CRU

June 13, 2021

CRU: China Set to Reduce Steel Output in 2021 H2

Written by CRU Americas

By CRU Senior Analyst Richard Lu, from CRU’s Steel Sheet Products Monitor

In September 2020, President Xi Jinping formally announced that China will aim to achieve a peak in carbon emissions before 2030, followed by carbon neutrality before 2060. As part of the decarbonization efforts, the Chinese government at the start of the year announced its intention to start reducing steel production in 2021.

![]()

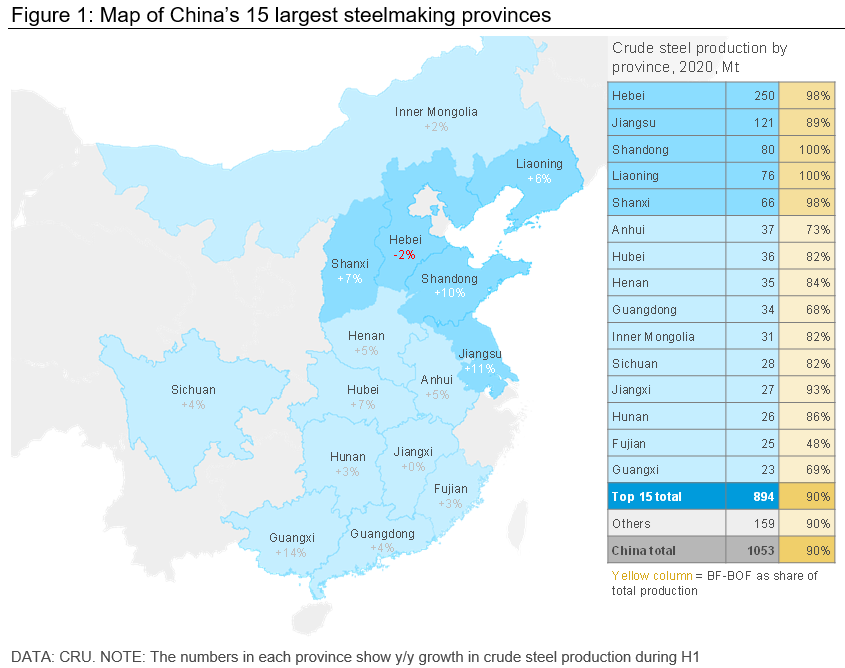

In 2021 H1, Crude Steel Production Rises by 64 Mt y/y

Despite the government’s desire to cut steel output, Chinese crude steel production in 2021 H1 was 64 Mt higher than in 2020 H1. Apart from Tianjin municipality and Hebei province, all provinces and municipalities with steel capacity in China saw crude steel production growth in H1. Among them, Guangxi province was the largest contributor, producing ~9 Mt of additional crude steel y/y that was primarily due to new capacity commissioning including the Fangcheng Port project belonging to Liuzhou Iron & Steel. Jiangsu province ranked second with crude steel production growth of ~7 Mt, equivalent to 11% of the country’s total growth, followed by Shandong province (+6 Mt), accounting for 10% of total growth. Shanxi and Hubei province were tied for the fourth place (+5 Mt) and in the remaining 23 provinces and municipalities, 15 of them saw y/y production growth exceeding 1 Mt.

Hebei province with steelmaking capacity of more than 250 Mt/y is the largest steel producing province in China, but it underperformed other key producers such as Jiangsu and Shandong in terms of production growth. This is primarily because operating restrictions of up to 50% of capacity were implemented in Tangshan city since late March, as the local government aimed to get rid of its name from the list of the most polluting cities in the country.

We believe the strong production growth in 2021 H1 was driven by three key factors:

• Strong demand on the back of the government stimulus in 2020

• Ongoing robustness of steel-containing goods exports

• Front-loaded steel purchases on the expectation of production cuts in 2021 H2.

Regarding the last point, it usually takes months for the central government’s target to be outlined and distributed to local governments before any actions are taken. Given this, steel end-users believed steel production would fall in 2021 H2, so they brought forward their purchases to 2021 H1. This reinforced already strong demand that lifted steel margins, which consequently encouraged steelmakers to maximize production before any government-led cuts are implemented.

In 2021 H2, Crude Steel Production to Fall by 48 Mt y/y

By the time of this writing, we have identified a few local governments and steel mills planning to implement production cuts in H2. Although there is no formal announcement, a general guidance is that annual crude steel production in 2021 should not exceed that in 2020.

It was reported that, in Jiangsu province, the level of production cuts would vary by mill, and new capacity could be exempted from any cuts. Having said that, there would be a control over annual production in the province. Similar measures were also planned and discussed in Gansu in western China, Anhui province in central China and Shandong province in east China.

The central-government owned Baowu Group is also planning production cuts for each individual mill. For example, at Echeng Iron & Steel in Hubei province, steelmakers will not shut down any facilities but reduce productivity through charging less high-grade iron ore in BFs while lowering the scrap rate in BOFs. In contrast, at Chongqing Iron & Steel, which produced 5 Mt of steel in 2021 H1, crude steel production is required to fall to 2 Mt in 2021 H2 in order to fall below 2020 production levels. Given this, two BFs and subsequent steelmaking and rolling capacity will be completely shut down in H2 with only one production route remaining in operation, producing steel flat products.

Steel production cuts have also started or been under discussion at a few major steelmaking groups including Shougang in Hebei province, Ansteel and Benxi Iron & Steel in Liaoning province, and Baotou Iron & Steel in Inner Mongolia.

