Market Data

May 26, 2021

SMU Steel Buyers Sentiment: Firmly Bullish

Written by Michael Cowden

Steel buyers’ sentiment remains firmly in bullish territory even as carbon steel prices are nearing levels more commonly associated with stainless steel or even aluminum. While some sources continue to fret about the steep downside risk of current high prices, most have gotten over their initial sticker shock and are busy trying to secure enough tons to meet the surprisingly durable demand.

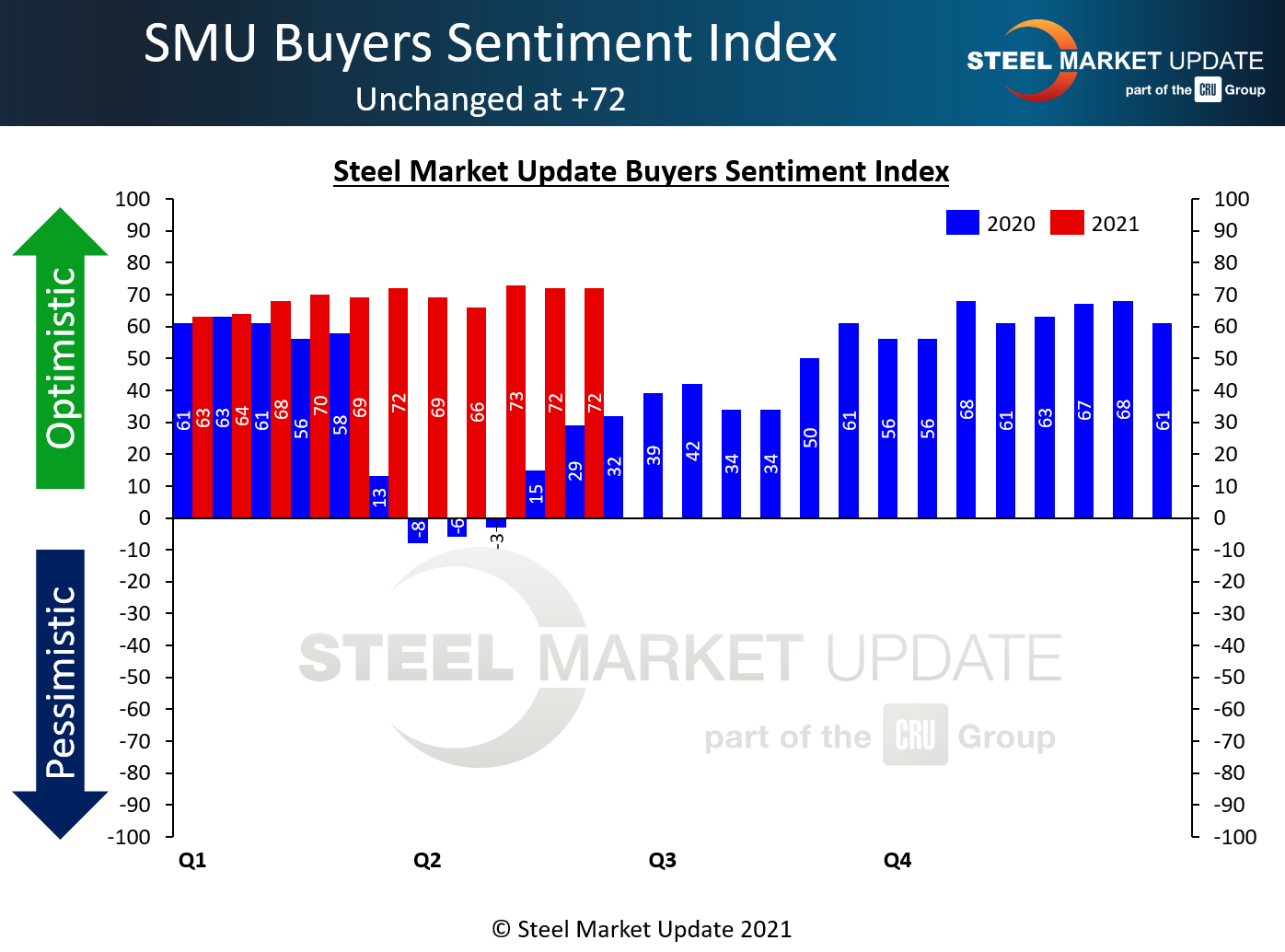

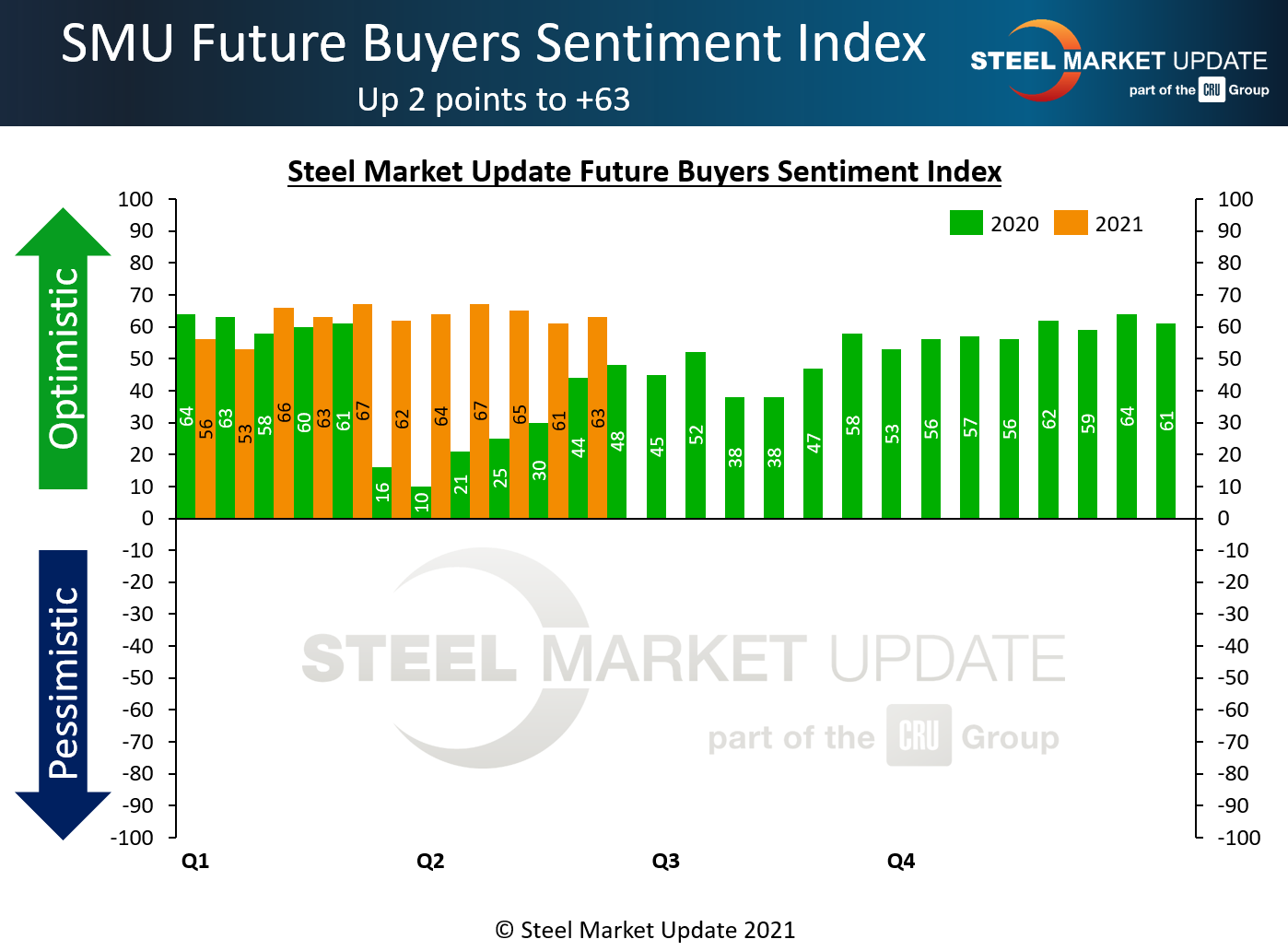

SMU asks steel buyers every two weeks how they view their company’s chances for success in the current environment and how they view their prospects three to six months in the future. SMU’s Current Buyers Sentiment Index stands +72 this week, unchanged from two weeks ago. SMU’s Future Sentiment Index inched up by two points to +63. Both indexes have been in the +60s and +70s for most of the year–showing a huge recovery from the pandemic lows in 2020–and are not far removed from the record highs of +77-78 seen in 2018.

