Market Data

March 16, 2021

CRU Economic Outlook: The Winter is Past, Flowers Appear

Written by Jumana Saleheen

By CRU Principal Economist Alex Tuckett and CRU Chief Economist Jumana Saleheen, from CRU’s March Global Economic Outlook

In March, we received good news on the outlook for the world’s two largest economies: the U.S. stimulus package was larger than expected, and economic growth in China is stronger. We expect a temporary rise in inflation in 2021 reflecting (a) higher energy prices now compared to the low prices of 2020 and (b) a surge in spending as pent-up demand is released when lockdowns end. Further out, our view is that inflation will fall back towards central bank targets. Bond markets are less sure; they fear higher inflation and are uncertain about the path towards normalizing monetary policy. The path to global recovery seems more durable with each passing month, but risks remain.

Stimulus, Momentum, Vaccines Support Brighter Outlook

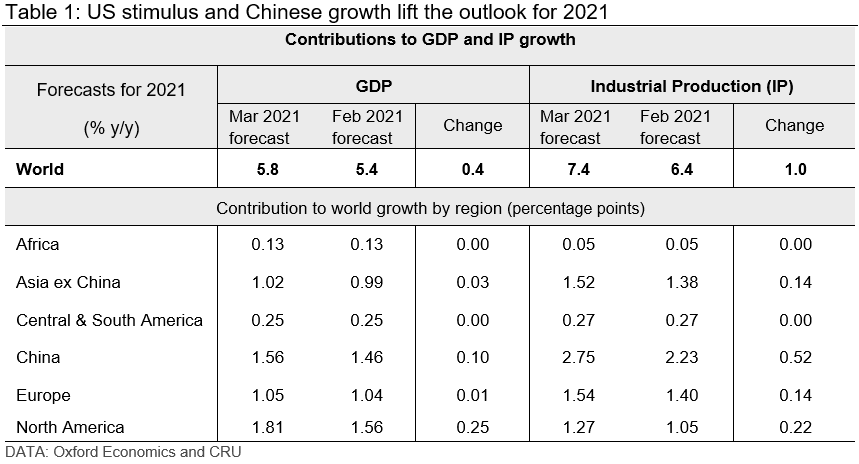

Table 1 shows the contributions to GDP and Industrial Production (IP) growth across countries. Unsurprisingly, North America and China make the largest contributions to world activity.

This month we have revised up our global GDP growth forecast for 2021 to 5.8% from 5.4%. Growth in IP has been revised up to 7.4% from 6.4%. Most of the upward revisions to both measures come from China and the U.S. There were minimal revisions to other regions this month. Europe continues to struggle with ramping up its vaccine roll out. There have been small upgrades to our global GDP outlook in 2022, but negligible changes thereafter.

Biden’s $1.9 Trillion Stimulus Passes Congress with Minimal Changes

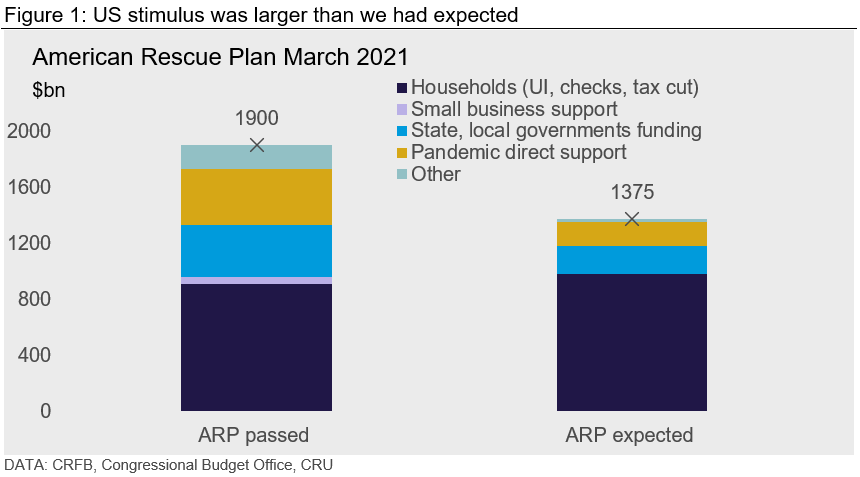

Most of the upward revision to our U.S. growth outlook springs from the U.S. fiscal stimulus. Biden’s American Rescue Plan of $1.9 trillion was passed in Congress on March 8. This was $0.5 trillion higher than what was included in our February forecast, and has led us to revise up our U.S. GDP growth forecast in 2021 to 6.5% from 5.6%.

The details of the agreed stimulus package are presented in Figure 1. As expected, the package provides ample support to households. More surprising was that the full amount of proposed spending on pandemic relief (e.g. testing and healthcare) and aid to state and local governments was passed. At the time of writing, the U.S. had fully vaccinated 16% of the population and 29% had received at least one dose. That contributes to our optimism about the U.S. recovery.

