Analysis

June 4, 2021

Shedding Light on the Housing Supply "Shortage"

Written by Brett Linton

The following article was reprinted with permission from John Burns Real Estate Consulting.

True statements can lead to misleading conclusions, especially in a busy world full of sound bites and analysis limited to 280 characters. Thank you to one of our clients for several long exchanges that pushed me to clarify our thinking on numerous issues.

To help you continue making decisions with great clarity, here is our version of what is true and not true on four hot topics:

- Home supply shortages

- Owning vs. renting

- Urban vs. suburban

- Housing Cycle Risk

In a nutshell, supply is short because DEMAND is huge. This is a demand-driven housing boom, which is contrary to the housing shortage theories being propagated by those who have an incentive to make others think there is no risk to investing in housing today.

Home Shortage Clarity

- NOT TRUE: Supply is low because many people are not selling their homes due to COVID fear. Both new and existing home sales are up dramatically and to the highest level in years. Sales cannot be up if fewer people are selling, although we grant that some people may be waiting to sell until they are less afraid of COVID.

- TRUE: Very few homes are available for sale, primarily because homes that come on the market are sold immediately. This shortage is due to very high DEMAND. There is a supply shortage of homes available to purchase because demand is so very, very strong.

- NOT TRUE: Current conditions are not the result of a supply problem due to years of underbuilding. If that were true, prices and rents would have been rising much faster than incomes in 2019. Home prices, rents and incomes were also rising 3%–5% in 2019. Comparison to building levels in prior cycles is misleading because recent adult population growth has been much lower than historical growth, due in large part to Baby Boomers causing the prior surge.

- TRUE: Household formations surged during the pandemic even though the Census Bureau acknowledges, and we agree, that there have been huge problems with this data recently. We believe the surge is due to an increase in something called the headship rate. The headship rate is the percentage of people heading a household. The headship rate has been trending down for several decades, and it must be trending back up right now. This is usually caused by roommates and/or couples splitting up, which is the exact opposite of what happens during a normal recession when people move back in with their parents or add a roommate. There is no data to support our thesis right now, but we are working on it, so let’s say it is MAYBE TRUE.

- TRUE: More homes now need to be built due to the surge in DEMAND that is allowing a greater number of people to buy or rent further from work.

- TRUE: Demand is so strong that potential home buyers are having difficulty finding a home, and many home renters are experiencing significant rent increases.

- TRUE: New home supply cannot ramp up quickly because materials and labor are in great shortage. The many issues driving material and labor shortages include unanticipated strong new home demand, COVID-related manufacturing slowdowns, Hurricane Laura in August, the February Texas freeze, the March Suez Canal blockage, and a shortage of working adults that was already happening and has now been exacerbated by low immigration, the need to home school, and government income subsidies that have made some ambivalent about returning to work.

Owning vs. Renting Clarity

- TRUE: There is an increase in homeowners becoming renters. A recent survey we conducted proved it.

- TRUE: There is an increase in renters becoming homeowners. Our monthly builder survey dramatically proved this to be true.

- NOT TRUE: There is certainly some sort of generational shift to preferring to rent.

- NOT TRUE: There is certainly some sort of generational shift to preferring to own.

- TRUE: The number of renters AND the number of homeowners is growing right now, which is great for home buying demand AND home leasing demand. It is far too early to tell if the homeownership rate is going to trend up or down due to COVID. The homeownership rate data from the Census Bureau right now is very unreliable.

Urban/Suburban Clarity

- TRUE: There has been an urban exodus as evidenced by a clear decline in rents in urban areas versus suburban areas in the last year.

- TRUE: There has been a surge in demand in outlying areas and more affordable metro areas due to a surge in newly-granted permission to work from home. Price appreciation in outlying areas and more affordable metro areas has been higher than urban areas and more expensive metro areas. Our exurban feasibility business is booming.

- NOT TRUE: Urban is dead. Urban rents and home prices in most urban areas are now rising after a price/rent adjustment.

Housing Cycle Risk Clarity

- NOT TRUE: Home prices cannot fall because supply is low. This is a very dangerous conclusion I am seeing far too often. Demand needs to stay strong. Affordability needs to be maintained. If either erodes, the number of homes available for sale could quickly skyrocket.

- TRUE: We have an affordability problem for a rising number of people who are unwilling or unable to relocate.

- NOT TRUE: We have an affordability problem for people who can relocate to an affordable area where they will also be happy. It is actually possible for many urban renters to become homeowners in more affordable areas and see their monthly housing costs decline.

