Prices

May 11, 2021

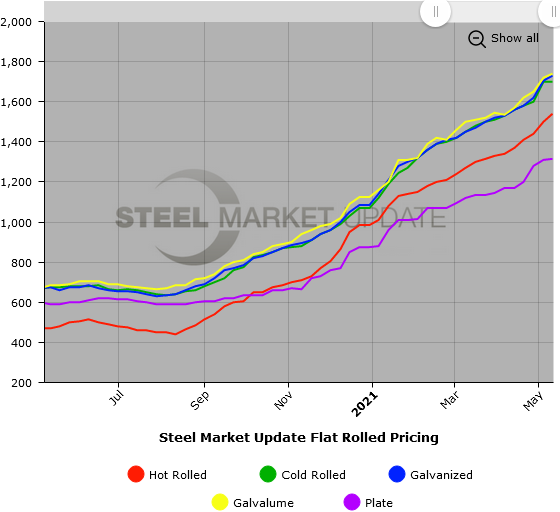

SMU Price Ranges & Indices: Flat Rolled Moves Up By Another $20-40 Per Ton

Written by Brett Linton

The flat rolled steel market was a little tougher to read this week. Steel Market Update’s survey of the market over the past two days clearly shows a further increase in hot rolled prices, with buyers reporting offers as high as $1,600 per ton. SMU puts the average HR price at $1,540 this week as tons available on the spot market continue to lag demand. Cold rolled prices typically rise along with hot rolled, but the data for cold rolled was less clear, so we opted to leave our CR price unchanged from last week. Coated product prices are up by another $20-25 per ton as demand stays strong in construction, automotive and other markets. Plate prices saw a small increase as well. SMU’s Price Momentum Indicators continue to point toward even higher prices over the next 30 days.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,480-$1,600 per net ton ($74.00-$80.00/cwt) with an average of $1,540 per ton ($77.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $80 per ton. Our overall average is up $40 per ton from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 8-13 weeks

Cold Rolled Coil: SMU price range is $1,600-$1,800 per net ton ($80.00-$90.00/cwt) with an average of $1,700 per ton ($85.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained unchanged compared to last week. Our overall average is unchanged from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 10-14 weeks

Galvanized Coil: SMU price range is $1,660-$1,800 per net ton ($83.00-$90.00/cwt) with an average of $1,730 per ton ($86.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $50 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is up $25 per ton from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,729-$1,869 per ton with an average of $1,799 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 11-16 weeks

Galvalume Coil: SMU price range is $1,700-$1,780 per net ton ($85.00-$89.00/cwt) with an average of $1,740 per ton ($87.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $20 per ton compared to last week. Our overall average is up $20 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,991-$2,071 per ton with an average of $2,031 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 12-14 weeks

Plate: SMU price range is $1,220-$1,410 per net ton ($61.00-$70.50/cwt) with an average of $1,315 per ton ($65.75/cwt) FOB mill. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $10 per ton. Our overall average is up $5 per ton from one week ago. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 5-9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.