CRU

April 30, 2021

CRU: The Rotation of Consumer Demand

Written by Jumana Saleheen

By CRU Principal Economist Alex Tuckett and Chief Economist Jumana Saleheen, from CRU’s Global Economic Outlook

Our forecast for global growth in 2021 remains unchanged, with downward revisions to Europe, India and China being offset by upward revisions to other countries, principally the U.S. Although risks remain, we remain confident that the world will see a strong recovery in 2021. However, as demand rotates from goods to services, commodity markets may not feel the full benefit of the fastest rate of global growth for 40 years.

Durables Demand: a Smaller Slice of a Bigger Pie

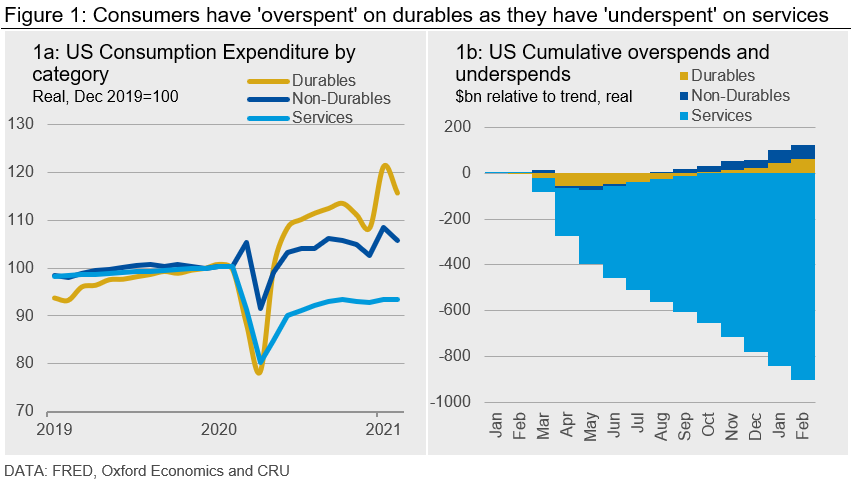

As the pandemic hit, consumer spending initially fell across all categories. As highlighted in our previous analysis, “Five features of the pandemic recovery,” spending on durables quickly recovered, and then exceeded, the pre-crisis trend. In contrast, spending on services has remained depressed (Figure 1a). A reversal of these trends presents a risk to demand for durables, the most commodity-intensive part of consumer spending.

Cumulatively, U.S. consumers have spent more on durables since January 2020 than would be suggested by the pre-pandemic trend, and less on services (Figure 1b). Although similar magnitudes in percentage terms, in billions of dollars the cumulative “overspend” on durables is dwarfed by the cumulative “underspend” on services.

This so-called “K-shaped” recovery contrasts with the usual pattern, whereby spending on goods—in particular durable goods—is more sensitive to the business cycle than services. For example, after the Global Financial Crisis (GFC), real spending on durables in the U.S. fell 13% and took over three years to return to the pre-recession level. Services fell only 0.6% and had recovered to pre-recession levels after little more than a year.

Provided vaccination programs continue to bring COVID-19 under control, advanced economies will re-open and there should be a rotation of consumer demand. The share of consumer spending on durables will fall, and the share on services rise. At the same time, total consumer spending should increase as incomes rise and the saving rate falls from historic highs. The effect on durables depends on the net impact of these two effects. As a baseline, if total U.S. consumer spending were to rise in line with our forecast, and the shares of that spending revert to pre-pandemic trends, then durable spending for the next four quarters (2021 Q2 onwards) would be 2.1% below the last four quarters (and 10.5% below the exceptionally strong demand in 2021 Q1). However, demand would still be 7.6% above 2019 levels.

Both the cumulative overspend on durables and the underspend on services (Figure 1b) could become further headwinds. Consumers have accumulated a larger stock of durables during the pandemic. If their lifestyles have permanently changed, they may choose to maintain this stock (for example, a computer screen bought for homeworking). However, if lifestyles revert to “normal,” durable demand may shift lower for some time (for example as gyms re-open, consumers may be left with unwanted home exercise equipment). In an equivalent way, the share of services could rise above the pre-pandemic trend if consumers decide to “make up for lost time.”

There are also upside risks. Households in the U.S.—and to a lesser extent other advanced economies—have accumulated a large stock of “excess savings.” If some of these savings are spent, consumption could surge even more strongly than forecast, potentially boosting spending on both goods and services. Nonetheless, the rotation of consumer demand could mean that strong growth rates in global consumer spending do not translate into as strong demand for commodities as might be expected. Of course, other sources of demand will also be important for the commodities demand outlook—infrastructure, real estate, corporate investment and the energy transition.

