CRU

March 16, 2021

CRU: Zinc Demand Surprises to Upside in USA and Europe

Written by Helen O’Cleary

By CRU Senior Analyst Helen O’Cleary from CRU’s Zinc Monitor

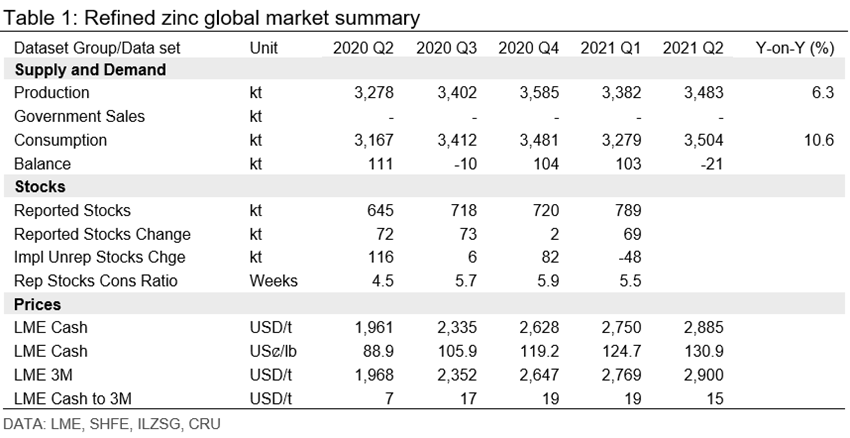

After a month of sideways trading in April, zinc’s price has entered ever more overbought territory in recent weeks, following copper’s price higher and benefiting from booming ex. China steel demand and the news this week of output cuts at zinc smelters in China’s Yunnan province.

Although Chinese demand growth is still high in both percentage and absolute tonnage terms compared to most major zinc-consuming countries, the demand picture is now looking notably more positive elsewhere and is likely to remain so through Q3 and into Q4. That is not to say that zinc’s current price just below $3,000 /t is a perfect reflection of market fundamentals, but the rebound in ex. China demand and Chinese smelter output cuts appear to have added legitimacy to already high prices.

Stimulus money and a bullish copper price have helped to fuel zinc’s price rise and, while it may take more than zinc’s own fundamentals to knock it off course, there are downside price risks on both the supply and the demand side. By our numbers, there are ~200,000 t of price-induced mine cutbacks from last year, which have yet to be rescinded and could restart relatively quickly. On the demand side, high prices always bring the threat of substitution for cheaper materials, although a relatively small zinc-aluminum delta and high materials prices across the board at the moment suggest that this is not an immediate danger. In the short-term it seems likely that zinc’s price will continue to ride high on strong demand and bullish investor sentiment, although inflation fears could weigh on markets.

While demand growth looks set to remain strong for at least the next 5-6 months, market participants have expressed concerns about the strength of underlying demand once the current restocking cycle comes to an end. Some are also worried about the potentially negative effects of inflation. We hear that some other materials are in short supply, particularly in the construction industry, and some end-users are restocking to cover themselves against refined zinc shortages (although these are unlikely, in our view, given last year’s surplus and our forecast surplus this year). While galvanizing sector strength has led to some tightness in CGG (continuous galvanizing grade), SHG ingot is still readily available and is likely to remain so given high smelter profitability at current price levels.

