Market Data

March 11, 2021

Shipments and Supply of Steel Products Rise in January

Written by David Schollaert

Steel Market Update is pleased to share this Premium content with Executive members. For information on upgrading to a Premium-level subscription, email Info@SteelMarketUpdate.com.

Mill shipments of steel products rose 6.9% month on month in January, while apparent supply was up by nearly 13.5% during the same period. Despite the continued growth month over month since reaching bottom back in May 2020, mill shipments and supply were still far behind year-ago levels. Mill shipments were down by 12.0% year on year, while supply trailed January 2020 totals by more than 20.0%. This reality supports the ongoing struggle with lead times, critically tight supply levels, and soaring steel prices.

This analysis is based on steel mill shipment data from the American Iron and Steel Institute (AISI) and import-export data from the U.S. Department of Commerce (DOC). The analysis summarizes total steel supply by product from 2008 through December 2020 and year-on-year changes. The supply data is a proxy for market demand, which does not take into consideration inventory changes in the supply chain. Our analysis compares domestic mill shipments with total supply to the market. It quantifies market direction by product and enables a side-by-side comparison of the degree to which imports have absorbed demand.

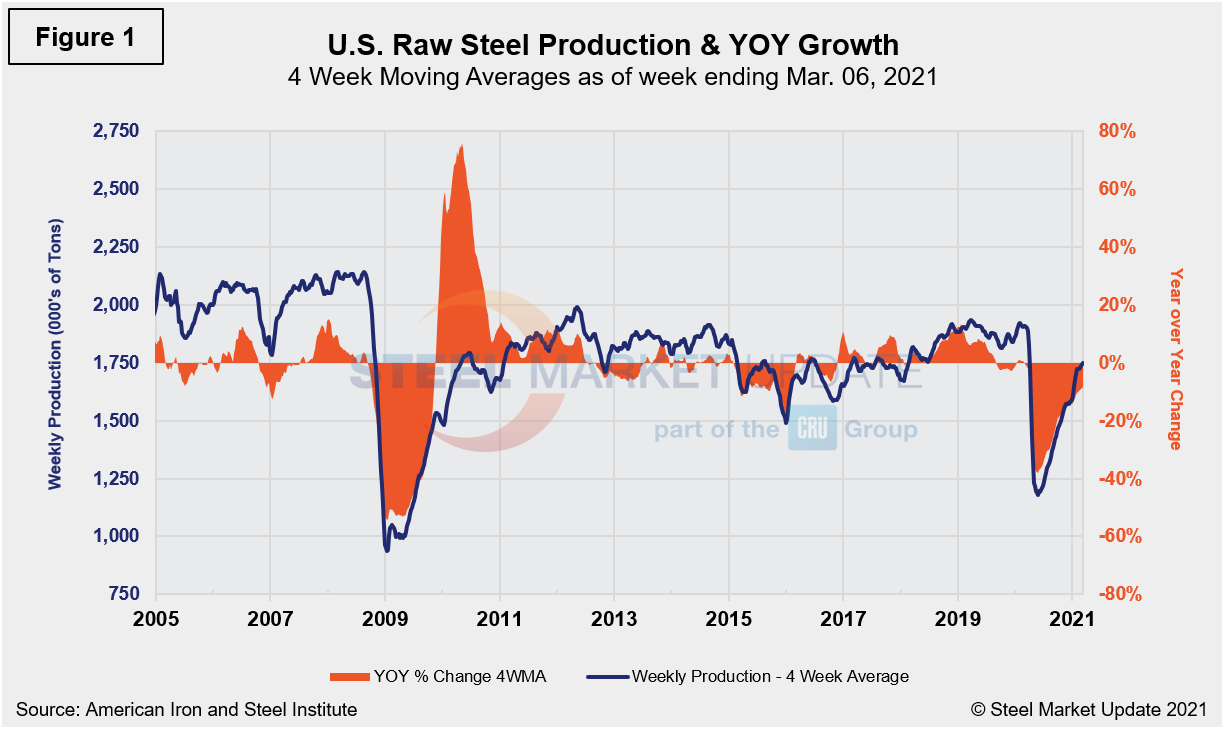

Plagued earlier on in 2020 by COVID, sheet shipments stalled in last year’s second quarter, and although the market has been in a corrective mode since the pandemic-driven freefall, demand continues to outpace supply. These marketplace dynamics have driven steel prices to historic highs, with hot rolled steel setting yet another record this week, according to Steel Market Update’s latest check of the market. Prices for HRC have reached an average of $1,270 per ton, topping the previous high mark set in 2008 by $200 per ton. Despite strong efforts across the steel sector, the three-month moving averages (3MMAs) for shipments and supply of steel products are still well below pre-pandemic levels. Since plummeting to a negative 37.3% in the week ending May 16, 2020, raw steel production has improved to a negative 8.4% in the week ending March 6. These are four-week moving averages and are based on weekly data from the AISI in Figure 1 below.

