Prices

August 9, 2021

U.S. Raw Steel Production Eases Slightly in June, Remains Elevated

Written by Brett Linton

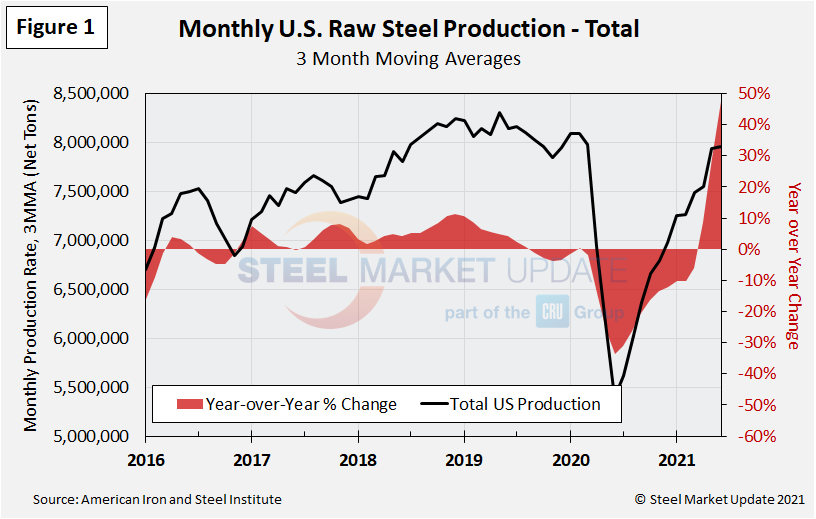

U.S. raw steel production eased in June to 7.90 million net tons, according to recently released American Iron and Steel Institute data. Although down 2.7% from the month prior, June marks the second-highest production level seen since January 2020 when 8.44 million tons were produced by domestic mills (May 2021 was a 16-month high). June production is up 2.45 million tons or 44.9% compared to the same month last year.

Note that AISI’s monthly production estimates are different than the weekly estimates SMU reports each Tuesday; the monthly estimates are based on over 75% of the domestic mills reporting versus only 50% reporting for the weekly estimates.

Figure 1 compares monthly production data on a three-month moving average (3MMA) basis to smooth out the month-to-month fluctuations. Raw production averaged 7.96 million tons between April and June 2021, the highest 3MMA level since March 2020. This quarterly average is up 6.3% versus the first quarter of the year, up 14.0% from the last quarter of 2020, and up 47.6% from Q2 2020. Recall that April through June 2020 production was the lowest 3MMA production level in our 12-year history at 5.39 million tons.

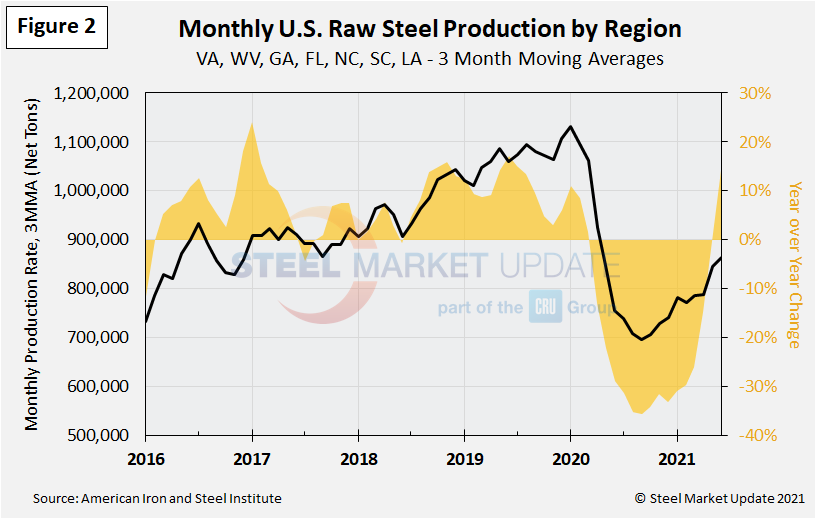

SMU is now publishing regional steel production data for the four regions responsible for 10% or more of total domestic production; Figure 2 shows 3MMA production history from the combined states of Virginia, West Virginia, Georgia, Florida, North Carolina, South Carolina and Louisiana. The latest 3MMA for June is 863,000 tons, the highest level since April 2020, and up 14.3% compared to the same period in 2020.

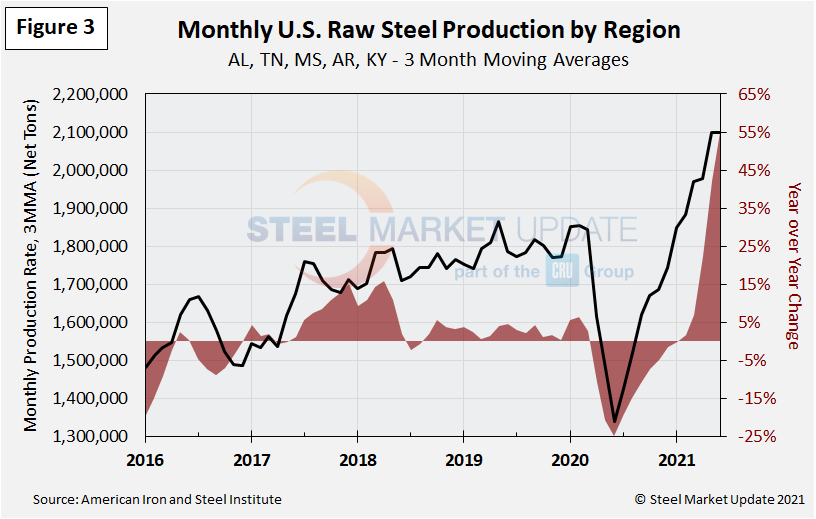

Figure 3 shows the combined production between Alabama, Tennessee, Mississippi, Arkansas and Kentucky. The June 3MMA is 2.10 million tons, the second highest level in SMU’s recorded history, just behind the month prior. Production among these states is up 56.5% year-over-year through June.