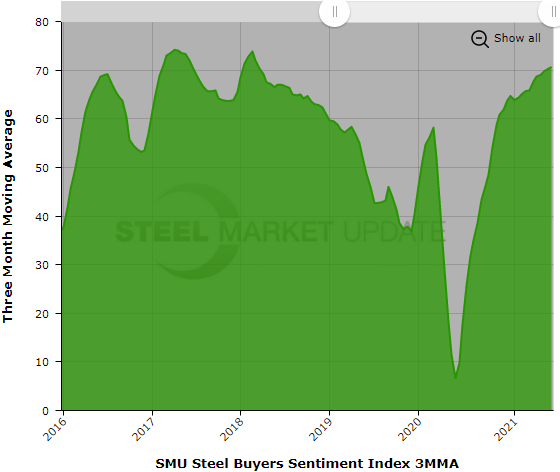

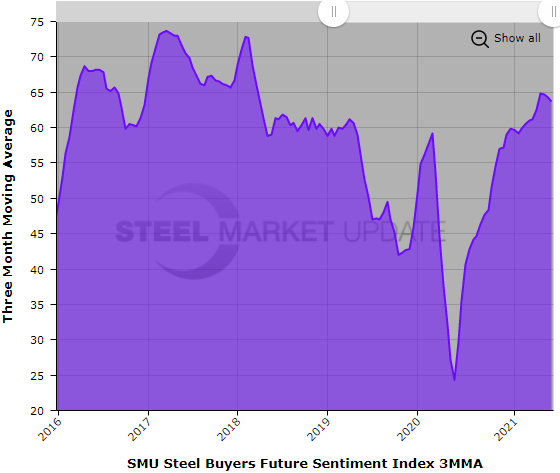

Measured as a three-month moving average (3MMA) to smooth out the variability, Current Sentiment stood at +70.67 this week, up from +70.17 two weeks ago. The Future Sentiment 3MMA was at +63.67, down slightly from +64.33 in the last survey.

What Respondents Are Saying

“Demand is through the roof. There’s no end in sight. We’re over four months behind in production; we need more steel!”

“Demand is very strong. Customers are even talking about 2022 now, trying to secure sourcing.”

“Downstream we’re seeing fewer and fewer consumers balk at the pricing. Folks are busy and they need metal!”

“Auto has slowed but is allowing us to catch up on other business.”

“The bulls are running!”

“We’re concerned pricing will see a downturn and create a slight recession in the market.”

“Panic buying.”

By any measure in SMU’s methodology, optimism is running extremely high in the steel industry, mirroring the high steel prices.

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat-rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings run from +10 to +100. A positive reading means the meter on the right-hand side of our home page will fall in the green area indicating optimistic sentiment. Negative readings run from -10 to -100. They result in the meter on our homepage trending into the red, indicating pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace. Sentiment is measured via Steel Market Update surveys that are conducted twice per month. We display the meter on our home page for all to see.

We currently send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies. Approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.

By Michael Cowden, Michael@SteelMarketUpdate.com