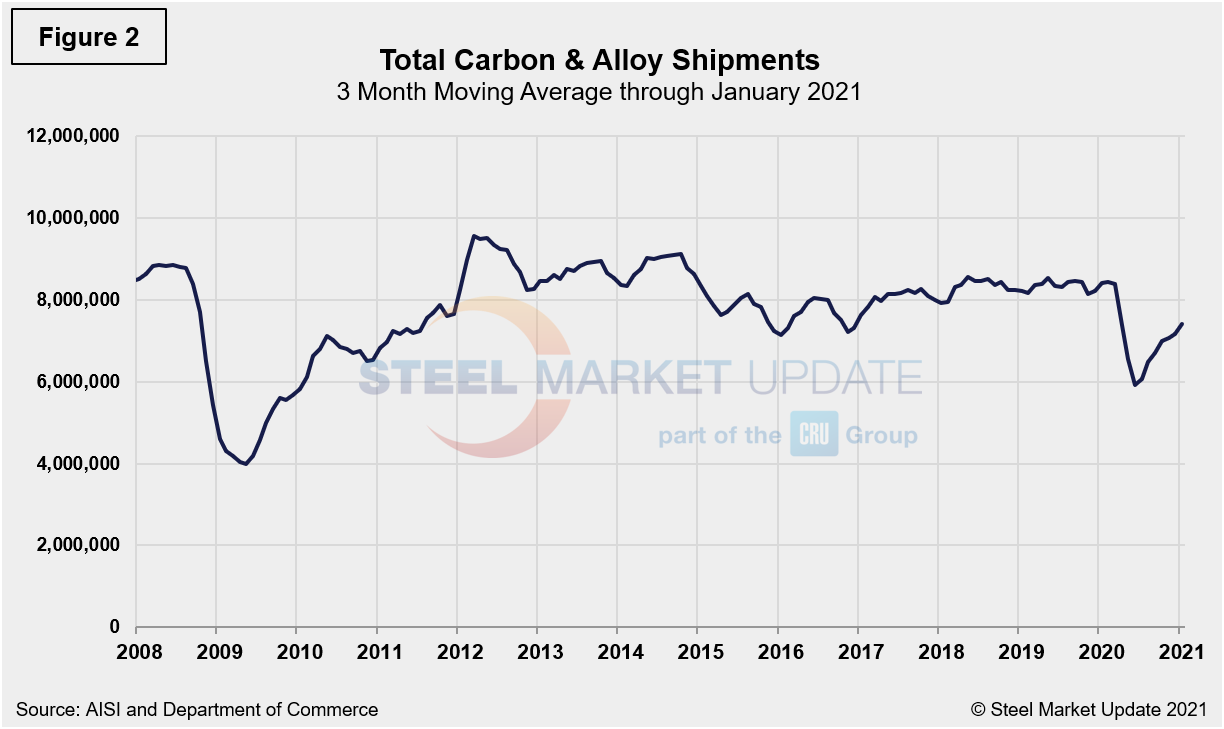

Monthly shipment data for all rolled steel products is noted in Figure 2. The trajectories of the rebounds since Q2 2020 are comparable in Figures 1 and 2. Measured as a 3MMA of the monthly data, January’s total was 7.877 million tons compared to 7.177 million tons in December, a 7.0% increase month on month. While the correction continues to rise steadily, monthly shipments are still trailing year-ago totals of 8.886 million tons by 12.8%.

