$2,190 per net ton ($100.50-$109.50/cwt) with an average of $2,100 per ton ($105.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $70 per ton compared to last week, while the upper end increased $70. Our overall average is unchanged from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 9-13 weeks

Galvanized Coil: SMU price range is $2,010-$2,180 per net ton ($100.50-$109.00/cwt) with an average of $2,095 per ton ($104.75/cwt) FOB mill, east of the Rockies. Both lower and upper ends of our range increased $10 per ton compared to one week ago. Our overall average is up $10 per ton from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $2,079-$2,249 per ton with an average of $2,164 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 10-14 weeks

Galvalume Coil: SMU price range is $2,090-$2,180 per net ton ($104.50-$109.00/cwt) with an average of $2,135 per ton ($106.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week, while the upper end increased $60. Our overall average is up $35 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,381-$2,471 per ton with an average of $2,426 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-15 weeks

Plate: SMU price range is $1,550-$1,790 per net ton ($77.50-$89.50/cwt) with an average of $1,670 per ton ($83.50/cwt) FOB mill. The lower end of our range declined $10 per ton compared to one week ago, while the upper end increased $10 per ton. Our overall average is unchanged from last week. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 8-10 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.