CRU

March 16, 2021

CRU: Iron Ore Exceeds $180/dmt as Steel Margins Surge

Written by Erik Hedborg

By CRU Principal Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

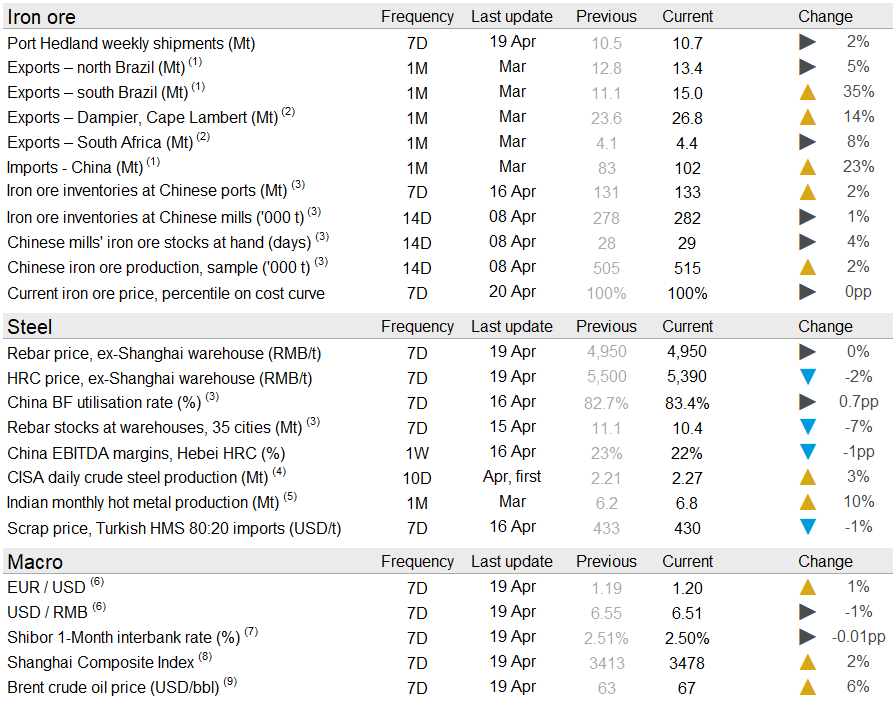

Iron ore prices jumped by $7.0 /dmt in the past week as steel margins continued to rise and concerns about Brazilian supply sparked new fears regarding iron ore availability. On Tuesday, April 20, CRU has assessed the 62% Fe fines price at $182.0 /dmt.

Last week, Chinese steel demand softened slightly as high steel prices started to place pressure on financing for steel end-users. Having said that, steel prices rose sharply on supply concerns, as steel production cuts were being planned in Handan city in the southern parts of Hebei province as well as in Jiangsu and Shandong. While these cuts remain in the planning stage, a few idled BFs in Tangshan were brought back along with improved air quality in that city. The surveyed BF capacity utilization lifted by 73bp w/w, indicating a w/w increase of iron ore consumption of ~220 kt. This actual consumption increase, coupled with mills’ restocking efforts under high steel margins, continued to support iron ore prices, albeit improved iron ore supply led to higher port inventories and longer vessel queue.

It has been an eventful week on the supply side. In Brazil, Vale reported iron ore production of 68 Mt in Q1, in line with CRU’s expectations of a 15% increase y/y. Iron ore sales did not increase as much and the news was not well-received. Also in Brazil, CSN’s shipments from its port, Tecar, were halted for a few days due to claims that the company had dumped waste material in the ocean. The port is back in operation and the weather conditions in Brazil are looking favorable in the coming weeks.

In Australia, rainfall in the Pilbara region following cyclone Seroja has impacted iron ore production in the region. Shipments have returned to a normal level at Rio Tinto’s two ports following last week’s operation halt. Ports Hedland continues its strong performance and shipped 10.7 Mt in the past week, which brings YTD shipments flat or even increasing slightly compared with 2020.

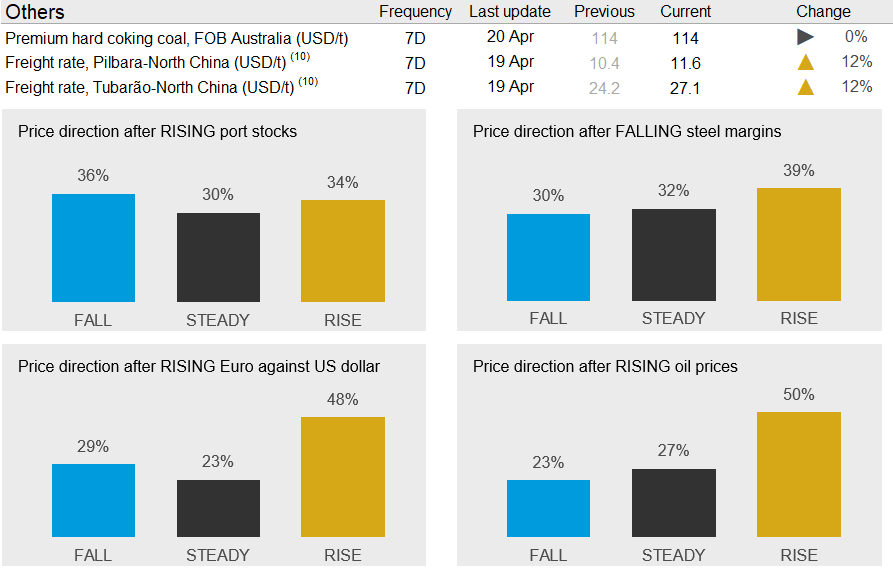

The market tightness is expected to continue in the coming week. Steel margins remain elevated and other macro indicators below point towards another week of price increases. There are, however, downside risks. Iron ore port stocks have been rising and there is potential for further steel production curbs in China, this time outside of the Tangshan region.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com