To achieve the government’s target of keeping annual crude steel production in 2021 below last year’s level, it requires 64 Mt of crude steel production reduction y/y in 2021 H2. In our base case, we project all planned production cuts mentioned above to take place, but there are other parts of China that have not yet announced similar plans. Therefore, we forecast production in 2021 H2 to be ~48 Mt lower than in 2020 H2, not enough to reduce China’s crude steel production for 2021 as a whole.

Hot Metal Production to Fall Less Than Crude Steel

We forecast hot metal production at 472 Mt in 2021 H2, that is 28 Mt or 6% lower y/y, a lower decline compared with crude steel production. This is because scrap consumption and generation will also fall y/y in the same period, particularly in 2021 Q3 for three main reasons:

- Power shortage: Given a series of accidents at coal mines early in the year, the Chinese government has conducted strict safety checks, which limited domestic coal production. This, coupled with coal import restrictions and strong power demand, has resulted in power shortages in many provinces. Given this, many EAF producers in these provinces such as Guangdong have been requested to cut steel production in recent months.

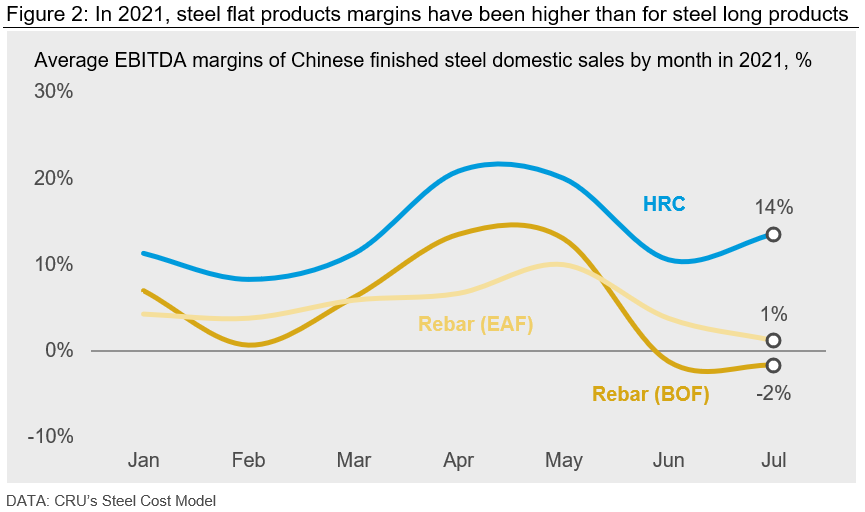

- Margins for steel flats producers are higher than for steel longs producers: According to CRU’s Steel Cost Model, EBITDA margin for HRC domestic sales is currently 15%, while that for rebar is at the edge of breakeven for both BOF- and EAF-based production (see below chart). Given this, we believe steel long products will bear the brunt of cuts in the near term, while production of steel flat products will be largely maintained. In China, steel flat products are typically produced by BF-BOF route with average scrap rates below 110 kg per tonne of crude steel over 2016–2020 compared with 255 kg in North America and 232 kg in Europe.

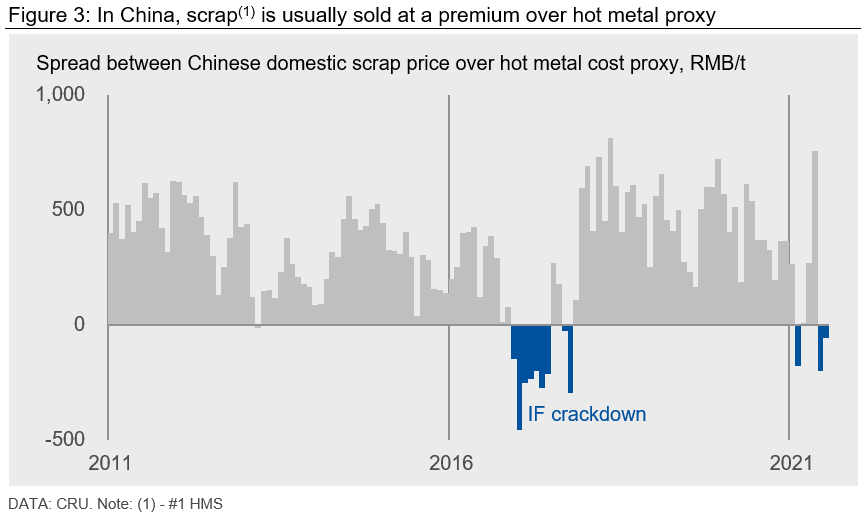

- Scrap having cost disadvantages relative to hot metal given China’s development stage: As scrap generation remains constrained in the current development stage of China, Chinese domestic scrap has always been sold at a premium over hot metal costs with a few exceptions in 2017 and recently in 2021.

• In 2017, because of the crackdown on off-spec steel products produced by Induction Furnaces (IFs), lots of scrap that was prepared for IFs became available and caused sharp scrap price falls. This situation had largely persisted throughout the year unless an outlet was found in the export market and more integrated steelmakers reconfigured their facilities to consume this lower-quality scrap.

• In 2021, scrap has yet again traded at a discount relative to hot metal costs. This is because scrap prices have fallen faster than iron ore and metallurgical coke prices when steel prices plummeted in February and June. Having said that, the premium restored 1-2 months after the market rebalanced.

In a market where total metallics demand is limited, scrap needs to compete with hot metal in the steelmaking process, but its cost disadvantage will entice integrated steelmakers to favor hot metal. Having said that, hot metal consumption and production will fall faster in 2021 Q4, when the more regular “Winter Heating Season” operating restrictions occur.

CRU will continue to monitor the progress of steel production cuts in China closely.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com