Prices

July 13, 2021

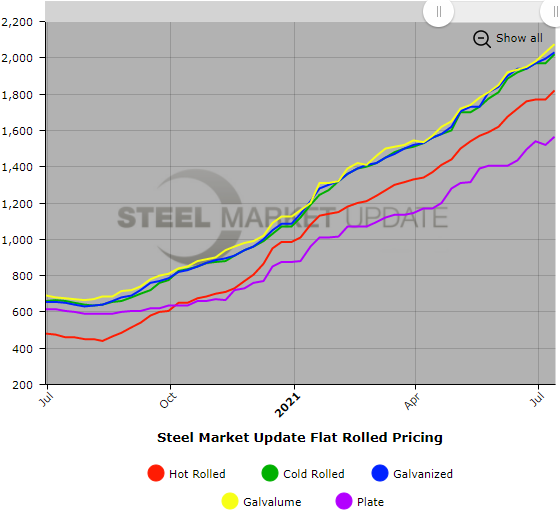

SMU Price Ranges & Indices: Hot Rolled Tops $1,800

Written by Brett Linton

Steel prices rose another $35-50 per ton this week with hot rolled and coated products surpassing notable new benchmarks of $1,800/$2,000. Steel Market Update’s canvass of the market this week puts the average HRC price at $1,820 per ton ($91/cwt) and galvanized at $2,030 ($101.5/cwt). Buyers continued to voice concerns about late mill shipments and outages that may call for even tighter allocation in the fourth quarter. Said one service center exec expressing a common view: “Until new capacity becomes available and buyers start turning away mill offers, the domestic prices will just keep moving up.” SMU’s Price Momentum indicator continues to point toward higher prices for all steel products over the next 30 days. Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,800-$1,840 per net ton ($90.00-$92.00/cwt) with an average of $1,820 per ton ($91.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $100 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is up $50 per ton from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 8-12 weeks

Cold Rolled Coil: SMU price range is $1,940-$2,100 per net ton ($97.00-$105.00/cwt) with an average of $2,020 per ton ($101.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week, while the upper end increased $80 per ton. Our overall average is up $50 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 12-14 weeks

Galvanized Coil: SMU price range is $2,000-$2,060 per net ton ($100.00-$103.00/cwt) with an average of $2,030 per ton ($101.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $60 per ton compared to one week ago, while the upper end increased $10 per ton. Our overall average is up $35 per ton from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $2,069-$2,129 per ton with an average of $2,099 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 12-14 weeks

Galvalume Coil: SMU price range is $2,030-$2,120 per net ton ($101.50-$106.00/cwt) with an average of $2,075 per ton ($103.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $70 per ton compared to last week, while the upper end increased $20 per ton. Our overall average is up $45 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,321-$2,411 per ton with an average of $2,366 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 12-14 weeks

Plate: SMU price range is $1,440-$1,690 per net ton ($72.00-$84.50/cwt) with an average of $1,565 per ton ($78.25/cwt) FOB mill. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $90 per ton. Our overall average is up $45 per ton from one week ago. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 8-10 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.