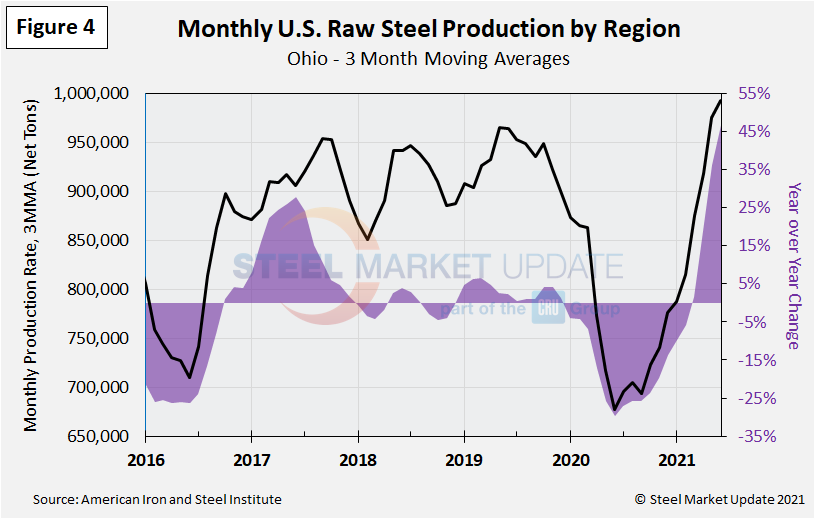

Figure 4 displays 3MMA production from Ohio, currently at 993,000 tons through June and up 46.6% over the same period in 2020. June represents the highest 3MMA seen since March 2015.

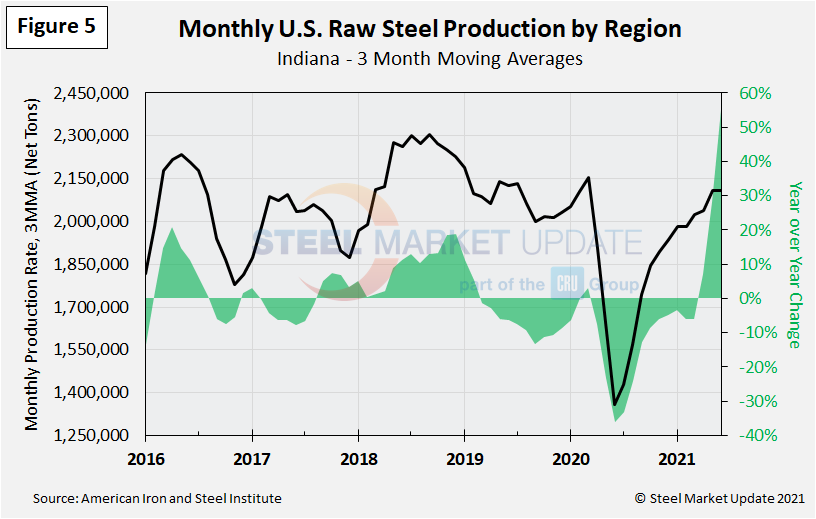

Figure 5 shows the 3MMA production levels from the state of Indiana through June. Production is now at 2.11 million tons, the highest production rate in 15 months. June 2021 production was up 55.2% compared to June 2020.

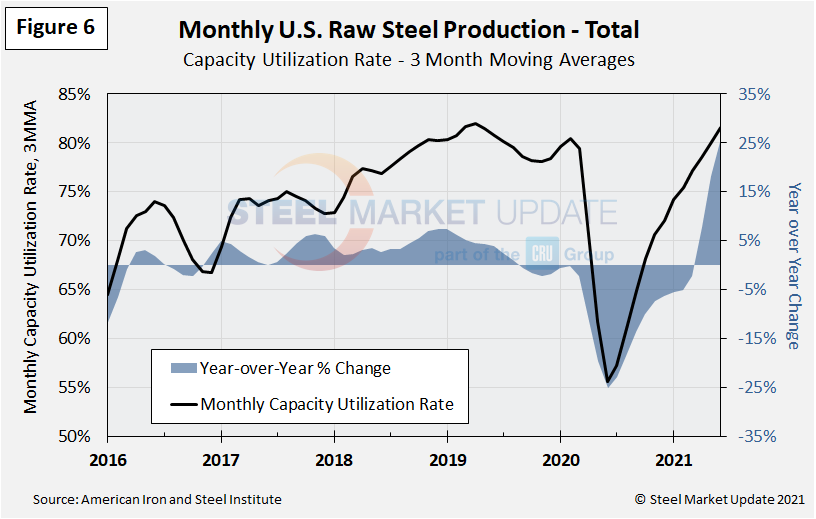

The mill capacity utilization rate for June was 83.0%, up from 81.0% in May, and up from 56.8% one year ago. The average capacity utilization rate for the year is now 79.4%, down from 67.8% in the same six-month period of 2020.

On a 3MMA basis, the capacity utilization rate through June increased to 81.6%, up 26.0% compared to the same period one year prior. As shown in Figure 6, this 3MMA rate has increased each month since the June 2020 low of 55.6%.

SMU Note: Additional raw steel production graphics are available in the Analysis section of our website here. If you need assistance logging into or navigating the website, contact us at info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com