Prices

May 13, 2021

March Import Market Share for Tubular and Long Products

Written by David Schollaert

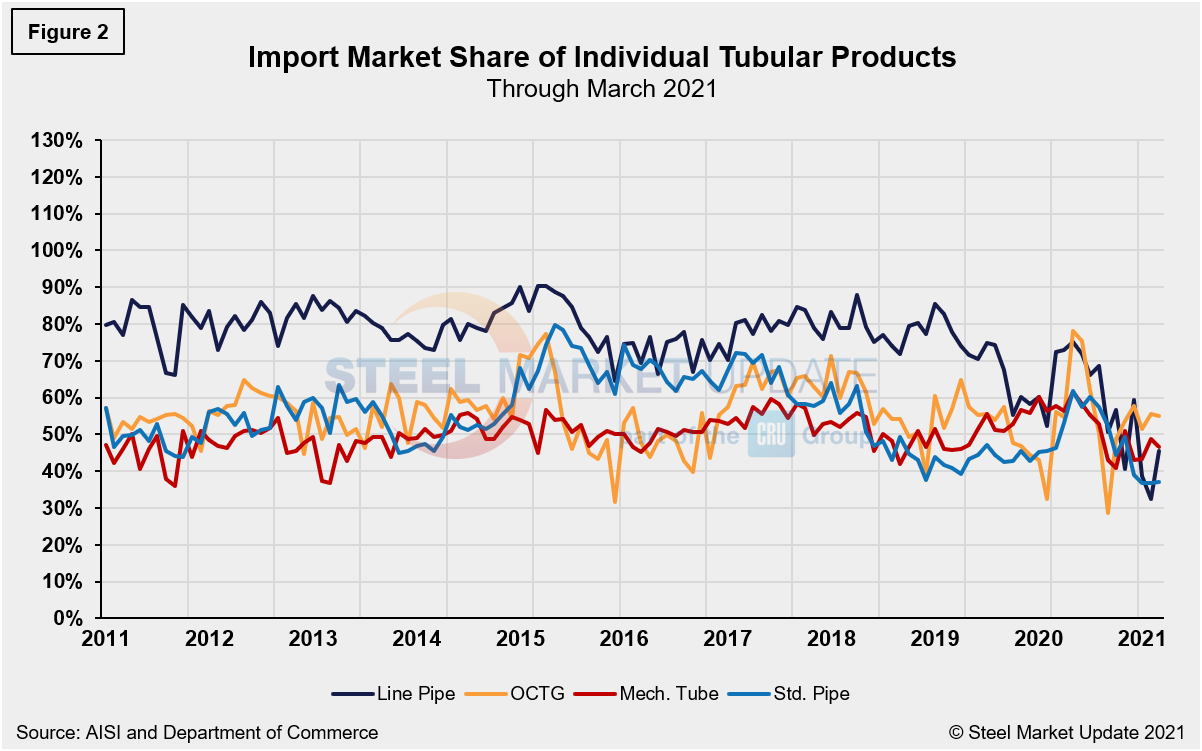

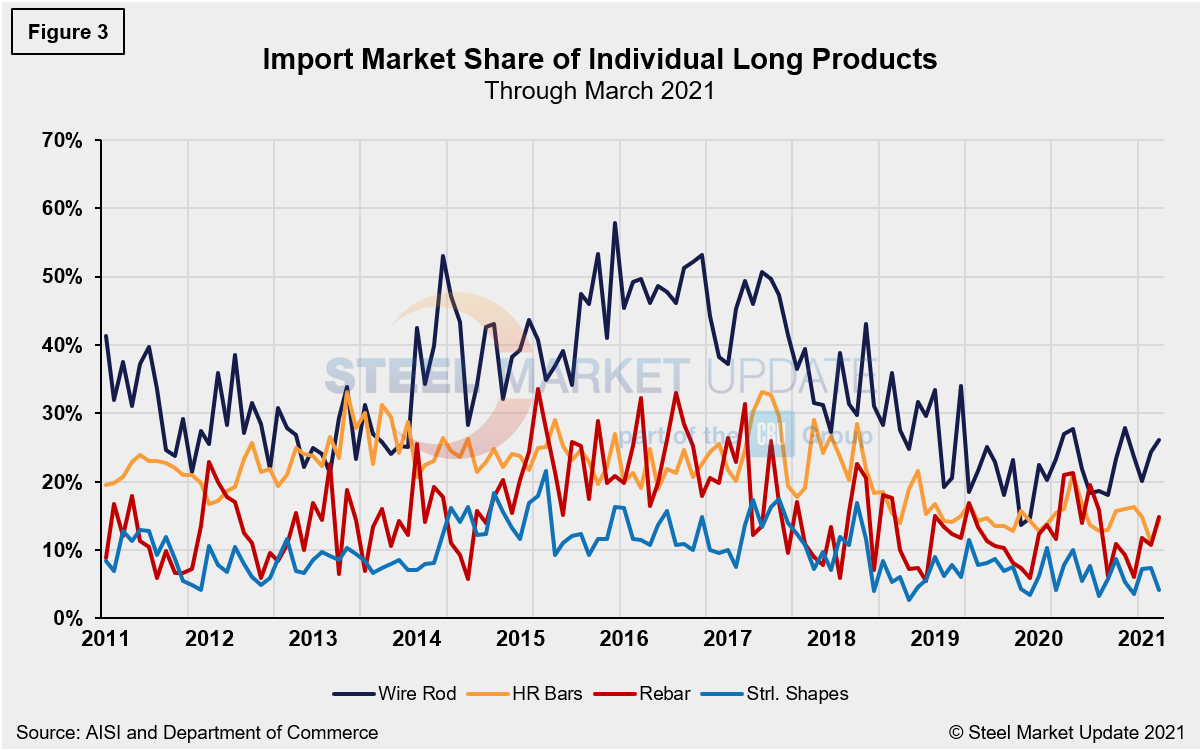

This report examines the import share of tubular and long products shipments. Imports’ share of total tubular products rose to 46.2% in March, up from 44.6% in February. Despite a 30.7% surge in domestic tubular shipments month on month, imports were even stronger at 39.3% in March compared to February. Tubular imports fell consecutively in January and February, however, March’s total of 262,833 tons was the highest import level since June 2020. Long products import market share rose from 11.2% in February to 12.7% in March, while both imports and domestic shipments increased month on month.

The import share of wire rod rose to 26.1% in March, up from 24.4% in February. OCTG saw its import share edge down to 55.1% in March, from 55.6% the month prior. An increase of 48.2% in OCTG imports month on month was offset by a 51.4% increase in domestic shipments. Mechanical tubing saw similar dynamics in March. Import market share edged down to 46.5% from 48.7% in February largely due to a surge of 39.3% in domestic shipments despite a rise of 27.3% of imports during the same period.