In summary,

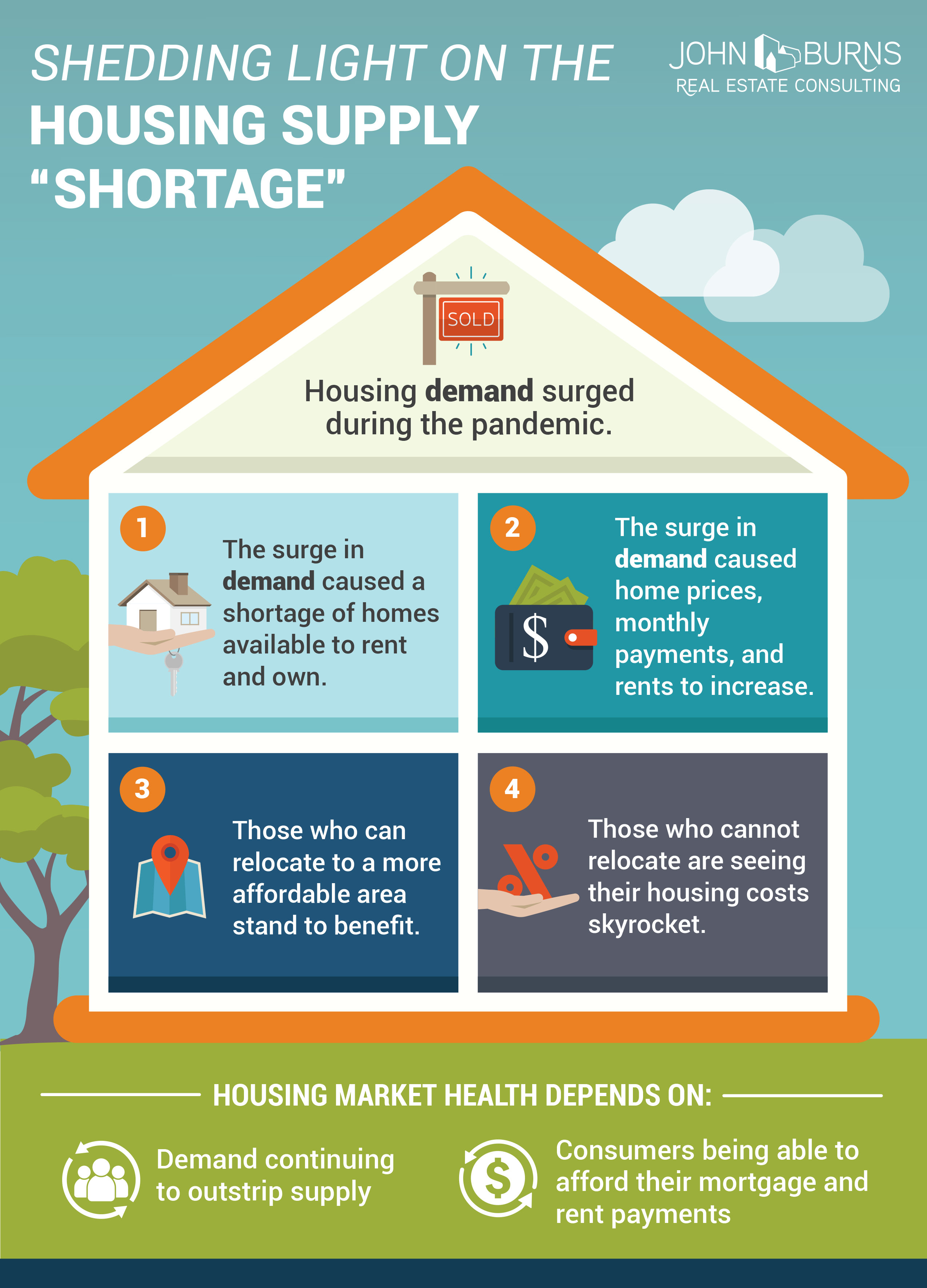

- Housing DEMAND surged during the pandemic.

- The surge in DEMAND—much more than a lack of home sellers due to fear of disease or a multi-year dearth of construction—caused a shortage of homes available to rent and own.

- The surge in DEMAND caused home prices, monthly payments, and rents to increase, which is an affordability problem for those who cannot relocate or choose not to relocate.

- Those who can relocate to a more affordable area stand to benefit.

- Those who cannot relocate are seeing their housing costs skyrocket unless they are already homeowners with a 30-year mortgage and in a place like California where property tax increases are minimal.

The continued health of the housing market depends on:

- DEMAND continuing to outstrip supply, which looks quite favorable given the newly-granted permission to work from home at least part of the time.

- CONSUMERS’ ability to afford their mortgage and rent payments, which is becoming challenging for those who cannot relocate.

This is just a brief overview. We have more detail in our research. If you would like to get more insight, please fill out this form.

John Burns

Chief Executive Officer

John Burns Real Estate Consulting

If you have any questions, please contact John at (949) 870-1210 or by email.