CRU

March 16, 2021

CRU: U.S. Long Prices Rise Again in April

Written by Dave Thewlis

By CRU Analyst Dave Thewlis, from CRU’s Steel Long Products Monitor

Prices among all types of long products rose again in April, the most challenged of which remains wire rod. February’s winter storms, which were extreme enough to cause a 2.2% m/m decline in U.S. industrial production, made a difficult situation worse for wire rod buyers by further delaying already-delayed material shipments. Domestic lead times are now booking into July, August, or in some cases, September. We continue to hear of mills operating on an allocation basis. There is sufficient desperation in the market for material that mills can comfortably raise prices in the event of scrap increases while feeling little to no pressure to drop them when scrap costs decline.

Demand for wire rod is uniquely strong, at least in part fueled by the home-centric tilt of the ongoing pandemic recovery. Consumer spending continues to disproportionately favor home goods purchases rather than services such as restaurants or travel. Products like furniture, bedding, paint and appliances remain in high demand while consumers continue to spend time at home waiting for the pandemic to subside. In wire rod terms, this translates to components such as springs or paint can handles. From a purchasing pattern standpoint, the pandemic also resulted in many buyers depleting existing inventories in 2020 Q2 and Q3 amid the uncertainty, driving a strong wave of restocking in 2020 Q4 and 2021 Q1. Beyond home-centric goods, we hear that demand is strong in other sectors as well. These end markets include agriculture, automotive, ATVs and construction.

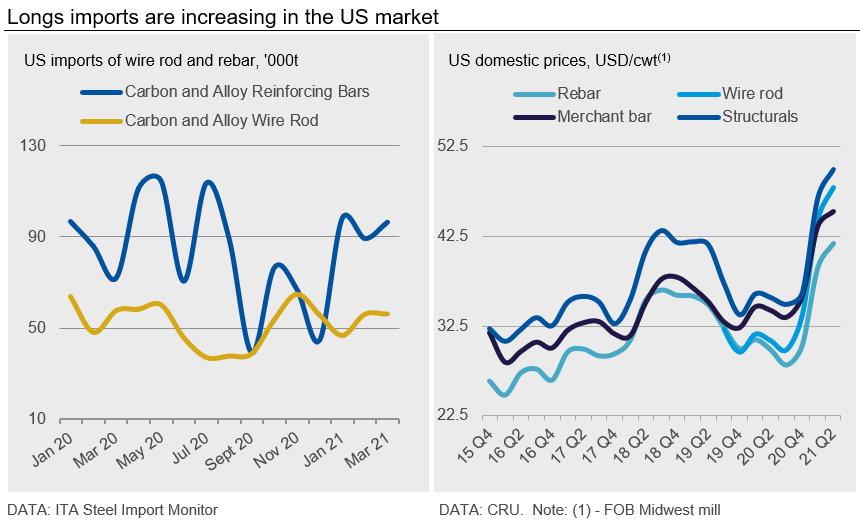

Given the added barriers to entry for wire rod imports from antidumping and countervailing duties versus other steel products, wire rod buyers are particularly challenged to find foreign alternatives. Despite the prohibitive costs, imports of wire rods increased by about 10,000 t in February to a total of approximately 56,000 t. A similar volume of imported material is projected to arrive in March. While imports of wire rod have largely represented desperation to secure material for buyers in 2021, we have heard of better deals recently, nearly on par with domestic prices, even with the AD/CVD and tariff costs included.

Rebar Market Less Supply-Challenged; More Potential Downside Pressure

Unlike the wire rod market, we hear that rebar buyers continue to find more standard lead times ranging from a few weeks to a month. Imports are more dynamic for rebar as well, having surged to about 100,000 t in January and remaining around that level on a monthly basis since then. Given the added pressure from domestic and foreign supply, we saw potential for rebar prices to evade further increases. Rebar prices ultimately did increase regardless, given the March spike in scrap prices and the strong demand for material. It remains a sellers’ market and mills appear to be un-phased by the pressures on rebar.

Outlook: Imports Trending and Demand May Ease, But Mill Outages Could Complicate Price Correction

The usual peak buying season for longs typically eases towards the end of Q2. Additionally, a large influx of imports throughout the steel industry are likely to begin arriving in the U.S. around the start of 2021 Q3. These factors point toward upcoming downside pressure on pricing. While we continue to hear that demand is strong in the construction market, there are hints that some project backlogs may be easing due the high price of materials. U.S. Census data showed a 0.8% m/m decline in construction spending in February 2021, though that was likely due to the winter storm. Looking toward to 2021 H2, an economic shift is expected as consumers move spending from home goods to the service sectors of restaurants, bars and travel as the pandemic eases. This is likely to reduce some demand for wire rod from its currently high levels, but the varied end market uses of the product will likely protect its demand from a sharp decline.

While we see downside pressures mounting in 2021 H2, upcoming mill outages may further complicate the wire rod market balance. Optimus Steel is projected to begin a nearly month-long maintenance outage in June, and later in the year Sterling Steel Co. has a planned outage in October. Planning around these outages is already likely built into current lead times to some extent, though we hear anxieties from buyers nervous about less supply in an already-challenging market.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com