Prices

April 1, 2021

Hot Rolled Futures: Price Expectations Ramp Up

Written by Jack Marshall

The following article on the hot rolled coil (HRC), scrap and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Hot Rolled

The limited availability of hot rolled steel on the spot market continues to dictate higher prices, and in turn has ramped up expectations of future prices.

Expected hot roll spot availability over the next few months remains a concern as reflected in the HR futures curve, which has moved higher since the beginning of April. The recent HR index, which is pointing north of $1,375/ST is up from $1,310/ST at the beginning of the month. During the same timeframe, the Q2’21, Q3’21, Q4’21 and Q1’22 HR futures have risen by an average of over $200/ST—more than double the move in spot prices. Q2’21 rose $115/ST ($1,327 to $1,443/ST), Q3’21 rose $245/ST ($1,190 to $1,435/ST), Q4’21 rose $284/ST ($999 to $1,283/ST) and Q4’21 rose $173/ST ($901 to $1,074/ST). The largest change in value for a given month has been in Oct’21, which since the beginning of the month had risen over $300/ST ($1,048 to $1,350/ST).

Recent trades in May’21 and Jun’21 futures have been over $1,500/ST. The large moves higher have given rise to an increase in the number of queries for HRO call options, a number of which have traded in the last two weeks. High current HR futures prices, as well as the high daily price volatility and concern about fixing at the high price levels, has softened the stance on paying some time premium for an instrument that gives protection on the topside of this market should it keep grinding higher, but also not being fixed on price should the market price rapidly move lower as it retraces its recent large moves.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

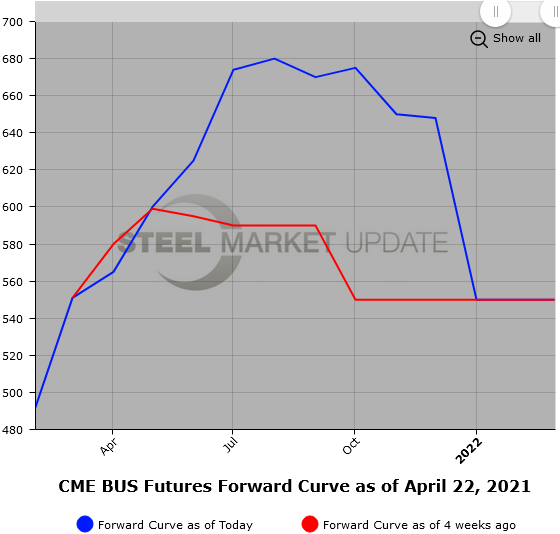

Scrap

In BUS, early chatter has prime scrap moving higher by $10-20/GT. April price is $565/GT. But the latest strong price moves higher in HR have bolstered the BUS prices. The metal margin spread is likely pulling expectations for prices to go higher. May’21 BUS futures have been $600 bid recently, well above the early chatter expectations. Jun’21 BUS futures traded at a $40 premium to May’21 futures just the other day. Since the beginning of April, BUS futures in Q3’21 have risen an average of $80/GT. While pig iron prices currently are potentially capping a rise in spot, concern about the situation with Ukraine/Russia have likely changed future expectations. Recent pickup in the export scrap market, along with the global supply chain issues, could be further supportive of scrap prices.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.