Euro Vaccination Program Finally Shifts into the Fast Lane

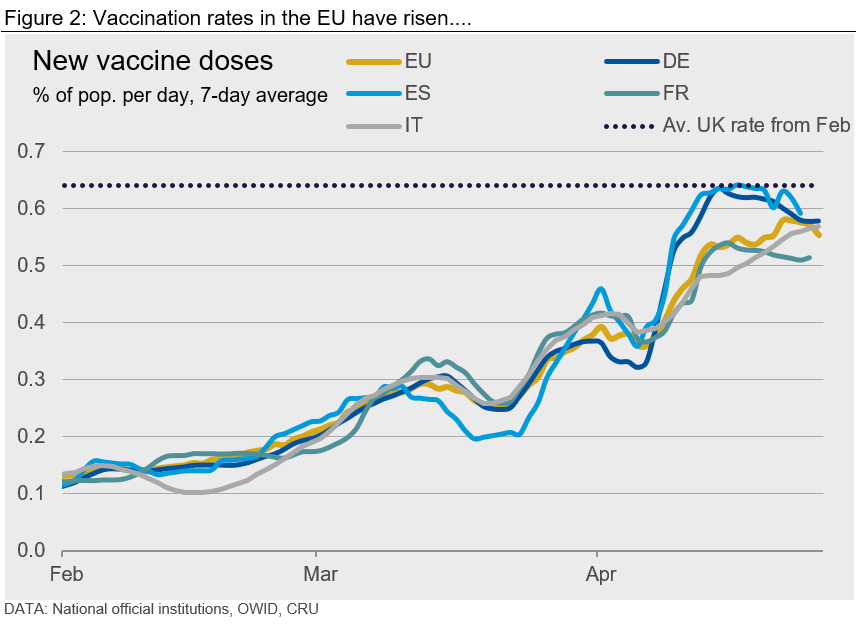

Vaccination programs in the UK and U.S. are proceeding rapidly. Vaccination has been slower to get off the ground in EU countries, initially due to later regulatory approval, more recently due to problems with vaccine supply. April was the month when an increase in supply was expected to finally boost the speed of the rollout. Data in the past few weeks has confirmed this: Germany and Spain have sharply increased the speed that vaccines are being administered, with France and Italy also seeing increases (Figure 2).

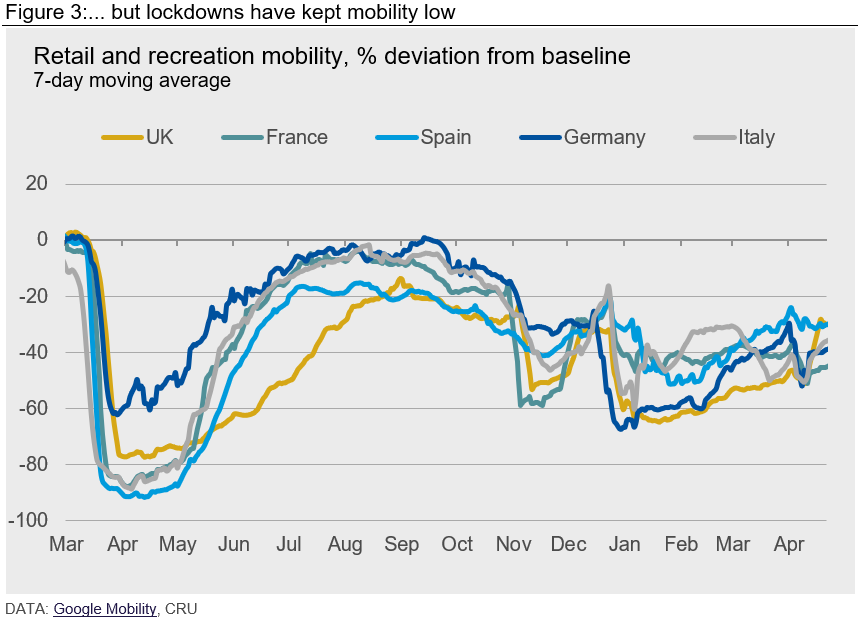

However, in the short term the outlook for Europe has worsened. The increase in vaccination rates in the past few weeks has come too late to prevent a third wave, and many European countries have tightened restrictions. This has prevented mobility from recovering to the levels of last summer (Figure 3), so the rebound in economic activity will be delayed. Our revised expectation is that “lockdown” restrictions will begin to ease from mid-May (although this will vary from country to country). At this point, if the current pace of vaccinations is maintained, the EU will have administered doses equal to around 40% of the population (the proportion of the population inoculated with at least one dose will depend on the dosing regime). By the end of Q2, this should have risen to over 60% of the population, potentially more if the Johnson & Johnson vaccine is successfully rolled out.

Based on these assumptions, we expect growth of 1.1% in Q2, followed by growth of 2.5% in Q3, with GDP returning to pre-pandemic level in 2022 Q1. Downside risks remain to this. Further problems with vaccine supply could delay re-opening from lockdowns. Most seriously, the spread of new variants could undermine the effectiveness of even a more rapid vaccine rollout.

Stronger U.S. Recovery Offsets Europe and China

This month we have modestly revised down our forecast for Eurozone growth from 4.4% to 4.2%. We have also marginally revised down growth in China from 8.4% to 8.3%. The latest data from China have confirmed the strength of the recovery, but were slightly below our expectations. Our India forecast has been cut from 11.7% to 9.3% as a third wave of COVID-19 spreads rapidly. These downward adjustments are fully offset by upward revisions to a number of countries, most importantly the U.S. (revised from 6.5% to 6.9%); the strong recovery we have forecast appears to be happening sooner than anticipated. We continue to expect 2021 to be a very strong year for the global economy, with growth of 5.8%, as vaccination allows economies to recover from the effects of COVID-19. However, there will be a rotation of consumer demand that will inevitably accompany the easing of lockdowns. This will reduce the growth dividend enjoyed by commodity markets.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com