Product

June 1, 2021

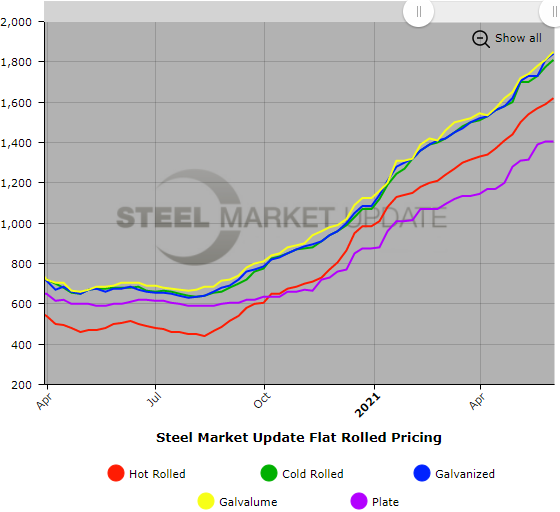

Hot Rolled Coil Tops $1,600 a Ton

Written by Brett Linton

Hot rolled steel prices passed another milestone this week, topping the $1,600 mark to set yet another record that would have been unimaginable at this time last year when HR was selling for around $500 a ton. Steel Market Update’s latest check of the market shows an average HR price of $1,620 per ton, up by $30 over last week. Cold rolled and coated products also jumped by another $30-40 per ton as the market gets back to business following the Memorial Day holiday and looks forward to what appears to be a promising summer ahead. Note that due to the limited transactions and data from the marketplace, we were conservative with our average on Galvalume, which may be somewhat higher. Plate prices were relatively unchanged. Despite prices that continue to rise week after week, buyers report little erosion in demand so far. SMU’s Price Momentum Indicators continue to point toward higher prices for all steel products in the next 30 days.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,600-$1,640 per net ton ($80.00-$82.00/cwt) with an average of $1,620 per ton ($81.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $100 per ton compared to one week ago, while the upper end decreased $40 per ton. Our overall average is up $30 per ton from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 8-12 weeks

Cold Rolled Coil: SMU price range is $1,800-$1,820 per net ton ($90.00-$91.00/cwt) with an average of $1,810 per ton ($90.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $100 per ton compared to last week, while the upper end decreased $30. Our overall average is up $35 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 11-14 weeks

ARTICLE CONTINUES BELOW

{loadposition reserved_message}

Galvanized Coil: SMU price range is $1,800-$1,880 per net ton ($90.00-$94.00/cwt) with an average of $1,840 per ton ($92.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $80 per ton compared to one week ago, while the upper end decreased $20. Our overall average is up $30 per ton from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,869-$1,949 per ton with an average of $1,909 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 12-16 weeks

Galvalume Coil: SMU price range is $1,800-$1,900 per net ton ($90.00-$95.00/cwt) with an average of $1,850 per ton ($92.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $80 per ton compared to last week, while the upper end remained unchanged. Our overall average is up $40 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,091-$2,191 per ton with an average of $2,141 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 12-16 weeks

Plate: SMU price range is $1,320-$1,490 per net ton ($66.00-$74.50/cwt) with an average of $1,405 per ton ($70.25/cwt) FOB mill. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is unchanged from one week ago. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 6-9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.