Prices

May 27, 2021

Hot Rolled Futures: Volatility Increases Open Interest

Written by Jack Marshall

The following article on the hot rolled coil (HRC), scrap and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Hot Rolled

Increased directional volatility as well as inter-day volatility have helped increase hot rolled open interest.

May is proving to be a very choppy market in HR futures with different periods adjusting to reflect divisions in market sentiment. Watching the HR futures price action during May has been a bit like watching the Cedar Point roller coaster. While the weekly HR spot index steadily rose roughly $130/ST to just shy of $1,600/ST, the futures curve has had considerable volatility in both directions.

We can see this volatility in the price movement in Q3’21 and Q4’21 for the period from May 13 through yesterday, May 26, as reflected by settlement values. Q3’21 HR settlement values during this period declined $162/ST and then rose $188/ST to settled yesterday at $1593/ST. However, Q4’21 HR settlement values during this period declined $207/ST and then only rose $127/ST to settle yesterday at $1,337/ST, which has left the forward curve more steeply backwardated.

The majority of the HR futures volumes traded have fallen in the 2H’21 period, which is where 90% of the open interest lies. Open Interest is currently just shy of 34,900 contracts or 1,396,000 ST of market trades.

The HR futures marketplace has been very active in May with 20,255 contracts trading, which is over 810,000 ST of trades/hedges.

Market watchers have been focusing on mill lead times and actual delivery times to check for any slack in the supply, as well as import prices and availability. Further price inflation and difficulty in hiring new employees continues to stymie forecasting, which will likely keep implied volatilities elevated.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

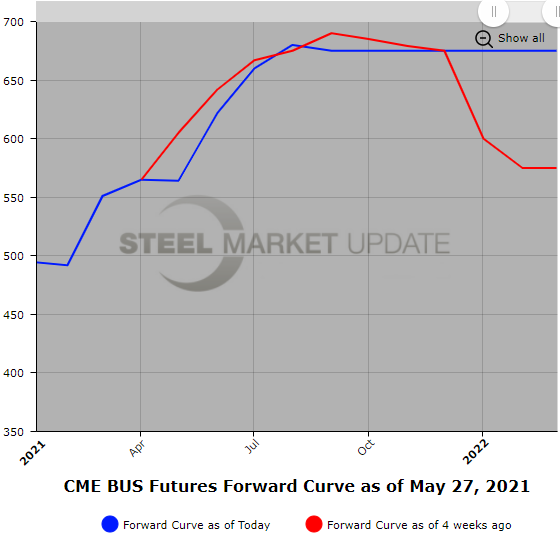

Scrap

Increasing prices for obsolete and alternatives have kept the Jun’21 BUS futures well bid. Current market for the front month, Jun’21 BUS is $600/$620 per gross ton, which matches up nicely with the current chatter, which suggests that June No. 1 Busheling delivered Midwest will be up roughly $50/GT. 2H’21 BUS has been settling at about $675/GT. Rising pig iron prices along with rising obsolete export prices are shifting the focus back onto BUS, which is reflected in the higher 2H’21 BUS bids.

May metal margin settled at ($1,521 HR – $564 BUS = $957 MM), which is up from $800 last month.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.