Market Data

May 14, 2021

SMU Steel Buyers Sentiment: The Future is Bright, Right?

Written by Michael Cowden

Steel buyer sentiment remains near its highest reading of the year even as prices shoot farther into uncharted territory.

The stratospheric price gains in theory bring the risk of an equally jarring crash. But steel buyers don’t appear overly concerned about that possibility – not when assessing their prospects in today’s market or when looking out at business conditions over the coming months.

SMU asks steel buyers every two weeks how they view their company’s chances for success in the current environment and how they view their prospects three to six months in the future.

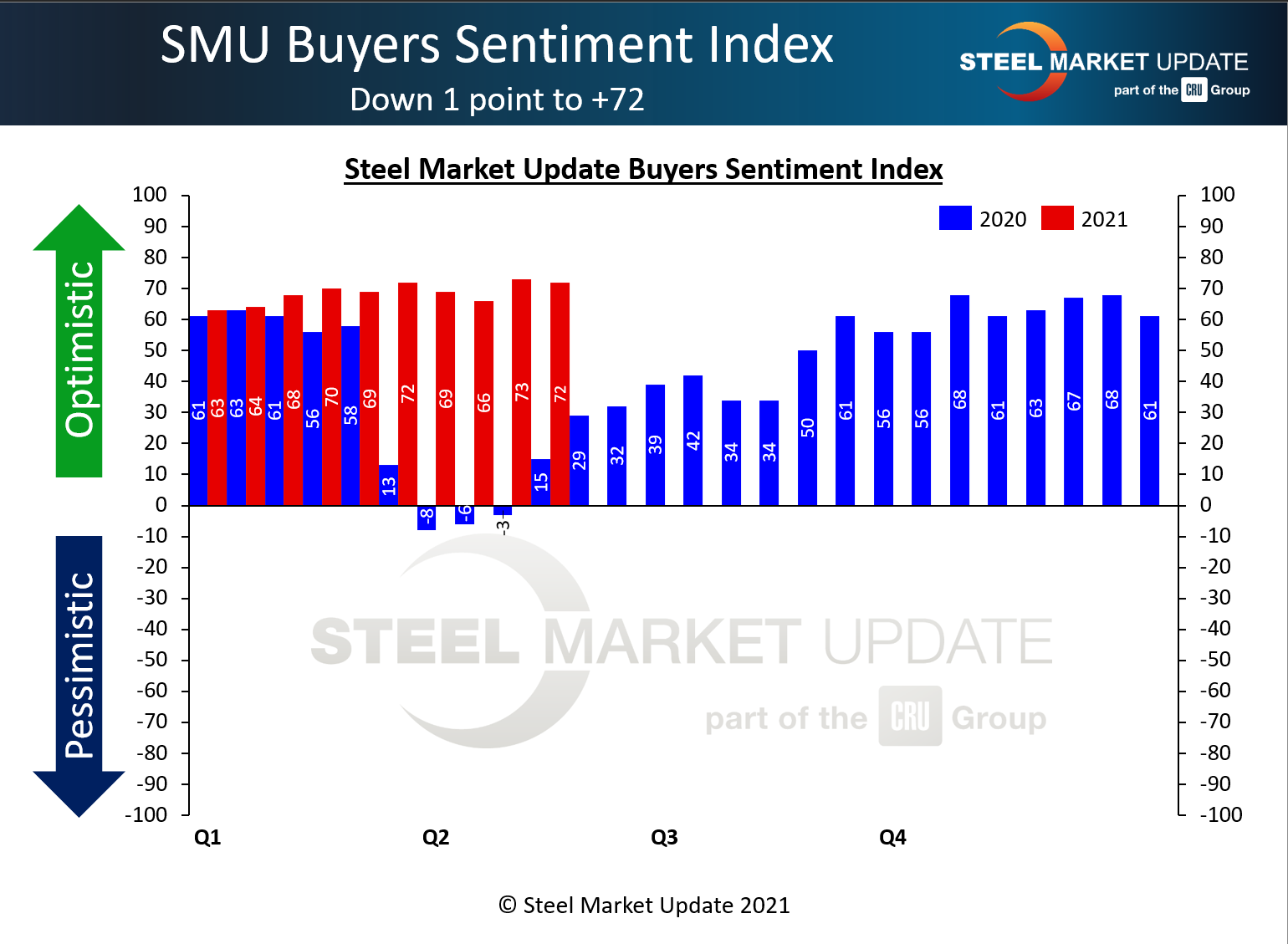

SMU’s Current Buyers Sentiment Index stands +72 this week, little changed from +73 on April 29 – which also represented the high-water mark for 2021.