China: a Bullish Start to the Year of the Ox

We have revised up the near-term outlook for China for two reasons: we expect the momentum seen in the recent data to continue; and the announced fiscal stance was more bullish than what we had assumed in our February forecast.

China’s data for January and February showed strong overall growth, supported by robust export growth and a faster return to work after the New Year holidays. This has led us to revise up our GDP growth forecast for 2021 to 8.4% from 7.8% last month.

China released its 14th Five Year Plan (FYP) between March 5-11. It set ambitious innovation targets but modest environmental targets. With the virus under control, and a robust recovery underway, the message from China’s “Two Sessions” meeting this year was one of policy normalization.

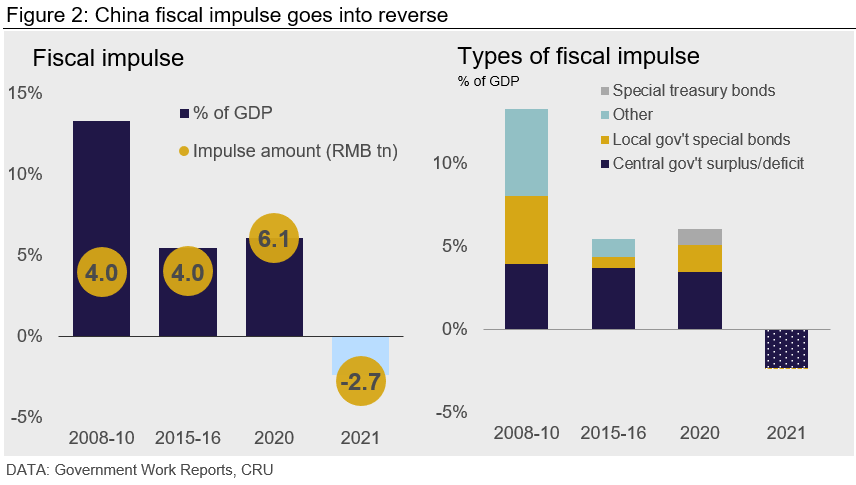

On fiscal policy, two points are worth noting. First the government has set a fiscal deficit target of 3.2% in 2021, which is smaller than the 3.6% target set last year. That will produce a negative “fiscal impulse” – where fiscal policy detracts from, rather than adds, to GDP growth. We estimate that the net impulse provided to the economy this year will reduce GDP by RMB2.7 trillion (excluding other influences).

Second, a number of policy decisions are helpful for the construction sector’s outlook. The quota for local government special bonds was lowered marginally in 2021. The fall was smaller than what had been embodied in our forecast. Local government special bonds are an important funding source for infrastructure spending, and this has led us to revise up our IP and construction forecasts. In 2021, the government has slightly increased the target for “shanty town” renovation. In addition, the 14th FYP aims to increase the urbanization rate from 60% to 65% by 2025.

On monetary policy, China aims to reduce the growth of total social financing and bring it down to move in line with nominal GDP growth. This will reduce credit growth, but China will continue to support targeted areas. For example, bank lending to SMEs will continue to grow but at a slower pace than last year.

Expect a Temporary Rise in Inflation in 2021

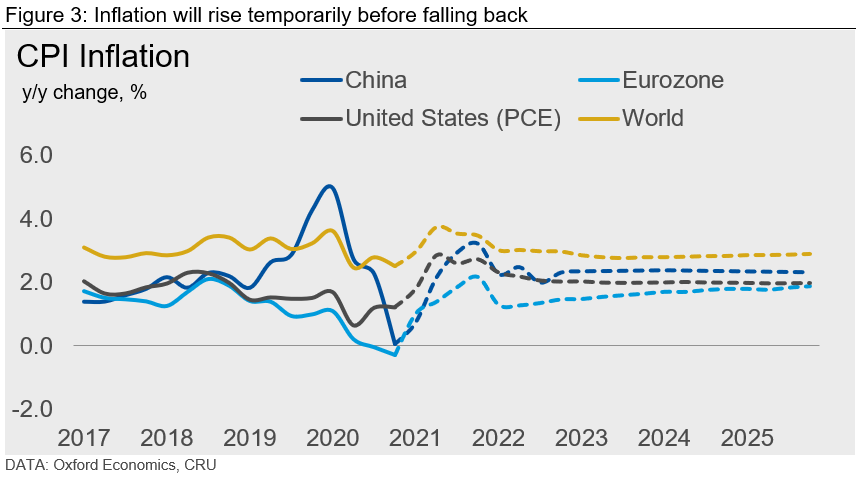

We forecast that inflation will rise in the near term before falling back towards respective country inflation targets in the medium term. We forecast world inflation to rise from 2.4% in 2020 Q4 to 3.7% by 2021 Q2. We forecast the rate to fall back to 2.8% by 2025.

U.S. inflation is forecast to rise temporarily above 3% in 2021. There are two reasons for this. First, energy prices are higher now than they were during the lows of last year – the so-called base level effect. Second, spending is likely to surge as the economy re-opens, and pent-up demand (supported by the latest stimulus) is released. Both effects are expected to be temporary. In the medium term we expect inflation to fall back to 2%.