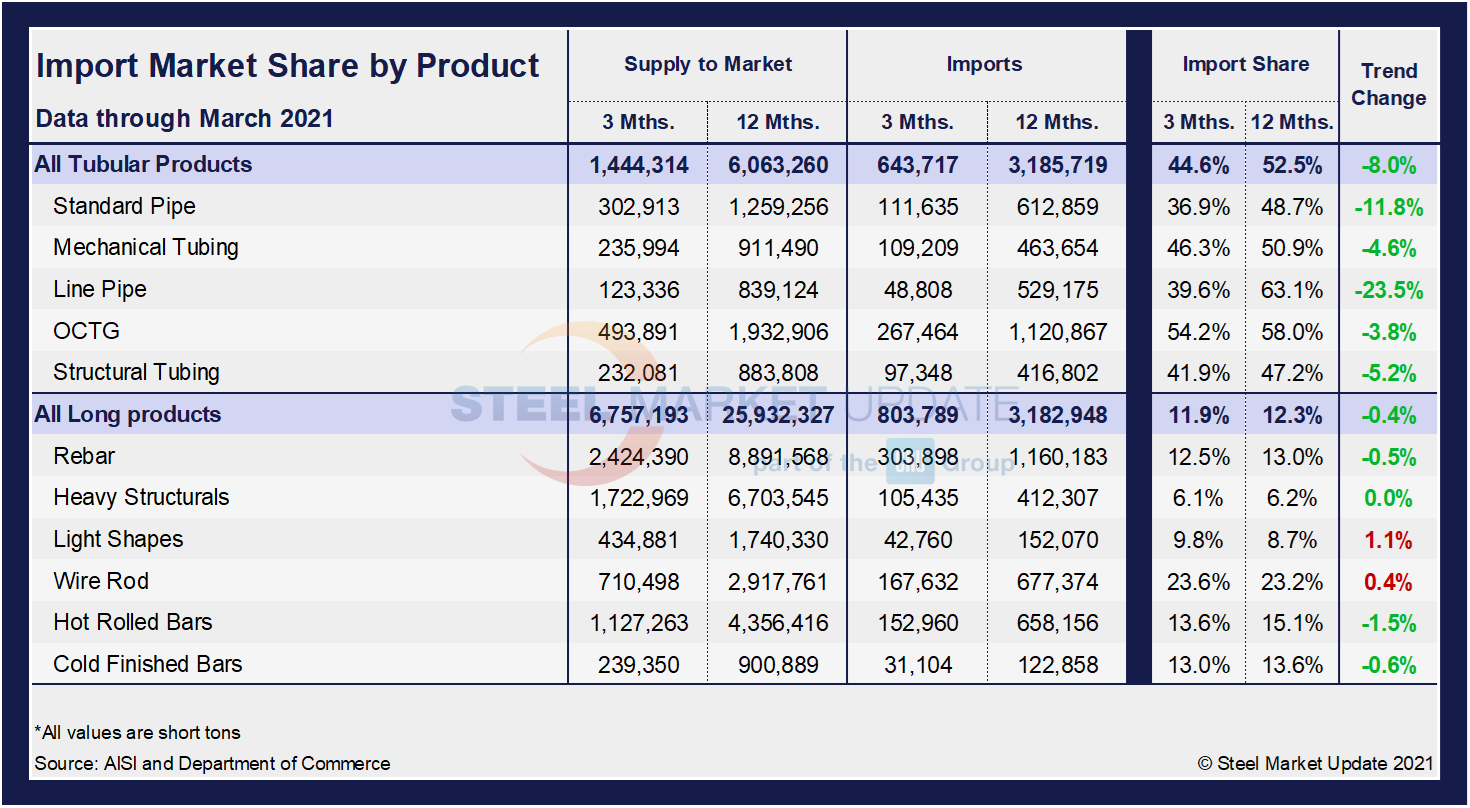

The table below shows total supply to the market in three months and 12 months through March 2021 for the tubular and long product groups and 11 subcategories. Supply to the market is the total of domestic mill shipments plus imports. It shows imports on the same three- and 12-month basis and then calculates import market share for the two time periods for 11 products. Finally, it subtracts the 12-month share from the three-month share and color codes the result green or red according to gains or losses. If the result of the subtraction is positive, it means that the import share is increasing, and the code is red. Most importantly, in regard to tubular and long products, the import market share has decreased in three months compared to 12 months across product groups except for light shapes (1.1%) and wire rods (0.4%), which saw inconsequential increases through March 2021.

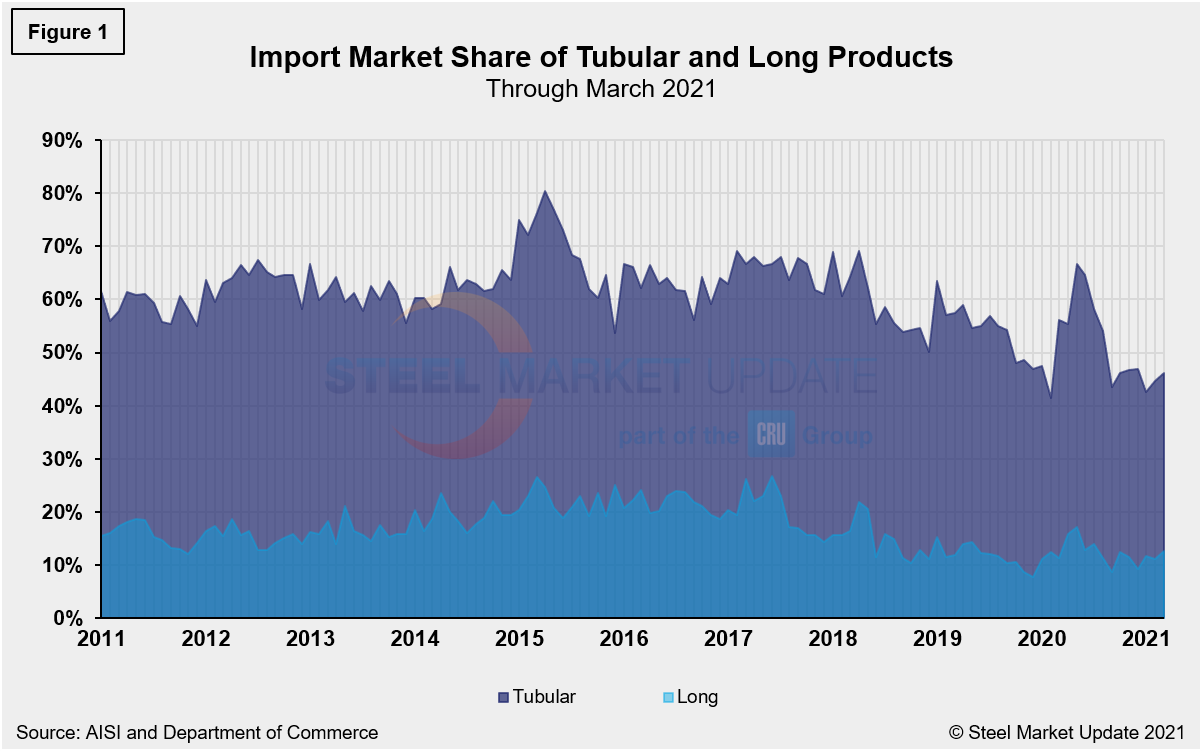

The historical import market share of tubular and total long products is shown in Figure 1, while the import market share of the four major tubular products is displayed in Figure 2. Lastly, the import market share of individual long products is shown in Figure 3. The import share of tubular products is more than triple that of long products, however, both have seen significant increases month on month. While both were impacted by COVID-19 mitigation efforts, long products have surpassed pre-pandemic levels. Tubular products are not far behind, but they have had more ground to cover as they were far more impacted than long products over that period. In March, line pipe saw the strongest swing in imports month on month; after seeing imports fall by 24.5% in February, they rebounded by 92.2% in March. By comparison, structural shapes imports have contracted consecutively in February and March, down 31.2% month on month.

By David Schollaert, David@SteelMarketUpdate.com