Product

August 4, 2021

SMU Steel Price Ranges & Indices: Mixed Signals?

Written by Brett Linton

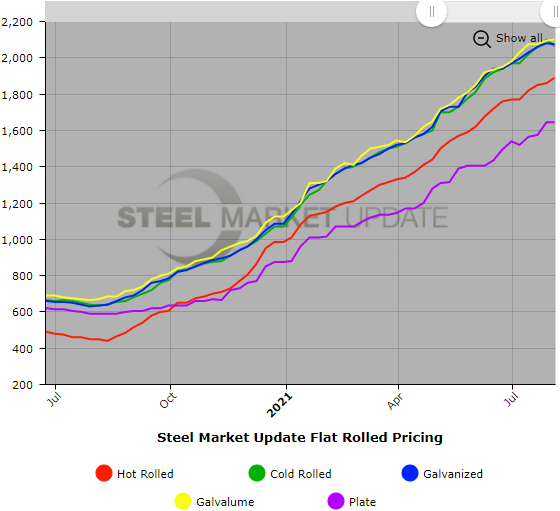

Steel prices have moved steadily and predictably upward week after week for the past year. But Steel Market Update’s check of the market on Monday and Tuesday delivered some mixed signals for the first time since August of 2020. Hot rolled coil prices moved up again by another $30 per ton, falling just short of the $1,900 mark. But coated products and plate saw little or no change, while the price for cold rolled appears to have declined. One week does not a trend make, however, and this may just be a summertime statistical anomaly. In fact, SMU’s Price Momentum Indicators will continue to point toward higher prices in the short term. We will only move our Indicators to Neutral and then possibly Lower once it becomes clear the price trend is changing. In the meantime, we would not be surprised to see gyrations in the pricing data for each product as it bounces up and down over the coming weeks or months in search of a peak. Here’s what we see for this week’s prices:

Hot Rolled Coil: SMU price range is $1,840-$1,940 per net ton ($92.00-$97.00/cwt) with an average of $1,890 per ton ($94.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end increased $40. Our overall average is up $30 per ton from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 8-12 weeks

Cold Rolled Coil: SMU price range is $2,020-$2,110 per net ton ($101.00-$105.50/cwt) with an average of $2,065 per ton ($103.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to last week, while the upper end decreased $50. Our overall average is down $35 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 8-14 weeks

Galvanized Coil: SMU price range is $2,030-$2,120 per net ton ($101.50-$106.00/cwt) with an average of $2,075 per ton ($103.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to one week ago, while the upper end decreased $40 per ton. Our overall average is down $5 per ton from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $2,099-$2,189 per ton with an average of $2,144 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 12-14 weeks

ARTICLE CONTINUES BELOW

{loadposition reserved_message}

Galvalume Coil: SMU price range is $2,060-$2,140 per net ton ($103.00-$107.00/cwt) with an average of $2,100 per ton ($105.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week, while the upper end remained unchanged. Our overall average is up $5 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,351-$2,431 per ton with an average of $2,391 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 12-16 weeks

Plate: SMU price range is $1,560-$1,730 per net ton ($78.00-$86.50/cwt) with an average of $1,645 per ton ($82.25/cwt) FOB mill. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is unchanged from one week ago. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 9-14 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.