The same inflationary forces are also present in the Eurozone. However, its slower recovery means that the surge in spending post-lockdown will be more protracted. Inflation is forecast to rise gradually from -0.3% in 2020 Q4 to 2% by the end of 2021, but this rise will be temporary.

In China, the pace of growth allows inflation to rise to the government’s target rate of 3% in 2021. Beyond that we expect inflation to fall back to 2%.

U.S. Bond Tantrum Spills Over to Other Markets

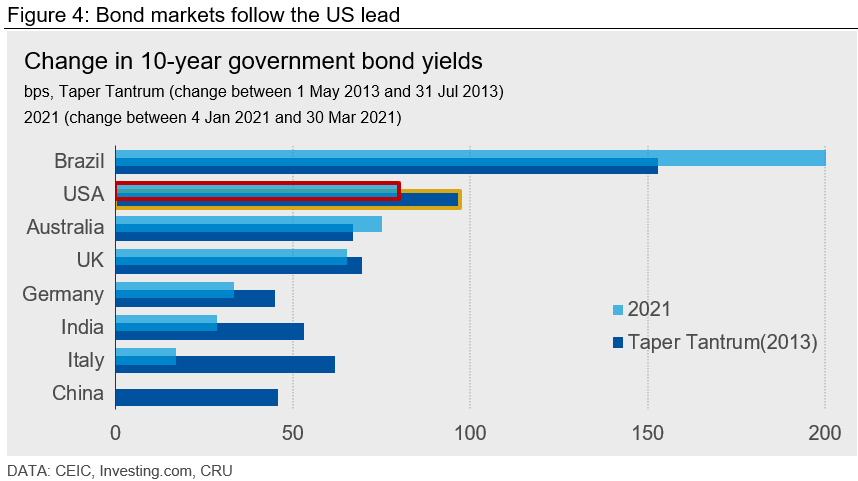

This section provides our interpretation of the recent volatility in financial markets. There has been a sell-off in U.S. Treasuries since the start of 2021. It has caused the 10-year yield to rise by 0.7pp. Given the global nature of financial markets, bond yields have also increased in Australia, Brazil, India and Italy. In recent weeks, yields have also edged up in U.S. corporate and mortgage bonds.

Comparisons are being made to the 2013 “taper tantrum.” When the Fed signaled it would taper the pace of its asset purchases in May 2013, asset prices fell significantly. The U.S. 10-year bond yield jumped 100bps between May and July 2013. EMs also saw a jump in bond yields, large capital outflows, depreciating currencies and a sudden tightening of financial conditions.

In March, the Bank of America Global Fund Manager Survey voted higher than expected inflation as the No. 1 tail risk for markets. No. 2 was a tantrum in the bond market. Markets have two concerns:

• Reflation: that the recovery will be faster than expected, leading central banks to tighten policy more rapidly than what is currently priced into markets

• High inflation: that central banks could fail to respond to inflationary risks in a timely manner leading inflation to rise well above target.

On high inflation, our base case view is that these inflation fears are premature. We believe the analogy that we are back to the 1970s is overdone. However, we do acknowledge that central bank policy error is a possible tail risk, and that high inflation can only be brought down at great economic cost.

On reflation, our view is that the process is underway. As economies recover towards their pre-COVID-19 rates of growth, we expect inflation to rise and return to inflation targets; the recovery will also involve a corresponding rise in interest rates to around pre-COVID-19 levels.

From a macro perspective, reflation is a good thing. However, a premature tightening of financial conditions is undesirable as it would feed through to higher borrowing rates for households and corporations. This could dampen the post-COVID-19 recovery.

On March 10, the ECB responded to the tightening of EU financial conditions since the start of the year by increasing the pace of its monthly asset purchases. In contrast, on March 18, the Fed did not alter its policy stance, but used words to reassure markets.

However, from the perspective of individual companies or countries with high leverage or stretched asset valuations, reflation can be bad news as the costs from higher debt may outweigh the benefit of faster growth.

Faster Global Recovery Keeps Inflation Fears Alive

In March, we received good news for our medium-term growth outlook. Biden was successful in passing a stimulus package that was larger than we had expected. Progress on vaccine rollout has been impressive in the UK and U.S., but slower in the EU. The pace of growth has been stronger in China, allowing the country to start the process of policy normalization.

Markets remain optimistic that the global economy is on a path to normality. A return to higher growth and higher inflation also means a return to higher interest rates. The timing and pace of rate rises will depend on the pace and nature of economic recovery. All of that is still uncertain. Bond markets will continue to second guess the Fed. Central banks will continue to monitor financial conditions in markets. The cat and mouse game will continue for a while yet.

(Editor’s note: At the time of this writing, President Biden had not yet unveiled his $2 trillion infrastructure plan, which is yet to make it through Congress.)

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com