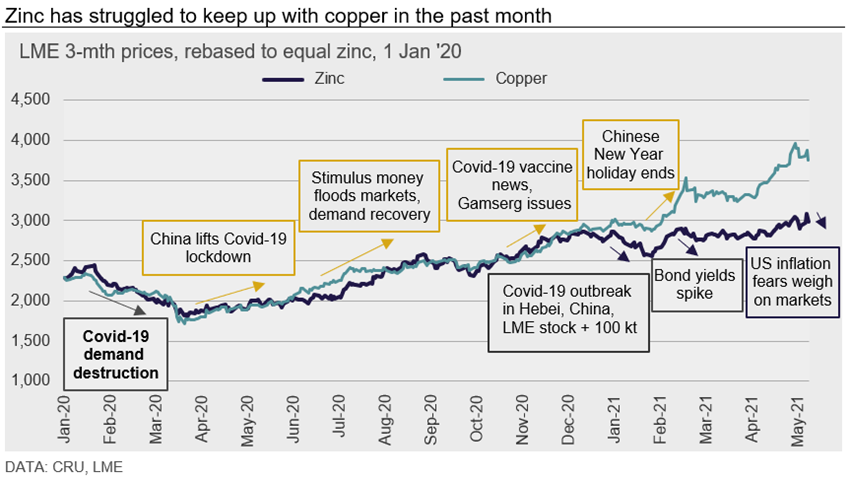

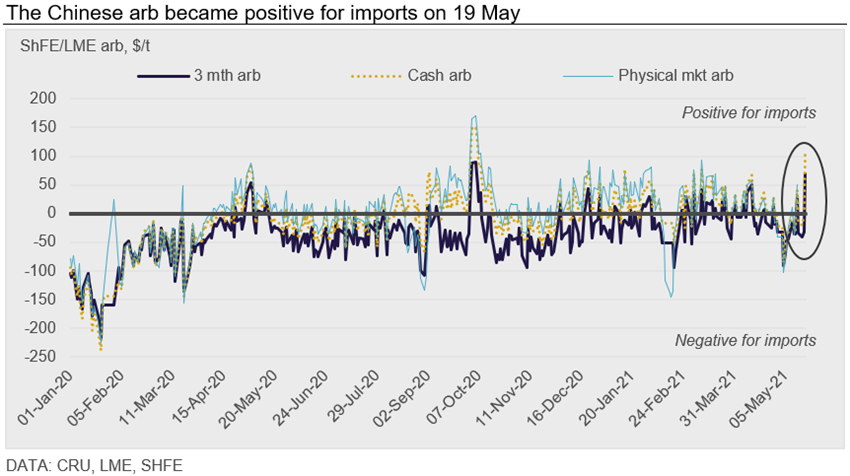

We revised down our forecast for Chinese zinc demand growth in 2021 from 3.0% to 2.7% due to a slightly less buoyant return to the market after the New Year holiday than expected. Even though Chinese demand growth has been somewhat disappointing so far this year, supply-side issues (firstly at zinc smelters in Inner Mongolia and more recently in Yunnan) helped lift zinc’s three-month price on the ShFE to a multi-year high of

RMB22,990 /t on May 18. Until this week, zinc’s price on the ShFE had been struggling to keep up with the LME price and the LME import arb was firmly negative, but switched to positive on May 19 as LME prices fell back below $3,000 /t. If a sustained, positive import arb leads to a significant uptick in Chinese refined zinc imports, this could add further support to zinc’s price on the LME.

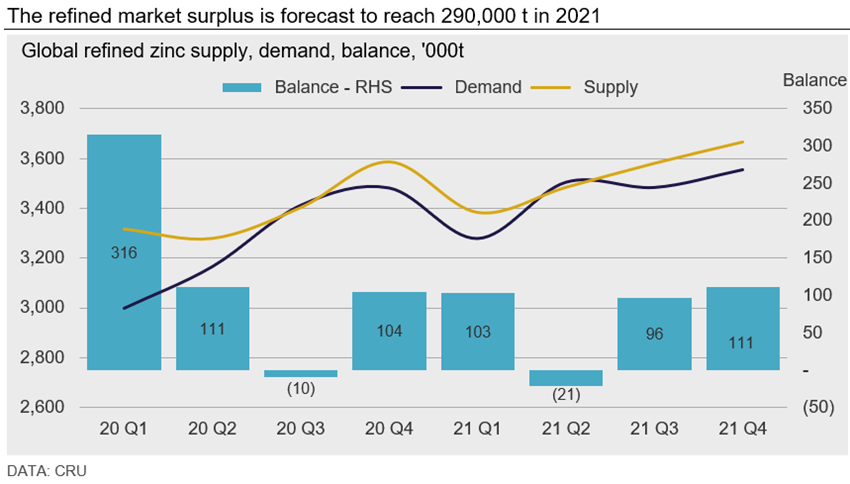

We Still Expect a Sizeable Refined Zinc Surplus in 2021

We have incorporated all available Q1 results into our numbers and now expect global smelter output to grow by a slightly lower 3.9% y/y this year. Risks are to the downside on supply given resurgent COVID-19 infections in India and the recent news from Yunnan. At the same time, global refined demand is expected to grow by 5.8% y/y, with risks to the upside given the strength of the ex. China rebound.

We currently expect the global refined surplus to reach 290,000 t in 2021, but believe that the balance of risk is in favor of this decreasing as the year progresses.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com