Product

March 16, 2021

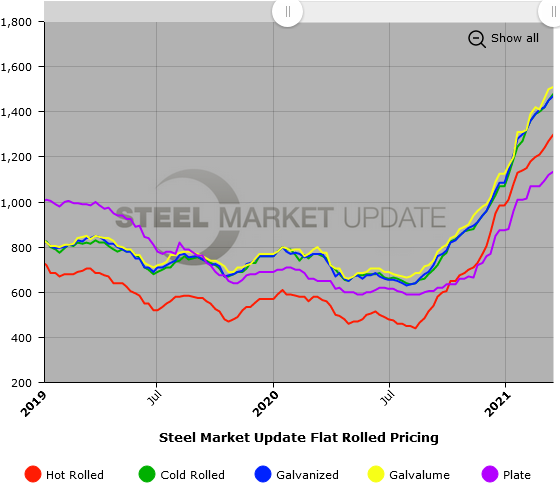

Hot Rolled Coil Spot Prices Hit $1,300

Written by Brett Linton

Hot rolled steel prices reached another eyebrow-raising milestone this week, hitting an average of $1,300 per ton ($65/cwt), which is an all-time record even adjusting for inflation from the previous high of $1,070 per ton recorded by Steel Market Update in 2008. Flat rolled prices rose by an additional $10-30 per ton as the market sees no letup in demand, while steel supplies remain critically tight. The massive stimulus package passed by Congress last week can only fuel the economy, and steel demand, even further. SMU’s Price Momentum Indicators continue to point toward higher steel prices over the next 30 days.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,260-$1,340 per net ton ($63.00-$67.00/cwt) with an average of $1,300 per ton ($65.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 compared to one week ago, while the upper end increased $40. Our overall average is up $30 from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 6-12 weeks

Cold Rolled Coil: SMU price range is $1,440-$1,520 per net ton ($72.00-$76.00/cwt) with an average of $1,480 per ton ($74.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 compared to last week, while the upper end increased $40. Our overall average is up $30 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 7-12 weeks

ARTICLE CONTINUES BELOW

{loadposition reserved_message}

Galvanized Coil: SMU price range is $1,440-$1,500 per net ton ($72.00-$75.00/cwt) with an average of $1,470 per ton ($73.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is up $20 from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,509-$1,569 per ton with an average of $1,539 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 8-14 weeks

Galvalume Coil: SMU price range is $1,500-$1,520 per net ton ($75.00-$76.00/cwt) with an average of $1,510 per ton ($75.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week, while the upper range remained unchanged. Our overall average is up $10 from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,791-$1,811 per ton with an average of $1,801 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 9-12 weeks

Plate: SMU price range is $1,090-$1,180 per net ton ($54.50-$59.00/cwt) with an average of $1,135 per ton ($56.75/cwt) FOB mill. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $30. Our overall average is up $15 from one week ago. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 6-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.