Market Data

April 15, 2021

Service Center Shipments and Inventories Report for March

Written by Estelle Tran

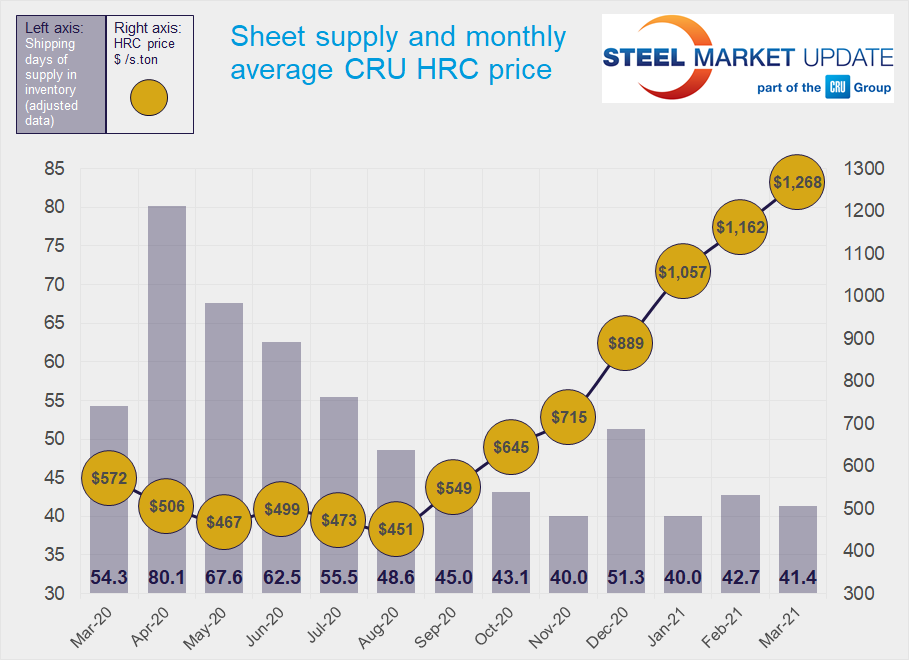

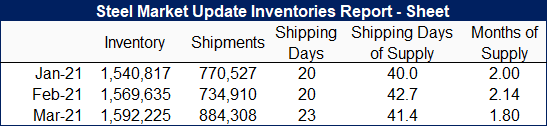

Flat Rolled = 41.4 Shipping Days of Supply

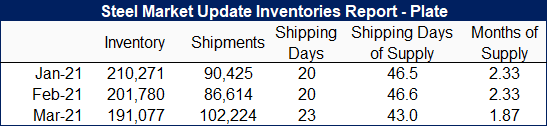

Plate = 43 Shipping Days of Supply

Flat Rolled

U.S. service center flat rolled inventories remained very lean in March, as shipments were strong, but mills continued to run late on deliveries. At the end of March, U.S. service centers had 41.4 shipping days of supply of flat roll; this is down from 42.7 on an adjusted basis for February. Service center stocks represented 1.80 months of supply at the end of March, down from 2.14 months in February.

With 23 shipping days, March had three more shipping days than February – a 15% increase. The daily shipping rate increased 4.6% month on month, indicating that seasonal demand remains strong and service centers may have been catching up on orders delayed in February.

The tightness seen by service centers can be explained by domestic mills running weeks behind schedule in many cases and continuing to restrict order entry. Multiple contacts have commented about how they do not have enough inventory to meet customer requirements and how much higher their inventories would be if orders more than a month late were to arrive. Service center contacts have reported more trading among service centers and calls from infrequent customers – sometimes in long freight locations – because of supply tightness. Other factors keeping inventories lean are the limited availability of trucks and credit restrictions.

Lead times remain stretched with HRC lead times recorded at 8.6 weeks in the SMU survey published April 1. In many cases, these lead times are theoretical, as mills delay opening up their order books.

The amount of material on order increased at the end of March. The amount of flat rolled steel on order remains high because of long mill lead times and late material, as well as the increase in import volumes booked. We are seeing indications of rising imports with 902,000 tonnes of carbon and alloy flat products licensed in March, according to U.S. Department of Commerce license data. With the market still tight and prices high, we expect import volumes to spike around July.

The amount of inventory committed to contracts has trended around 60% this year, reflecting sheet prices that have reached record highs.

Plate

Plate inventories declined in March because of strong shipments, however, service centers remain cautious about new purchases as prices continue to rise. At the end of March, service centers carried 43 shipping days of supply, which was a new low and down from 46.6 days in February. In terms of months on hand, plate inventories fell to 1.87 months of supply at the end of March, down from 2.33 months in February.

Similar to sheet, service center shipments of plate also rose 18% month on month. The demand outlook for plate remains mixed, as some sectors, such as manufacturing, construction and mining, have had strong demand, while oil and gas remains depressed.

Service centers continue to trade material, as mill lead times remain long. SMU’s latest lead time survey reported plate mill lead times at 7 weeks. Plate prices have been supported by high prices for sheet, and mills that have the ability to produce both have reduced the allocation for plate customers.

At these high prices, credit has been an issue as well, and people have become increasingly leery about building inventory as mills have continued to raise prices. Some contacts have complained that they have been busy quoting, but that has not been translating into orders. At the same time, with prices strong, mills have shortened validity terms on quotes – making it difficult for companies to bid on projects. With inventories so low and prices elevated, some service centers have also had to decline to quote new business.

The percentage of inventory on order edged up in March, as inventories dwindled. With the elevated daily shipping rate, however, the on-order volumes represented fewer shipping days in March.

Service centers remain reluctant to place orders that are not pre-sold, as they do not want to be stuck with high-priced inventory. The percentage of plate inventories tied to contracts was 35.7% in March, up from 32.7% in February.