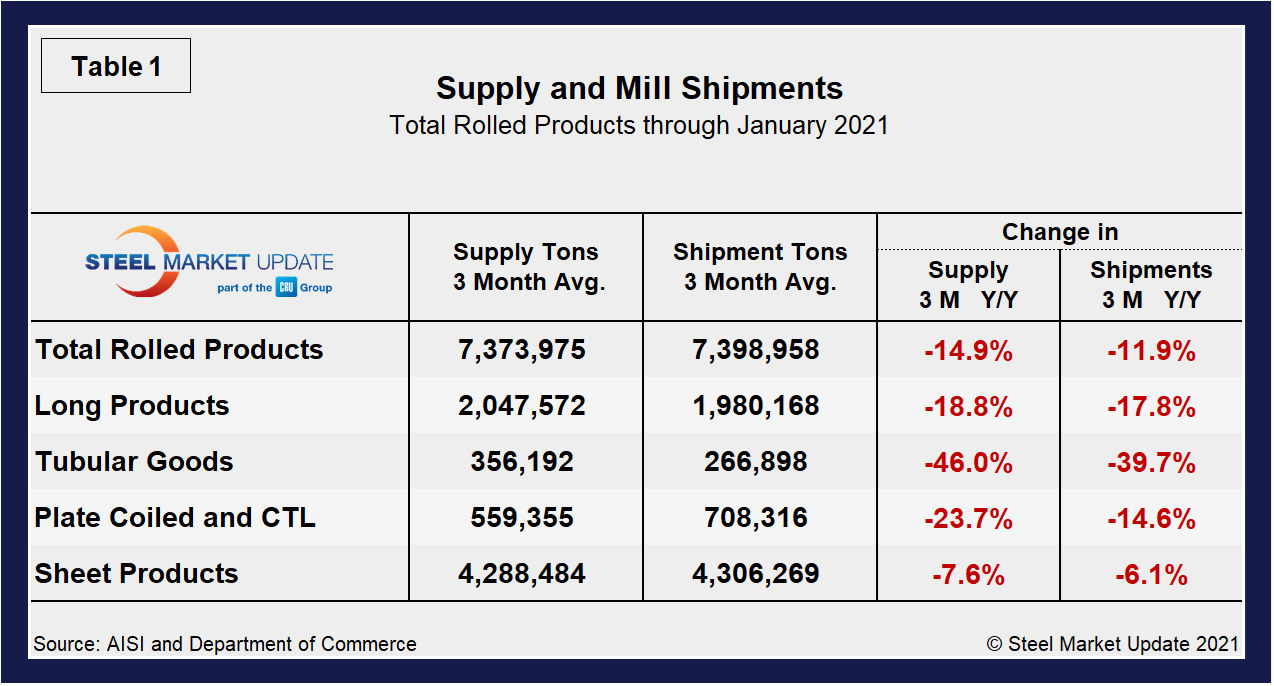

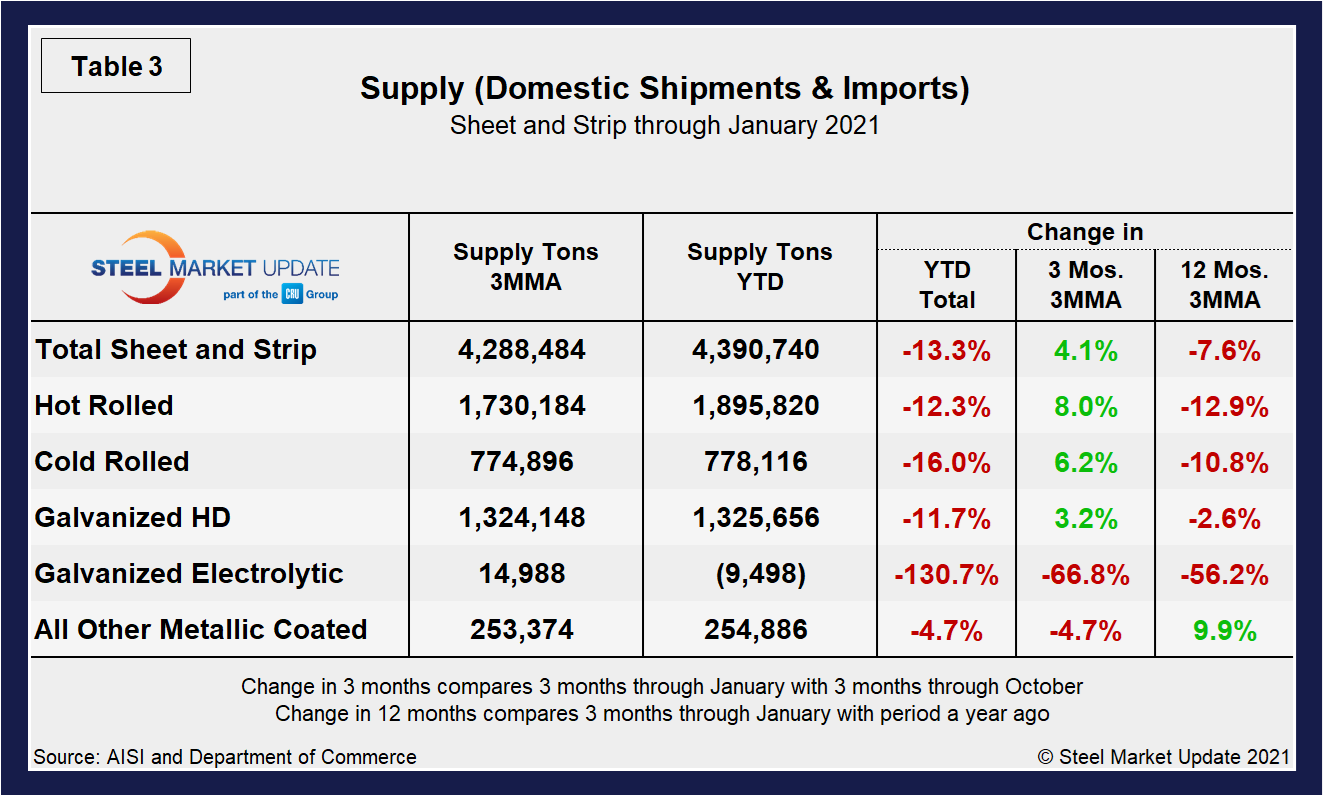

Shipment and supply details for all product groups are noted in Table 1, followed by individual sheet products in Table 2, and domestic supply (shipments and imports) in Table 3. Total supply (proxy for market demand) as a 3MMA was down by 14.9% year over year in January, but up from negative 15.4% in December and negative 28.1% in June when the market was at its lowest. Apparent supply is defined as domestic mill shipments to domestic locations plus imports. Mill shipments improved to negative 11.9% in January, compared to negative 12.7% in December and negative 29.1% in June. There is still a major variance between products. Even though a decline across all products was seen, tubular products continue to be the most affected at negative 46.0% and negative 39.7% for supply and shipments, respectively.

