Prices

June 13, 2021

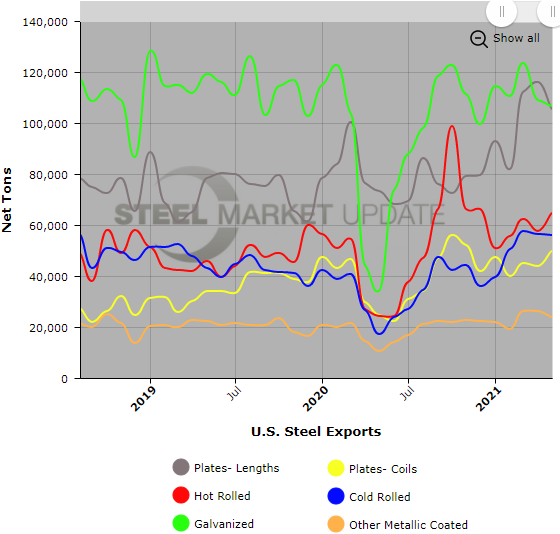

May Exports Slip to Three-Month Low, But Still Strong Historically

Written by Brett Linton

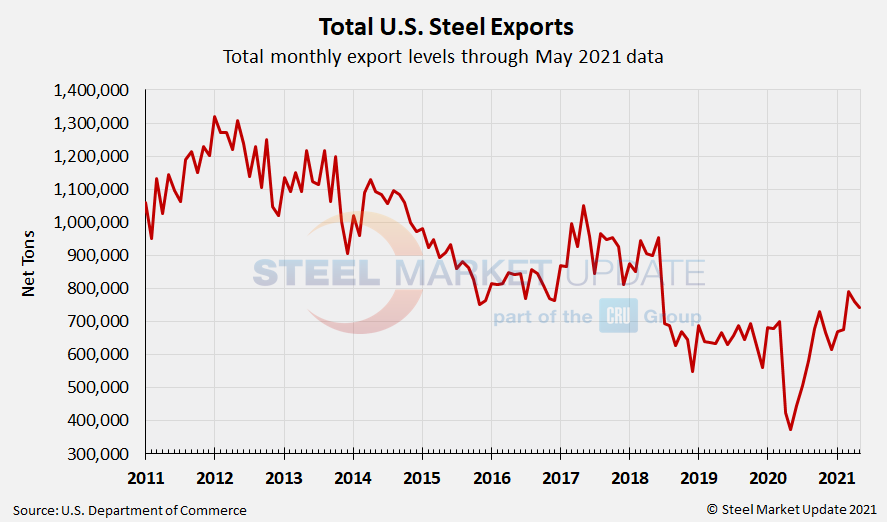

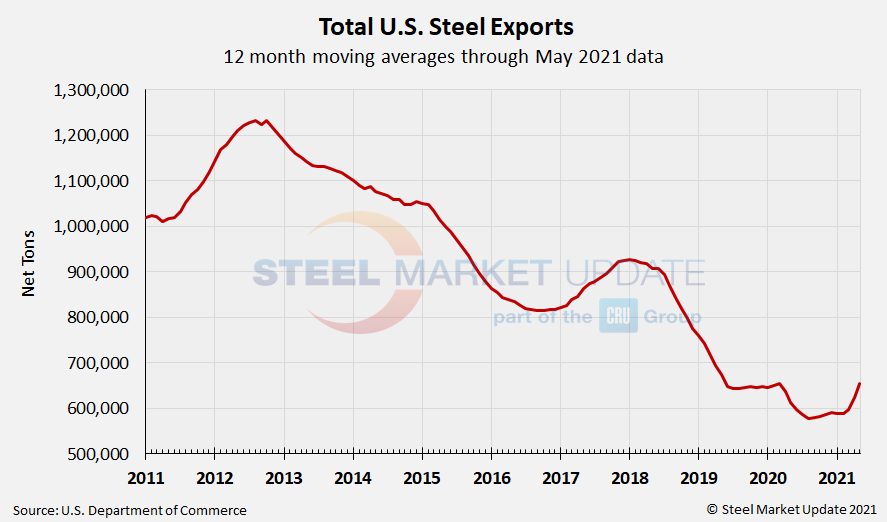

U.S. steel exports declined 2% in May to 742,000 tons, according to recently released U.S. Department of Commerce trade data. Although down from the month prior, recall that March and April exports were at the two highest levels seen since June 2018. May marks the third highest monthly export level since June 2018. Of our six monitored product groups, four products were down month-over-month and two were up. In total, May 2021 exports are 98% higher than April 2020 levels.

Recall that 2020 saw a big swing in export levels: The year started strong, nearing 700,000 tons through March. Then the COVID-19 downturn choked exports in the summer months, with May levels reaching the lowest seen in SMU’s 24-year data history at 374,000 tons. Monthly export levels recovered each month afterward through October, reaching a 2.5-year high of 730,000 tons, but slowed again through the remaining months of the year.

The 2020 monthly average for exports was 591,000 tons, below both the 2019 monthly average of 648,000 tons and the 2018 monthly average of 775,000 tons. The 2021 monthly average is now up to 728,000 tons through May figures.

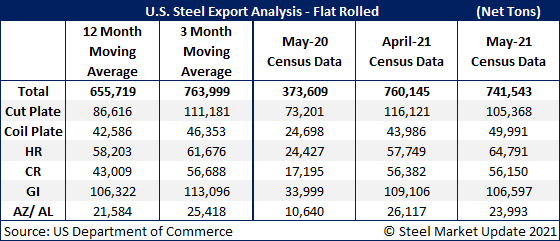

Total May exports were 3% below the three-month moving average (average of March through May 2021), but 13% above the 12-month moving average (average of June 2020 through May 2021). Here is a detailed breakdown by product:

Cut-to-length plate exports were down 9% from April to 105,368 tons, but up 44% compared to one year ago.

Exports of coiled plate were 49,991 tons in May, up 14% over the prior month, and up 102% from levels seen one year earlier.

Hot rolled steel exports were up 12% from April to 64,791 tons, up 165% from the prior year.

Exports of cold rolled products were 56,150 tons in May, down less than 1% from April, but up 227% from the same time last year.

Galvanized exports decreased 2% month over month to 106,597 tons. Compared to levels one year ago, May was up 214%.

Exports of all other metallic-coated products were 23,993 tons, down 8% from April, but up 125% year-over-year.

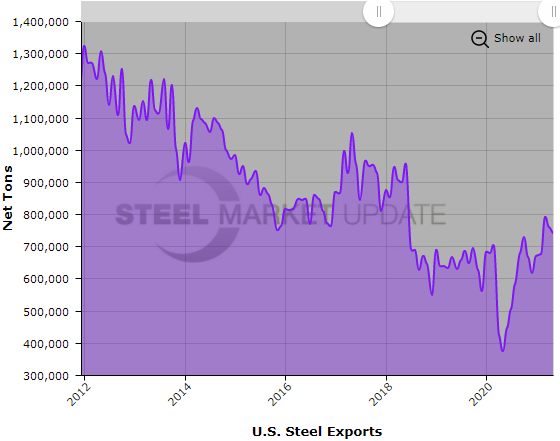

Below are two graphs showing the history of U.S. steel exports through the latest final data, in total and by product. We have an interactive graphing tool available here on our website where readers can further investigate export data by product. If you need assistance logging into or navigating the website, contact us at Info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com