Analysis

July 9, 2021

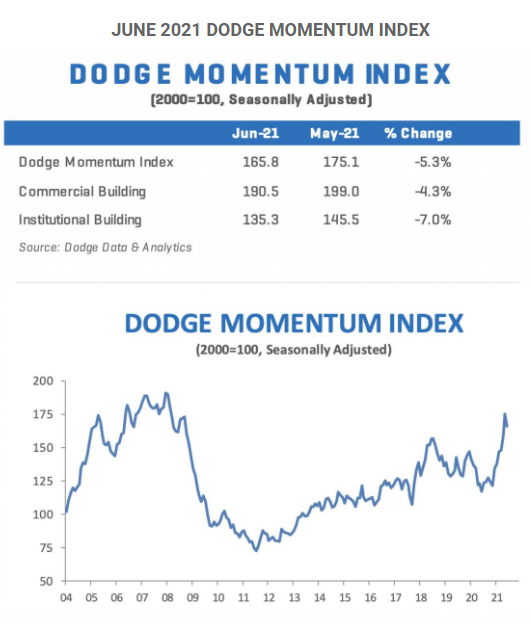

Dodge Momentum Index Sees First Decline This Year

Written by Michael Cowden

The Dodge Momentum Index has fallen for the first time this year – and after six consecutive months of gains – on uneven demand and higher costs.

The index now stands at 165.8, down 5% from a revised May number of 175.1, according to Hamilton, N.J.-based Dodge Data & Analytics.

![]()

“Uncertain demand for some building types (such as retail and hotels), higher material prices, and continued labor shortages are weighing down new project planning,” the group said in a statement.

Case in point when it comes to higher costs: SMU’s benchmark hot-rolled coil price is at $1,770 per ton ($88.50 per cwt), an all-time high by a wide margin. That figure is up 80% from $985 per ton at the beginning of 2021 and more than triple $475 per ton in July of 2020, according to SMU’s interactive steel pricing tool.

“June’s retreat in planning activity is another sign that the recovery from the pandemic-led recession will be nonlinear,” Dodge said.

Despite the June dip, the Momentum Index remains near a 13-year high. It is up 41% versus June 2020 with planning for commercial construction up 39% year-over-year and that for institutional construction up 46%.

“The current level of the Momentum Index and its underlying components … continue to signal that a more broad-based recovery in nonresidential construction starts will occur in 2022,” Dodge said.

Thirteen new projects valued at $100 million or more entered planning in June, the group said.

The Dodge Momentum Index is a key advance indicator of nonresidential construction demand. The group says its planning data lead construction spending by as much as a year.

An interactive history of the Dodge Momentum Index is available here on our website. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.