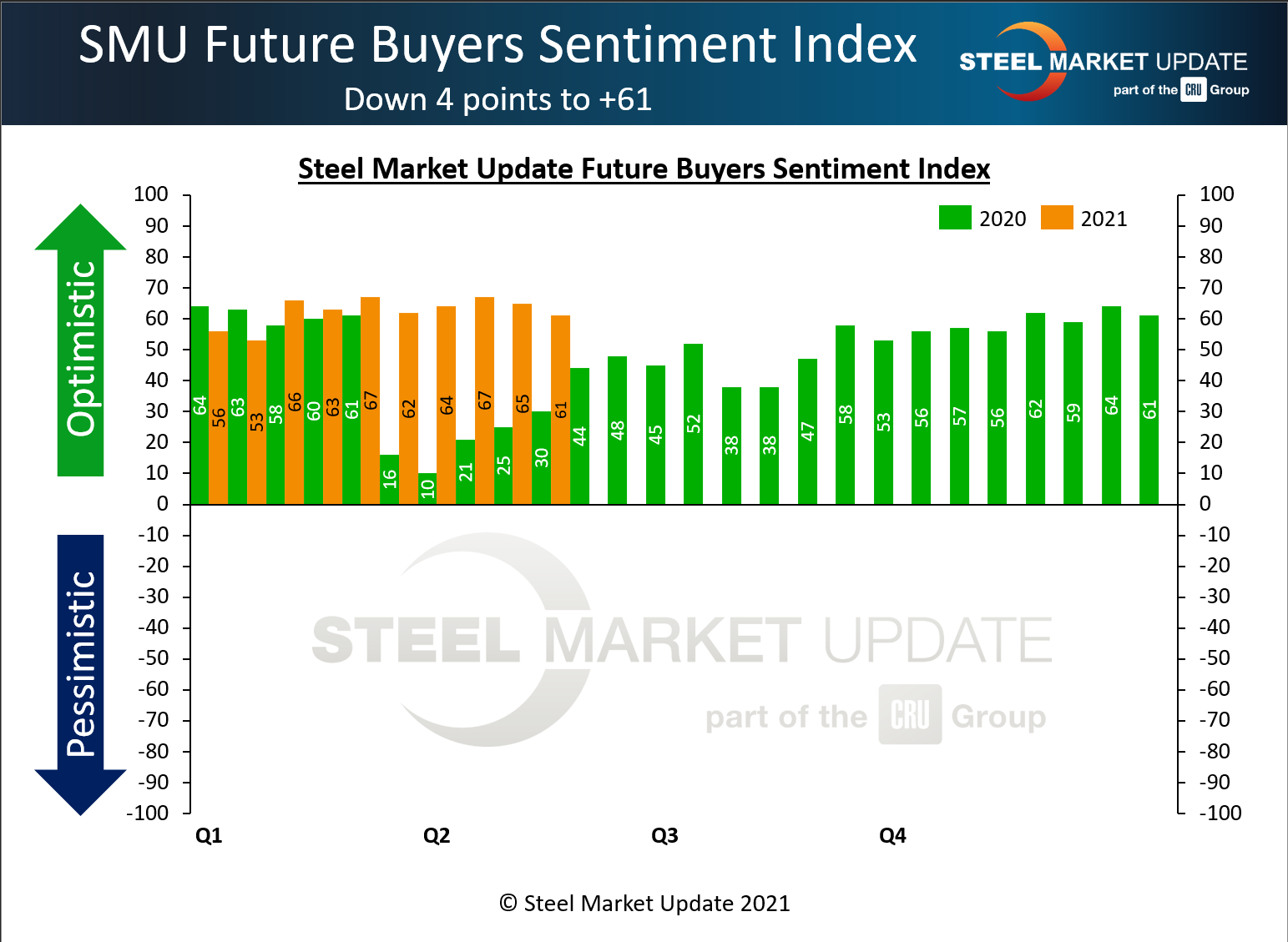

SMU’s Future Sentiment Index, meanwhile, continued to inch downward. It is at +61 — down four points from +65 in late April and down six points from a 2021 peak of +67 recorded on April 15.

While there has been little change in the numbers regarding future sentiment, some survey respondents were more bearish in their comments about the market (see below.)

It is difficult to conclude whether such modest declines represent the beginning of a new trend or simply week-to-week noise. Current sentiment has bounced around in a narrow bandwidth of +66-73 since mid-February. Future sentiment has held in a similarly narrow range of +61-67 over the same period.

Recall that steel prices had prior to mid-February shown potential signs of weakening – or least of gains slowing. And then winter storms that month, and resulting outages and supply chain snarls, sent prices skyrocketing again – a trend that has continued uninterrupted since.

What does a significant move in sentiment look like? For context, the same period last year saw current sentiment plunge from +56 in mid-February to -8 in early April before rebounding to +15 in mid-May. In short, sentiment, like prices, can change fast.

