Product

July 8, 2021

When Will Hot Rolled Prices Peak in USA?

Written by Tim Triplett

You may be tired of reading about it, but there is no ignoring the question: When will hot rolled coil prices finally peak? So many livelihoods depend on the answer. Unfortunately, Steel Market Update steel survey data clearly shows that no one knows.

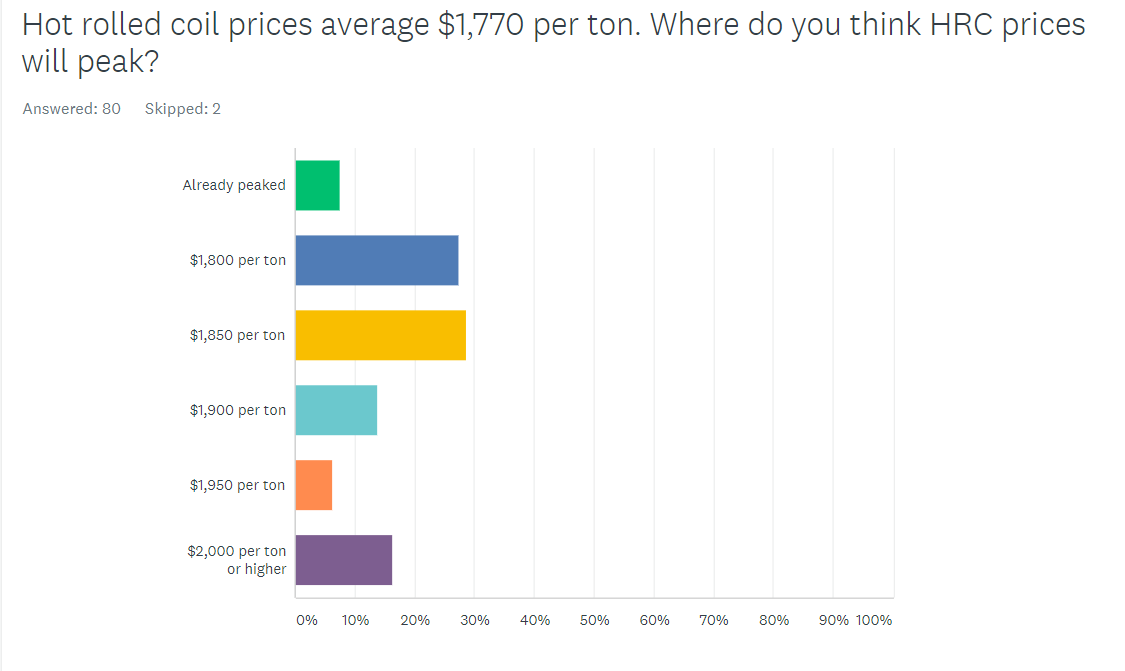

Roughly one-third of those polled this week believe hot rolled steel prices will have peaked by the time they hit $1,800 per ton—just $30 from the current SMU price of $1,770—which could happen as soon as this month. About half see the peak somewhere between $1,850-$1,950 per ton. The remaining 16% envision hot rolled prices reaching an astounding $2,000 per ton or more before finally beginning to correct to more reasonable levels sometime late this year or perhaps not until 2022.

Calculated as a weighted average of the latest survey responses, the current over/under is a hot rolled peak of $1,868 per ton. That’s about another $100 worth of increases. But don’t bet on it.

Based on respondents’ comments, very few anticipate a peak anytime soon:

“Spot pricing is really $92-$94/cwt ($1,840-$1,880 per ton). Supply is tightening and will continue to do so through the balance of the year with outages and reduced imports.

“The U.S. market has more legs, but will top out in the fourth quarter. The Asian and world markets will affect us eventually.”

“Just based on the timeframe of when most folks think the market will peak—not until at least mid-fourth quarter—it will crest $2,000 per ton. Wild.”

