Prices

July 22, 2021

Hot Rolled Futures: Into the Arena

Editor’s note: SMU contributor Bryan Tice is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and the firm design and execute risk management strategies for clients along with providing process and analytical support. Before joining Metal Edge Partners, Bryan held a variety of commercial leadership roles involving purchasing, sales, and risk management for Feralloy Corporation, Cargill Steel Service Centers and Plateplus Inc. You can learn more about Metal Edge at www.metaledgepartners.com. Bryan can be reached at Bryan@metaledgepartners.com.

Following the conclusion of the NBA finals on Tuesday night, one of the TV analysts quoted Theodore Roosevelt’s famous “Citizenship in a Republic” speech in a post-game analysis as a nod to Giannis Antetokounmpo’s epic game 6 performance and his eight-year journey in becoming an NBA champion. Many refer to Roosevelt’s “Man in the Arena” paragraph of the speech as the most memorable. It is one of my all-time favorites. It has provided inspiration to Ryder cup captains and Rugby coaches and has been memorized by Naval Academy plebes for years and recited by presidents from Nixon to Obama. At its core, the passage is about adversity, courage, resilience and consequence. Oddly, it made me think of the steel market over the last year and a half.

The quote begins with, “It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better.”

Sound familiar? I am sure many in the industry have been second guessed for decisions made months ago or for predicting or believing predictions that suggested steel was destined for a historic collapse shortly after we surpassed record price levels last seen in 2008. Hindsight tells us that if one were to have passed on (for fear the market would drop) a late February mill offer for a $1,200/t May production barge of hot rolled coil, it wound up being a half-million-dollar mistake, given how rapidly pricing escalated during the 90-day period thereafter. However, if one chose to execute a 1,000/tpm long futures contract in mid-May (after the chatter that a Section 232 removal with Europe sent the curve plummeting) for the Q4 of 2021, he or she would have netted close to a half-million-dollar gain if it had been closed out at yesterday’s settlement prices. Proof positive that you win some and lose some.

Roosevelt’s next sentence starts by saying, “The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly; who errs, who comes short again and again, because there is no effort without error and shortcoming.”

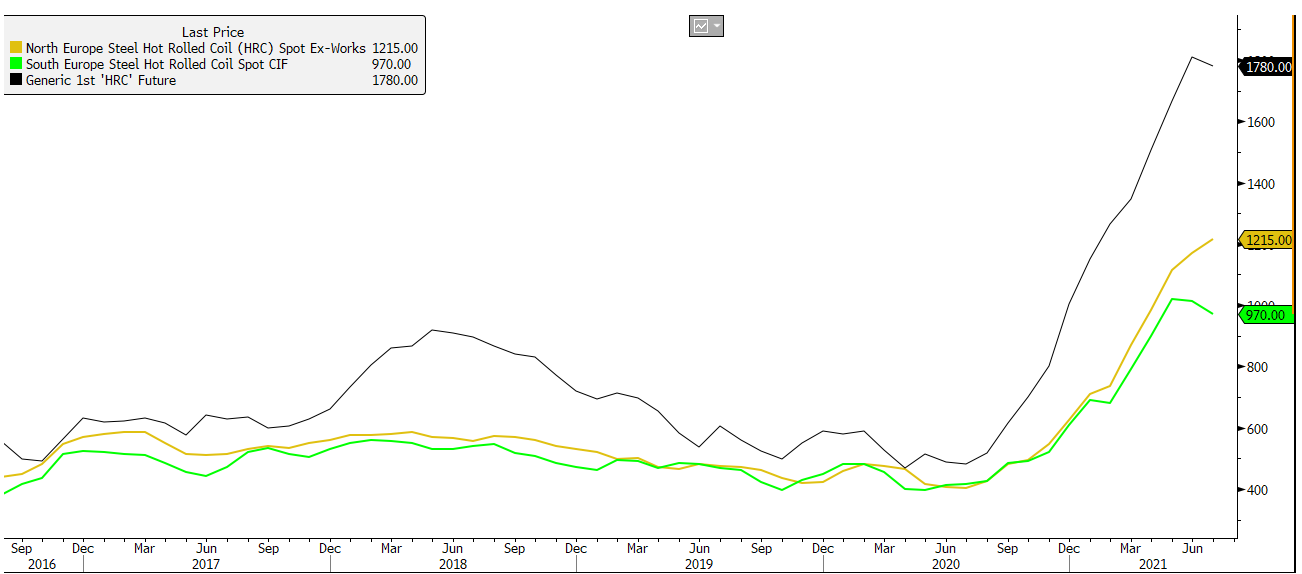

I know many steel buyers who would likely agree with the description of their faces being marred by dust and sweat and blood despite valiant efforts to secure a few more tons or work a better price to no avail. It has been a difficult last 9-10 months if you are on the “buy” side. Early reports suggest that contract negotiation season with steel mills may not offer buyers much of a reprieve. Despite steel mill capacity expansions inching closer to becoming reality in the Q421/Q122, the timing of negotiating these deals has become quite important and could have implications on buying behavior from now to the end of 2021. Steel mill consolidation has not made these discussions any easier. It seems that mills are intent to narrow the range of discounts, tighten volume ranges and enforce consistent price adders and freight charges. Buyers, on the other hand, tend to see a tale of two halves in 2022, where domestic availability could continue to be constrained into the first half before the new capacity hits full stride and the possibility of fewer imports being subject to Section 232 tariffs, which in combination could allow them to flow more freely and shift the supply and demand balance. The HRC futures curve as depicted below (see chart) continues to paint a slightly different picture, suggesting we are very close to a peak in the price cycle, with modest deterioration that begins to unfold by the end of this year and accelerating downward in the first half of 2022 before flattening in the second half of 2022, albeit at considerably higher prices than futures market participants anticipated six weeks ago.

That brings me back to the implications it could have in buying activity and ultimately on pricing. On one hand, if mills ultimately achieve their contract initiatives for 2022, it seems plausible we could see a surge in buying activity as buyers look to maximize their remaining and more favorable 2021 contract structures and pull forward what would otherwise be 2022 purchases to the extent possible. In theory that should keep mills’ order books solid, lead-times extended, and prices supported through the end of the year. On the other hand, if buyers decide there is too much risk in accepting these new contract structures, we could see a shift away from contractual agreements and see them pivot to import markets or become bigger spot players at a time where new domestic capacity should help provide some relief to the restricted availability we have seen during the pandemic recovery.

Another factor worth watching is the diverging trends occurring in Southern Europe vs. Northern Europe, (see chart below) as Southern European prices have moved lower in response to lower import offers from other parts of the world. Expectations are that a removal of Section 232 with Europe is likely in place by the first part of 2022, and it would seem reasonable to expect the current U.S. premium to Europe to narrow as it did in 2019.

The steel market continues to operate in an environment where the stakes are high, and risk lurks behind many tactical and strategic decisions. Utilization of hot rolled futures, galvanized premium futures, scrap futures and many of the nonferrous futures continues to see greater acceptance and adoption and can help facilitate market efficiencies, reduce risk and stabilize earnings.

The “Man in the Arena” quote concludes with, “But who strives to do the deeds; who knows great enthusiasms, the great devotions; who spends himself in a worthy cause; who at best knows in the end the triumph of high achievement, and who at the worst, if he fails, at least fails while daring greatly, so that his place shall never be with those cold and timid souls who neither know victory or defeat.”

For those of you in the arena, stay enthusiastic, strive valiantly, and dare greatly!

Disclaimer: The information in this write-up does not constitute “investment service”, “investment advice”, or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information.