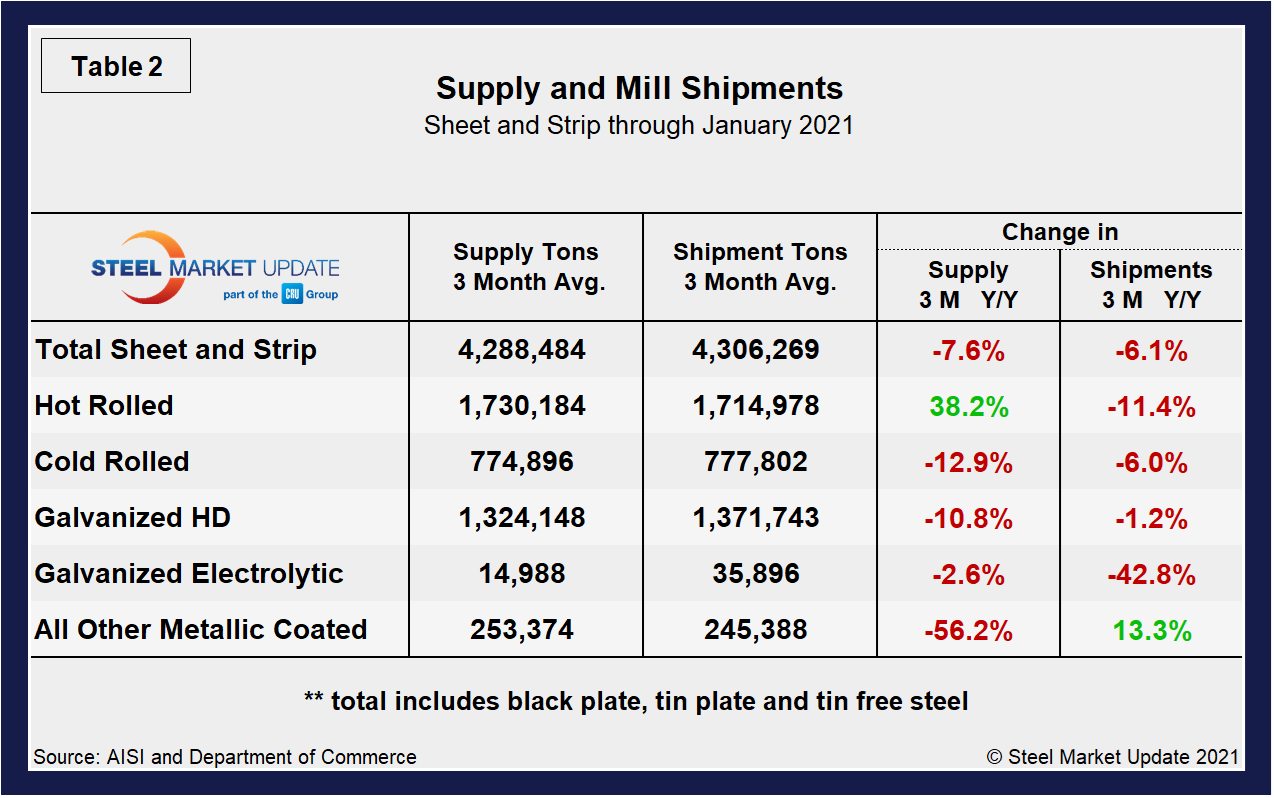

Overall sheet product shipments are down (Table 2), however, hot rolled has really taken off over the past few months, reaching 38.2% growth in January. In the three months through January 2021, the average monthly supply of sheet and strip was 4.288 million tons, down from 4.641 million tons the year prior. Note that year-over-year comparisons have seasonality removed. Total sheet and strip product shipments were down by 13.3% year to date (Table 3) compared to 2020, but up 4.1% month on month (not shown in Table 3). As a 3MMA, however, it’s important to note that all products have continued to turn, in some cases, markedly. Despite the near collapse in Q2, data continues to support the improving market sentiment, but the paced rebound and idled capacity is straining the marketplace in unprecedented ways. Consequently, imports took a noticeable market share in January, up 49.3% compared with the month prior, but still down by nearly 40.0% on year-ago totals. Still, imports are expected to rise further as buyers seek relief from historically high prices and extended lead times from domestic suppliers. According to preliminary data from the DOC, February license data for hot rolled and cold rolled sheet is already 73.1% above January’s Census data and 2.0% higher than year-ago levels, the highest month for total sheet imports on record in the last year.

