Market Data

April 1, 2021

Steel Mill Lead Times: Bouncing Along the Top

Written by Tim Triplett

Buyers continue to express frustration over the hugely extended lead times for delivery of steel from the mills. One respondent to Steel Market Update’s questionnaire this week described lead times as “late, late and late. That goes for imports, too.” Added another: “Lead time is not the issue. If they deliver 2-6 weeks late, the lead time is meaningless.”

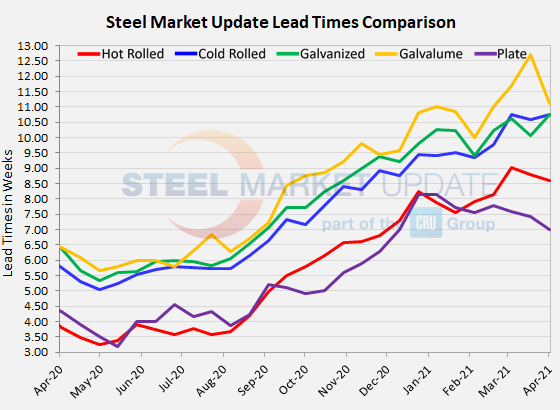

Lead times for spot orders of most steel products appear to be bouncing along the top, exhibiting only small changes from week to week. Average lead times for hot roll, Galvalume and plate were down slightly in this week’s check of the market, while cold rolled and galvanized delivery times extended a bit—none to a degree significant enough to signal a change in the trend.

Current hot rolled lead times now average 8.59 weeks, down from 8.81 two weeks ago. Cold rolled lead times, now averaging 10.75 weeks, are up slightly from 10.58 two weeks ago. In coated products, galvanized lead times now average 10.75 weeks, up from 10.06 weeks in SMU’s last check of the market. The current average Galvalume lead time moved down to 11.11 weeks from 12.71 weeks in the last survey. Plate lead times declined to an average of 7.00 weeks from 7.43 weeks earlier this month.

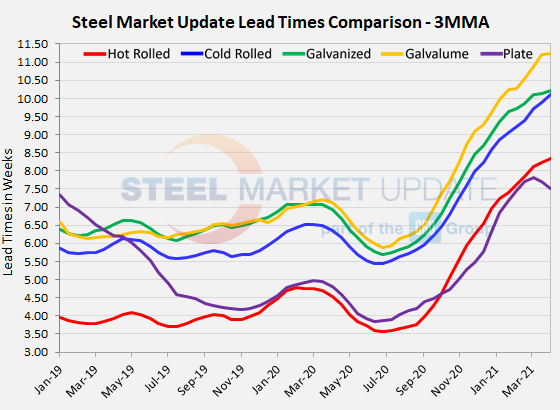

Viewed as three-month moving averages to smooth out the volatility, hot rolled lead times have continued to extend to 8.34 weeks, cold rolled to 10.12 weeks, galvanized to 10.22 weeks, and Galvalume to 11.23 weeks, while plate’s 3MMA dipped slightly to 7.51 weeks.

Lead times are an indicator of steel demand—the longer the average lead time, the busier the mills, and the less likely they are to discount prices. Rising lead times are expected to reverse course at some point as steel supplies catch up with demand, but it hasn’t happened yet.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

By Tim Triplett, Tim@SteelMarketUpdate.com