Market Data

July 25, 2021

SMU Market Trends: On Price, Availability, Imports

Written by Tim Triplett

Steel Market Update’s poll of service center and manufacturing executives this week shows a general consensus that steel prices still have a ways to go before they roll over and begin to correct. When that might happen is anyone’s guess. There are nascent indications that the tight steel supplies may be loosening a bit, however. In the questionnaire this week:

SMU asked: Where do you think HRC prices will peak?

Roughly one-third said they believe the market is already there at $1,850 per ton. Another one-third predict HRC will eventually hit an incredible $2,000 per ton or more. The others fall somewhere in between. Said one respondent: “Let’s just look at the calendar. If we’re all saying it won’t peak until Q4, how does it not get to $2,000/ton?” Added another: “Does it really matter. It’s a fictitious number as there is no spot available anyway. Import is the only thing being ordered right now.”

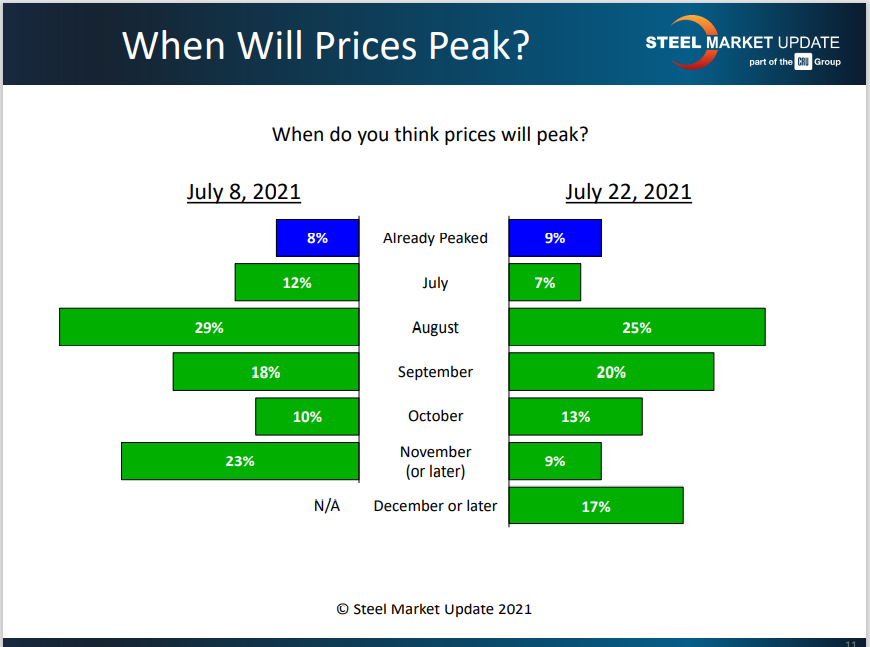

SMU asked: When do you think prices will peak?

The most popular answer was August, but without much confidence at just 25%. Nearly 40% see the peak sometime in the fourth quarter, and a significant number not until December or even later. “I’m safely saying “November,” but a big part of me wants to say Q1 2022,” commented one executive.

