Market Data

March 15, 2021

Service Center Shipments and Inventories Report for February

Written by Estelle Tran

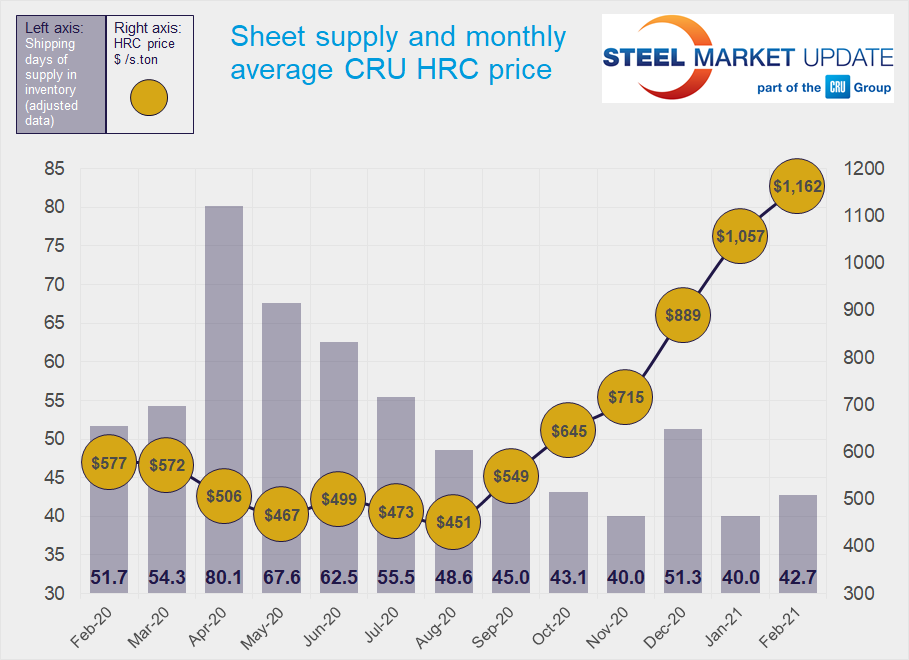

Flat Rolled = 42.7 Shipping Days of Supply

Plate = 46.6 Shipping Days of Supply

Flat Rolled

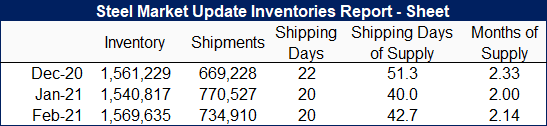

Flat rolled inventories at service centers edged up in February, largely because of lower shipments caused by harsh winter weather. Flat rolled inventories represented 42.7 shipping days of supply or 2.14 months of supply at the end of February, which was an increase from 40 shipping days of supply and 2 months on hand in January.

Inventories increased in February with more inbound shipments from domestic mills as well as imports. February import licenses for carbon and alloy flat products totaled 749,000 metric tonnes, which, if all materializes, will be the highest level of imports since January 2020, according to U.S. Department of Commerce data. At the same time, domestic lead times continue to extend. The latest Steel Market Update survey on March 3 reported HRC lead times at 9.03 weeks, up from 7.91 weeks a month before.

Shipments decreased nearly 5% month on month in February. February had 20 shipping days, the same as January. Overall shipments declined more than usual in February, probably in part due to severe winter weather.

The winter storm in February also impacted inbound shipments into service centers, which can be seen in the on-order data. The amount of material on order reached a new high in February, with extended domestic mill lead times, mills running late, elevated imports expected through the summer and strong demand.

Intake should increase in March as delayed orders work through the system and more imports arrive. The high level of on-order material raises concerns about double booking at domestic and foreign mills.

The percentage of inventory committed to contracts increased to 60.5% in February, up from 58.7% in January.

While many market contacts have reported that their customer demand has exceeded pre-COVID levels recently, some have started to see a slowdown, partly due to reluctance to do business at the current elevated prices. With service center inventories still low and mills holding customers to contract minimums, domestic sheet prices are expected to remain supported by tight supply.

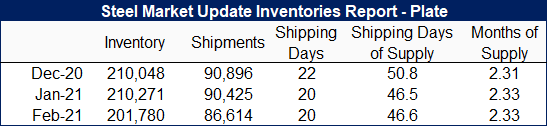

Plate

Plate inventories were flat in February with the decrease in shipments. Service centers carried 46.6 shipping days of plate supply at the end of February, compared to 46.5 shipping days in January. February inventories represented 2.33 months of supply, the same as January.

Plate inventories remain near historic low levels, and service centers have continued to trade material to meet customer requirements. SMU’s most recent survey reported plate lead times at 7.6 weeks, nearly even month on month.

Plate shipments were down 3% month on month. This can be attributed to a decrease in customer restocking and reluctance to build inventory at current prices. The percentage of plate inventories tied to contracts dropped to 32.7% in February from 38.7% in January. The latest price increases of $70-80 per ton could make service center customers even more hesitant. At the same time, mills have put customers on allocation, and supply is expected to remain tight.

The amount of plate on order edged down month on month, but with the lower shipping rate in February represented more supply.

One factor that is expected to keep plate inventories low is the lack of imports. Prices for plate, unlike sheet, have not risen to the point that they make imports attractive, when accounting for 25% Section 232 tariffs, antidumping and countervailing duties and lead times into mid-summer. Plate demand has been steady but not particularly robust, so mill discipline will continue to be the main driving factor in the U.S. plate market.