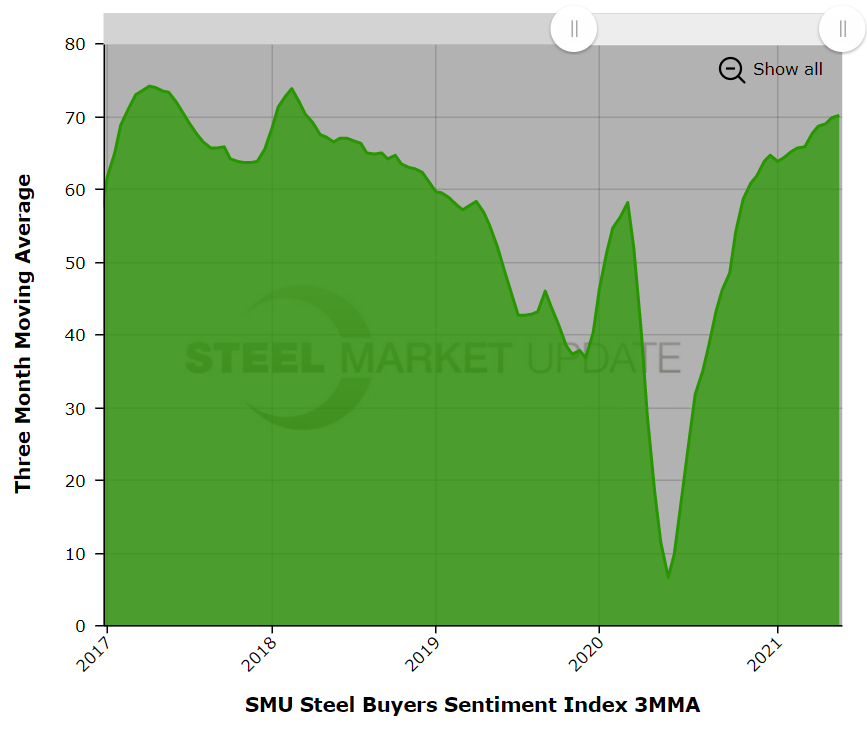

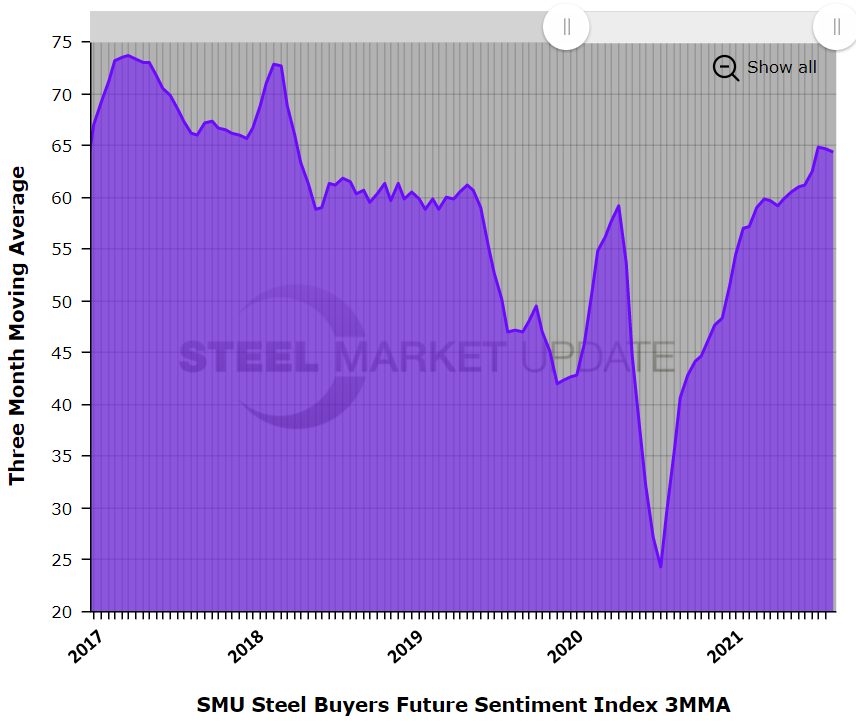

Measured as a three-month moving average (3MMA) to smooth out the variability, Current Sentiment stood at +70.15 this week, up from +69.83 on April 29. Future Sentiment 3MMA was at +64.35 this week, little changed from +64.67 in late April. Both figures are well above averages in the mid-50s over the past five years.

What Respondents Are Saying About Current Sentiment

What Respondents Are Saying About Current Sentiment

“We will wrap up a truly unprecedented and historic (read: record profits) 1H next month. I expect the 2H to be very good as well, just not as wild – mainly due to inventory costs catching up.”

“Declining availability (for the) next two months, prices moving upward further.”

“Demand is still good and buying steady for the moment.”

What Respondents Are Saying About Future Sentiment

“Due to our mix of contracts and spot business, we will successfully decouple from any potential severe reversal as we head into 2022 — at least that is what I’m telling myself.”

“Concerned pricing levels will start to impede and slow down the market.”

“I worry about the topping out, buying stopping and then market claims.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat-rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings run from +10 to +100. A positive reading means the meter on the right-hand side of our home page will fall in the green area indicating optimistic sentiment. Negative readings run from -10 to -100. They result in the meter on our homepage trending into the red, indicating pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace. Sentiment is measured via Steel Market Update surveys that are conducted twice per month. We display the meter on our home page for all to see.

We currently send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies. Approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.

By Michael Cowden, Michael@SteelMarketUpdate.com