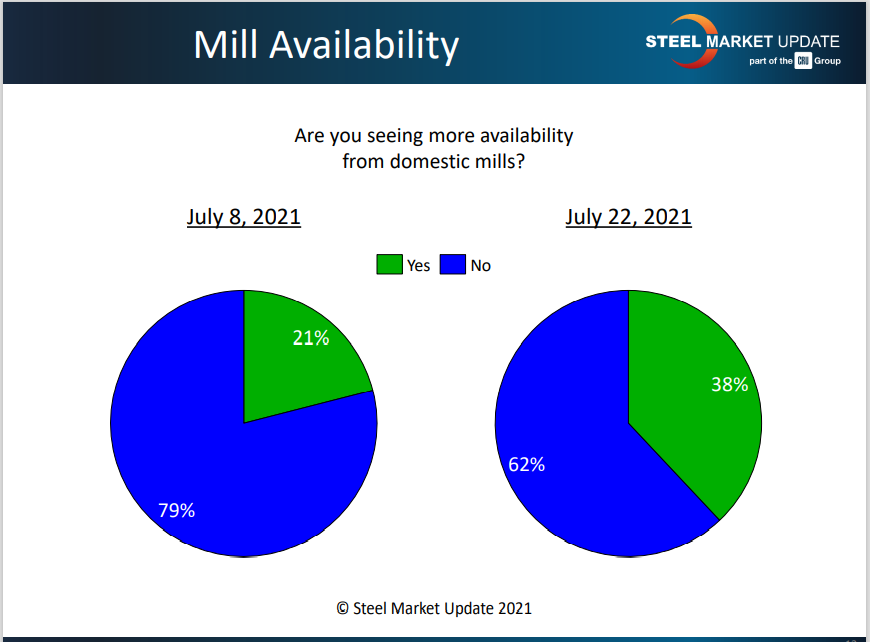

SMU asked: Are you seeing more availability from the domestic mills?

About 38% said yes, which is a notable change from the last survey earlier in July when just 21% reported improvement:

- “I have seen some availability, although I have been cautioned these are one-offs.”

- “There’s been slightly more availability, and not as many shortages against P.O. numbers.”

- “Not a lot of availability, but certainly more than May or June.”

- “HDG and CRC are still not seeing any additional availability.”

- “Nada. We are either still getting ‘No Quoted’ or placed on ‘Strict Allocation.’ Wild.”

- “Mills are being very coy about controlling and making available tons to their larger customers without publicly coming onto the market.”

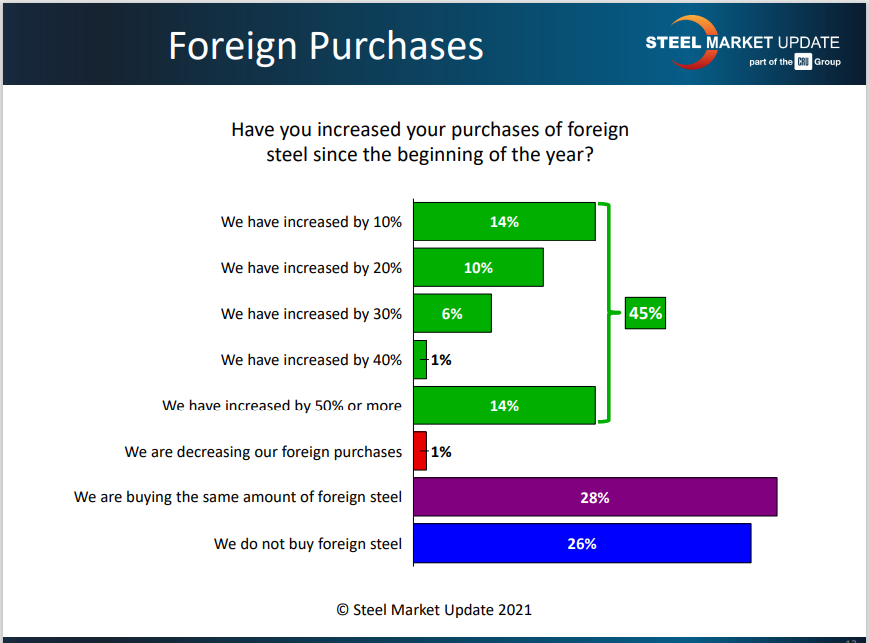

SMU asked: Have you increased your purchases of foreign steel since the beginning of the year?

The availability of spot tons from the domestic mills remains extremely tight, forcing buyers to look elsewhere. About 45% of the service centers responding to this week’s poll said they have increased their foreign purchases this year. Calculated as a weighted average, foreign sourcing is up by approximately 28% this year. Virtually none of the respondents is buying fewer imports. “Due to domestic shortages, we were forced to shift tons to foreign sourcing in certain cases,” said one respondent. “We had not previously purchased foreign steel,” said another. “We would have bought more if it had been available; so tired of the domestic mills’ games and short memory,” said a third.