CRU

March 16, 2021

CRU: Global Sheet Prices Set New Record High

Written by Josh Spoores

By CRU Principal Analyst Josh Spoores, from CRU’s Steel Sheet Products Monitor

The current global sheet market cycle is one which continues to reflect a strong demand rebound from the lows associated with various lockdowns in 2020 H1. It seems that in one market after the other, sheet production has failed to catch up with demand from not only consumption but also the rebuild of inventory. In some markets, such as India and Vietnam, domestic supply has been limited as mills are currently busy producing sheet for export to markets such as Europe, Mexico, and the USA.

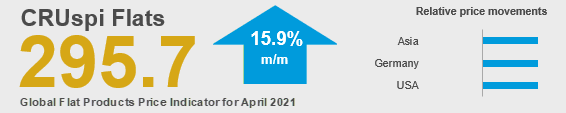

This market environment of a sustained demand rebound where production appears unable to catch up has not only lifted all regional sheet prices, but it has driven CRU’s Global Flat Products Steel Price Indicator (CRUspi flats) to a new record high. Our current reading is 295.7, a m/m increase of 15.9% and a y/y change of 111.4%.

This record level of global sheet prices has come about from further gains in the USA, yet also dramatic gains in both Europe and Eastern Asia. In the USA, domestic production and import arrivals have started to rise, yet multiple maintenance outages have limited buyers from procuring as much sheet as they require. These buyers have since tapped the import market to make up the difference, yet supply here may not improve until June at the earliest.

In Europe, demand continues to rise at a faster rate than production. Like the USA, import orders have been placed, yet due to long lead times, inventories continue to fall or remain at bare minimum levels.

As important as the USA and Europe are, the global sheet market often focuses on China and this focus today is correctly placed. This focus has been placed on two main issues: capacity cuts in Tangshan and an expected change to China’s export tax rebate.

In Tangshan, the city government has implemented a capacity cut policy to reduce emissions in 2021, which is expected to result in a significant reduction on hot metal production. CRU’s early assessment shows that a total of 31 Mt of hot metal will be slashed from Tangshan. So far, the rule has been strictly enforced and has started to limit local supply. Due to this, slab supply has become extremely tight and merchant slab prices grew by more than RMB200 /t in a week, forcing regional re-rollers to cut production. These price hikes have extended to downstream sheet products and exports.

The second issue surrounds speculation that the Chinese government is likely to reduce or eliminate the rebate it provides on the value added tax (VAT) paid by domestic producers when they export. The export tax rebate, which is currently provided at the rate of 13%, is rumored to either be lowered to 9% or completely removed. Accordingly, Chinese suppliers are adding a risk premium to their price quotes and buyers are unwilling to assume the related risk, which CRU estimates could be as high as $100 /t in the price for HR coil. Accordingly, there is some reluctance among buyers in booking Chinese origin material and thus they are willing to pay a premium for supplies from India or other markets.

India has become an exporter of choice to a variety of markets, including Europe. Under the EU’s safeguard system, during calendar Q2 countries are able to access up to 30% of the “other countries” quota in addition to their own named quotas. India filled its country-specific HR coil quota on the first day of the Q2 quota period, but due to this mechanism will be able to supply a total of over 450,000 tonnes of HR coil to EU this quarter.

Outlook: Price Volatility to Come, But Not Until New Record Highs are Reached

Our near-term expectations continue to revolve around higher sheet prices across most markets. Higher prices, though, are not expected to last as there is downside risk in our views. For China, we see a possibility that once any change to the export tax rebate is addressed by the government, it is likely that global buyers will start to book Chinese exports again, instead of more expensive options from other markets. Additionally, over the next few weeks, we expect to have a clearer view of capacity cuts in Tangshan and elsewhere in China, as the government appears to be increasingly concerned over high commodity prices.

Globally, downside risks to prices and demand continue to center around COVID-19 as well as a continued disruption to light weight vehicle production. Upside price risk lies primarily in a continue mismatch of supply to rising demand. Overall, we expect higher sheet prices in the coming weeks and a new record high for CRUspi flats next month, yet by then we may see some renewed price volatility due to these risks.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com