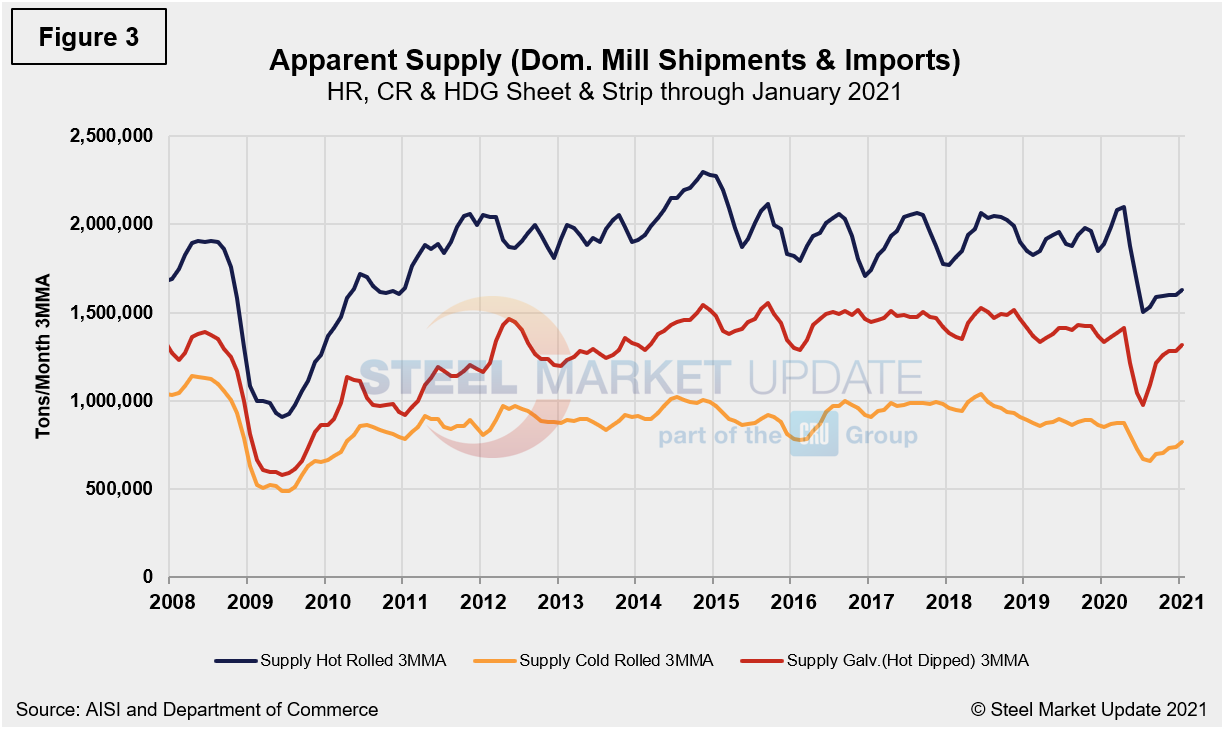

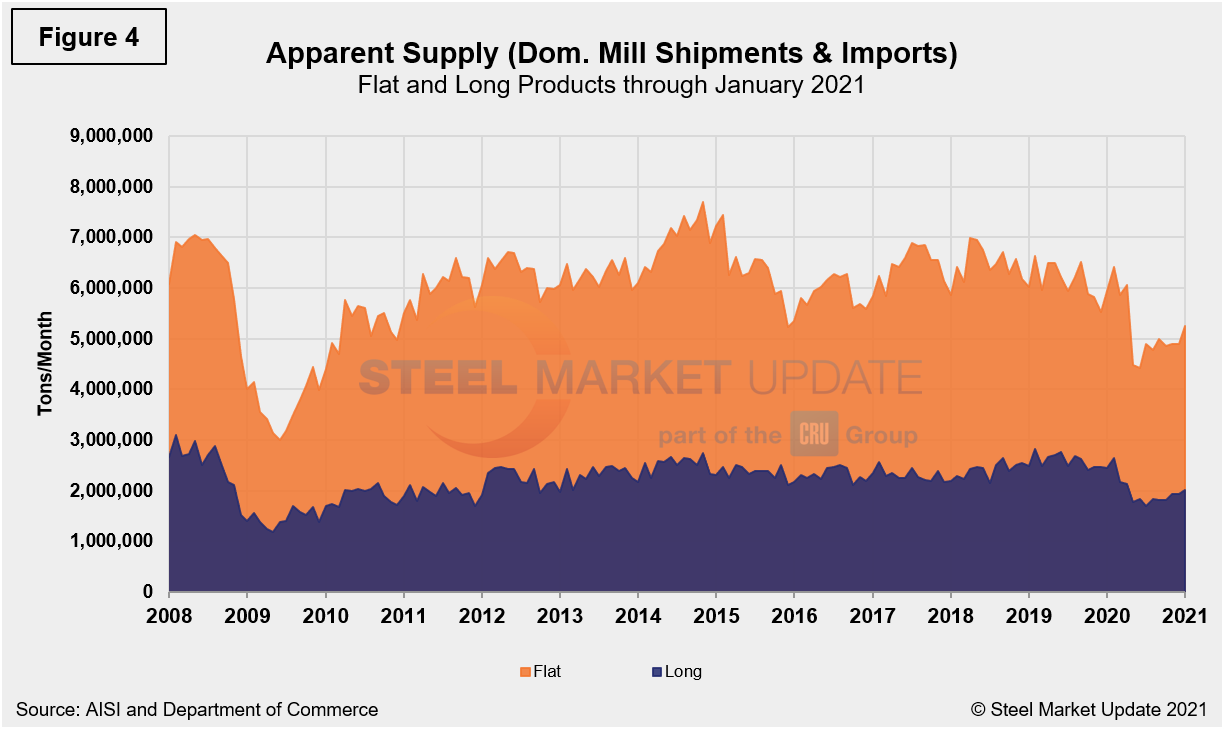

The long-term supply picture for HRC, CRC and HDG since August 2008 as three-month moving averages in Figure 3 and Figure 4 show the long-term comparison between flat and long products. All three sheet products have experienced some improvement since mid-2020, but hot-dipped galvanized has seen a 35.4% jump since reaching bottom this past June. In Figure 4, note that these are monthly numbers (not 3MMAs), and clearly show the trend difference between longs and flat products including plate.

By David Schollaert, David@SteelMarketUpdate.com