Analysis

April 28, 2021

Final Thoughts

Written by John Packard

Sometimes it seems like the faster I move the further behind I get….

I think steel buyers are beginning to realize they have precious little control over this market, and they are just along for the ride. As I reviewed the results of this week’s flat rolled and plate steel market trends analysis (our steel survey), it is apparent steel buyers do not know when flat rolled steel prices will stop rising or at what level they will peak.

If it makes you feel any better, neither do I….

The majority (58%) of those responding to this week’s survey believe hot rolled coil prices will peak above $1,500 per ton. We are not far away as SMU posted our HRC average at $1,440 per ton this week. More importantly, the upper end of our range is now sitting at $1,500 per ton. With our Price Momentum Indicator pointing toward higher HRC prices over the next 30 days, we should see our price average chip away at that $1,500 level and perhaps exceed it over the next couple of weeks.

As an “old timer,” I get up in the morning knowing I am going to say, “Yikes,” before the day ends. Yikes because steel prices are in rarified air never breathed before. I have a feeling we will smash through $1,500….

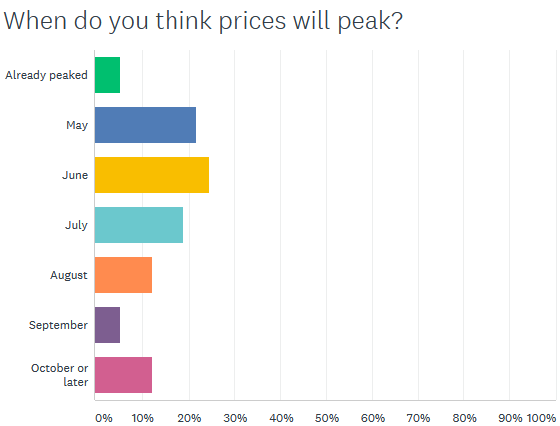

There is no clear consensus as to when steel prices will peak. We did ask the question in this week’s survey (see graphic below), but I am not yet a believer in something happening over the next couple of months. Demand is too strong, inventories continue to be too low, and supply is limited (and late). Ternium’s new hot strip mill in Mexico and the new SDI plant in Sinton, Texas, are not going to be putting enough tons into the market during the third quarter to force prices lower. I personally am not yet a believer in steel prices collapsing anytime soon. Maybe the rarified air is lacking much oxygen and I am too lightheaded to see the market clearly right now…?

When we asked a similar question in mid-February, the majority of the respondents (58%) believed prices would peak by no later than March. The same question in early March moved the majority further out by only one month to April or before (62%).

I was talking to one of the steel mills earlier today and this executive provided some interesting “color” about the steel industry: “Look, I think we are in a super-cycle and green initiatives and decarbonization is a great thing for U.S. steel. Carbon taxes on goods made with “dirty” steel is a boon…. The U.S. steel industry, thanks to years of innovation, EAF growth, fracking, S232, and doing the right thing is [making the U.S. steel industry] so competitive and ready for this balancing of the playing field…. [This is] going to be good for demand. As you know, we will still be cyclical, but look for the zoom-out view of those cycles to be consumption- and reshoring-supportive as steel-intensive finished goods also face the carbon purity test. Pricing will fall from lofty levels to fair/profitable levels when inventories balance out. Imports will help reach that point, but since the shortage is global at this point, volumes and arrivals are not instant. What seemed to be a huge swath of “game-changing” tons in transit five months ago are less impactful since demand has grown in the meantime. [HRC] Futures are $60s into next year for a reason. Moderation will come. More tons will arrive. Just happening later because people are consuming more steel than the experts expected.”

![]() One thing I learned during the 31 years I was selling flat rolled steel, if you were not innovating you were stagnating, and clients do not enjoy doing business with companies and people who are not looking forward and only living in the past. I took the same approach to Steel Market Update when I began the company in 2008, and even though I no longer own the company (we are owned by CRU), we continue to innovate and to look at markets and the products we are offering our clients in new ways. We continue to build new educational tools for the industry. We continue to expand and tweak our website, newsletters and how we take our products to market. We are also looking to the future as we strive to develop new proprietary products for our members so you and your company can function more efficiently, see data differently and make decisions that improve your company’s performance.

One thing I learned during the 31 years I was selling flat rolled steel, if you were not innovating you were stagnating, and clients do not enjoy doing business with companies and people who are not looking forward and only living in the past. I took the same approach to Steel Market Update when I began the company in 2008, and even though I no longer own the company (we are owned by CRU), we continue to innovate and to look at markets and the products we are offering our clients in new ways. We continue to build new educational tools for the industry. We continue to expand and tweak our website, newsletters and how we take our products to market. We are also looking to the future as we strive to develop new proprietary products for our members so you and your company can function more efficiently, see data differently and make decisions that improve your company’s performance.

In recent months we have added two new strong individuals to the SMU team – David Schollaert and Michael Cowden. Their past experiences, writing and analytical skills are meshing well with our existing team and helping to propel SMU forward.

As an “old salt” in the industry, I am pleased with the passion the entire SMU team has as we look to improve existing products, and they (along with our parent company) are rising to the challenge of innovating as we review how we report on the data we are collecting and the information we are collecting from those actively involved in the industry.

Those of you who are participating in our steel surveys may notice we are upgrading and reviewing the questions being asked and the way we are collecting data. We are trying to make the process easier for everyone involved. We are working to streamline the process and at the same time to improve the quality of the information we will be sharing with data providers, our Premium level members (who get access to our full PowerPoint presentation of each survey), and the articles we share in our Executive and Premium newsletters.

Yesterday we hosted Chris Shipp, Vice President of Supply Chain at Priefert Manufacturing/Priefert Steel, for one of our SMU Community Chat webinars. He spoke passionately about the dynamics he sees in the markets his company serves and how he has dealt with the challenges of a pricing environment seemingly gone mad. Multiple Priefert employees have attended all the SMU workshops we offer and over the past 18 months they have put to use what they learned in our hedging workshops to protect their company and their clients from the price volatility we are seeing. I highly recommend you watch the webinar, which you can do by clicking here.

Chris Shipp also recently visited the new SDI Sinton, Texas, steel mill that is under construction and scheduled to come online during the third and fourth quarters of 2021. He offered comments about the expansion of Ternium, the new SDI plant and the status of supply in the U.S. versus demand. Again, I recommend watching this video of yesterday’s SMU Community Chat Webinar.

I had a meeting with the CME Group and the CRU events team out of London to discuss the CME “Pre-Summit” workshop they will be conducting at this year’s SMU Steel Summit Conference. They are moving away from broker lead and introductory discussion on the HRC (hot rolled coil) futures contract. The concept for this year is for manufacturing and distribution companies who are active traders to discuss their experiences in getting into the market, how it has impacted their business and specifically how they are weathering the volatility we have been seeing over the past 12 months. You will want to arrive early into Atlanta as the CME “Futures Showcase” workshop is scheduled for 10 a.m. ET on Monday, Aug. 23. You can learn more about the conference, agenda, speakers, costs to attend and how to register by going to: https://www.events.crugroup.com/smusteelsummit/home or by clicking here.

As always, your business is truly appreciated by all of us here at Steel Market Update.

John Packard, President & CEO, John@steelMarketUpdate.com