Market Data

April 29, 2021

SMU Steel Buyers Sentiment: No Lag in Optimism

Written by Tim Triplett

While other measures of economic recovery still lag their pre-pandemic levels, that is not the case with the sentiment among steel buyers. Attitudes among buyers are already more positive than they were before COVID struck last year, and optimism levels are nearly the highest ever recorded in the 13 years that Steel Market Update has been gathering this data.

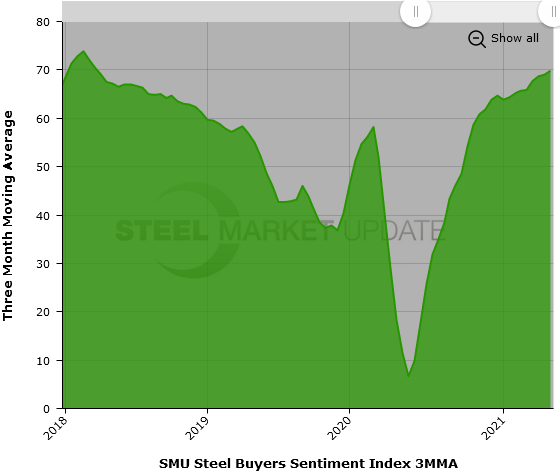

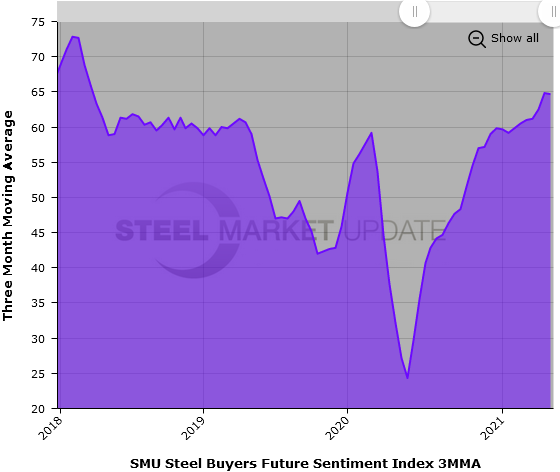

Every two weeks, SMU asks steel buyers how they view their company’s chances for success in the current environment, as well as three to six months in the future. SMU’s Current Buyers Sentiment Index saw a seven-point bump to a reading of +73 this week—just five points shy of the index peak of +78 in January 2018. SMU’s Future Sentiment Index ticked down by two points to a reading of +65—still within striking distance of the historical high of +77 in February 2018.

Comparing sentiment in the first quarter with the same period last year, the average sentiment reading in 2021 was a healthy +68, versus +52 in 2020 before the pandemic.

How to account for that difference? The price of steel is the obvious variable. The price of hot rolled jumped from about $1,000 per ton to the current $1,440 per ton in the first four months of this year. In 2020, the HR price started the year around $600 per ton and slid downward to just $460 per ton by the end of April. There’s a lot more people making a lot more money than they did last year.

So far, the historically high steel prices have not cut into demand, as service centers and manufacturers continue to report record sales and profits in an economy enjoying the sugar high of government stimulus. The fact that Future Sentiment is eights points lower than Current Sentiment no doubt reflects respondents’ uncertainty about the sustainability of demand and pricing in the second half. Plus lingering concern over COVID and its variants, which are surging in other parts of the world.

Measured as a three-month moving average (3MMA) to smooth out the variability, Current Sentiment hit +69.83 this week, while the Future Sentiment 3MMA dipped slightly to +64.67—both still well above the averages in the mid-50s over the past five years.

What Respondents are Saying

“I have all the orders I could ever want…too bad I can’t get steel.”

“It is safe to say that 2021 will be the most profitable year in our 60+ year history. Just exactly how record-breaking will depend on the strength in Q4. At this juncture, Q2 and Q3 are pretty much baked in and looking really nice!”

“My current bookings are great, but the limited availability makes it difficult to say [my prospects are] excellent.”

“We used to be 100% USA material, Unfortunately, we had to go to 80% imported steel due to the man-made steel crisis created in the U.S. The quality and cost of imports is actually very good.”

“The market is very risky and uncertain for the next six months, especially for imports.”

“Finding enough labor is also a challenge.”

“I think we are going to stall the economy with the high prices as the consumer is really just starting to see the effect when they go to buy manufactured goods. It takes six months before the cost changes really come through the system.”

“There are lots of unknowns and you just can’t trust the steel mills to do the right thing for the long term. They live for today with no memory of the past.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.

By Tim Triplett, Tim@SteelMarketUpdate.com