“There is no availability, so it really doesn’t matter where it is right now. Until there is some availability later this year, you will buy import if you need it.”

“Prices will peak once supply is equivalent to demand. Simple as that.”

Asked when they think prices will peak, half the respondents predicted August or before. Nearly 80% expect the peak by the end of October. But 22% believe it may not happen until November or even later. “Mill lead times are already extended into October, so it can’t be sooner than that,” observed one buyer. “I still have Q4 circled on my calendar, but with the recent mill outages (planned and unplanned), it could be late Q4 or early Q1 now,” said another.

Prices cannot continue to rise indefinitely without eventually affecting demand, according to the laws of economics. Yet the market continues to break the law at a felonious level without any consequences so far. Less than 9% of respondents said demand for steel is declining. Of the remainder, 48% said demand is stable, while a whopping 43% said demand continues to improve despite the record-high cost of steel. “We have yet to see any semblance of ‘demand destruction’. Things are still HOT!” commented one supplier. But for another, expressing the minority view, “pricing has slowed demand and we are seeing more push-back every day.”

Like the mills, service centers continue to raise their prices. More than 80 percent said they are having no problem passing along higher price tags to their customers. Just 3% of service centers polled this week said they are lowering prices. “Up…up…and up! We are raising prices at a feverish pace to keep up with the mills and the indices,” said one service center exec. “We are not running into any issues,” added one distributor. “The smart customers understand what is happening and the others complain, of course, but they need their steel, too, so they begrudgingly place the orders.”

SMU Steel Summit Conference – Update

We are getting down to the nitty gritty when it comes to this year’s SMU Steel Summit Conference. We are finishing up the last-minute changes to our conference agenda, and we should be able to share many of those with you next week. We are working with the Georgia International Convention Center, our audio-visual company, hotels and dealing with many of the issues attendees never get to see.

We have doubled the size of the exhibition area to provide more room for attendees so everyone can feel comfortable (and not crammed in like sardines).

We have been watching both the CDC and GICC guidelines regarding social distancing and the wearing of masks. As of today, there are no social distancing guidelines in place. We are being told that mask wearing outside the venue is not necessary for those who have been vaccinated. However, the current requirement is for mask wearing inside the convention center.

We are working on a system so that your badge will indicate whether you are available to be approached or if you are social distancing and do not want physical contact with others during the conference.

There will be a small group from the CRU Events team coming over from London. The plan is for them to arrive a week early so they can quarantine prior to the conference. We want to make sure you are comfortable interacting with the London people (they are also all vaccinated).

As I have mentioned on many occasions, we highly recommend that you get vaccinated if you are planning to attend the conference. If you are a procrastinator, there is still time to get fully vaccinated prior to the event.

Registrations are now moving toward 800 executives and we are confident we will have 900+ (perhaps more than 1,000) attendees when the SMU Steel Summit Conference opens on the morning of Aug. 23 at the Georgia International Convention Center in Atlanta.

New registrations and additional executives added to the SMU Steel Summit Conference over the past 48 hours (those with an * means more than one executive is attending from that company): Algoma Steel Inc.*, ASSA ABLOY Door Group*, B&W*, Cottrell, Inc., Doosan Bobcat*, Graber Post Buildings, Inc., Interlake Mecalux, Inc.*, Klein Steel*, Majestic Steel USA*, Material Sciences Corporation*, Medtrade*, OWC*, Phillips Tube Group*, Reliance Steel and Aluminum*, Ryerson*, Siskin Steel and Supply*, and Zeeco Metals, Inc.*

You can learn more about the agenda, speakers, NexGen Leadership Award nomination process, costs to attend, and how to register by clicking here or going to this website: https://events.crugroup.com/smusteelsummit/home

As always, your business is truly appreciated by all of us here at Steel Market Update.

Tim Triplett, Executive Editor, Tim@SteelMarketUpdate.com

{loadposition reserved_message}