Analysis

August 9, 2021

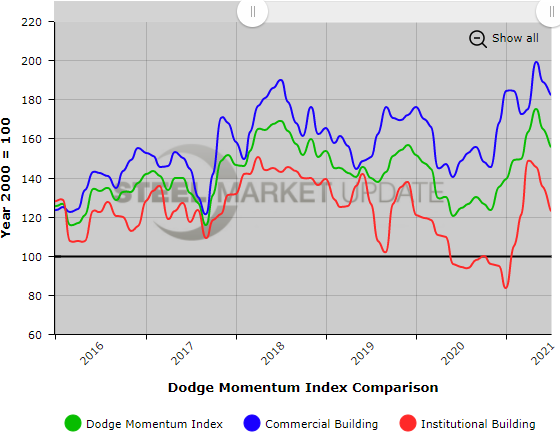

Dodge Momentum Index Dips 6% in July, Raising Concerns on Construction

Written by Brett Linton

The Dodge Momentum Index has declined for the second month in a row following six consecutive months of gains, suggesting that the pace of gains in the construction sector may be facing some headwinds. The index now stands at 155.8, down 5.5% from a revised June reading of 164.9, according to the latest Dodge Data & Analytics release.

![]()

Both components of the index declined in July, with commercial planning down 3% to 182.4 and institutional planning down 9% to 122.8.

Dodge Data & Analytics said the pressures caused by higher material prices and labor are unlikely to ease anytime soon and, when added to the rising number of COVID-19 cases caused by the Delta variant, raises concerns that the nascent recovery in construction may stall in the months ahead.

“The Momentum Index posted strong gains through much of the winter and spring as the economy and building markets began to stabilize following the recession. While the economy has continued its forward progress through the summer, the index has regressed somewhat as higher material prices and shortages of skilled labor continue to exert a strong influence over the construction sector. Despite the declines in June and July, the Momentum Index remains near levels last seen in 2018. Compared to a year earlier, the Momentum Index was 25% higher than in July 2020 – institutional planning was up 27% and commercial planning was 25% higher than last year.”

The Dodge Momentum Index is a key advance indicator of nonresidential construction demand, leading construction spending by as much as a year.

An interactive history of the Dodge Momentum Index is available here on our website, an example is shown below. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.