Prices

March 2, 2021

SMU Price Ranges & Indices: March Steel Prices Come in Like a Lion

Written by Brett Linton

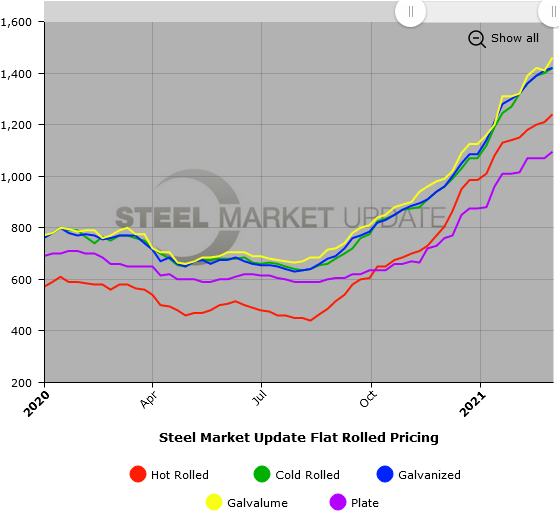

Steel prices took another bite out of the record books in March. The advent of March shows flat rolled and plate steel prices are still roaring upwards, with hot rolled hitting another record high of $1,240 per net ton, according to Steel Market Update’s check of the market this week. Prices generally moved up in a range from $10-30 per ton. Galvalume, which is in particularly short supply, jumped by $50, buyers reported. There’s no relief in sight from lead times stretching to 12 weeks or more. Ferrous scrap prices are expected to see a big leap of $40-70/GT in March, which will only add momentum to rising finished steel prices. The trend is concerning for steel buyers. “Lack of availability is hindering our ability to meet customer demand,” commented one service center executive. “Steel is just too expensive, I don’t know how much longer we can operate with these numbers from the mills,” said an OEM. “We are hearing universally now that customers are getting very nervous about their credit lines and the cost of materials derailing consumer demand,” said another source. Usually, as the old saying goes, when March weather comes in like a lion it leaves like a lamb, but it remains to be seen if steel prices follow the same pattern. Steel Market Update’s Price Momentum Indicators continue to point toward higher steel prices in the next 30 days.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,180-$1,300 per net ton ($59.00-$65.00/cwt) with an average of $1,240 per ton ($62.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end increased by $60. Our overall average is up $30 from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 6-12 weeks

Cold Rolled Coil: SMU price range is $1,380-$1,460 per net ton ($69.00-$73.00/cwt) with an average of $1,420 per ton ($71.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end increased $40. Our overall average is up $20 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 7-12 weeks

Galvanized Coil: SMU price range is $1,380-$1,460 per net ton ($69.00-$73.00/cwt) with an average of $1,420 per ton ($71.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is up $10 from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,449-$1,529 per ton with an average of $1,489 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 8-14 weeks

Galvalume Coil: SMU price range is $1,420-$1,500 per net ton ($71.00-$75.00/cwt) with an average of $1,460 per ton ($73.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $60 per ton compared to last week, while the upper range increased $40. Our overall average is up $50 from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,711-$1,791 per ton with an average of $1,751 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 9-12 weeks

Plate: SMU price range is $1,090-$1,100 per net ton ($54.50-$55.00/cwt) with an average of $1,095 per ton ($54.75/cwt) FOB mill. The lower end of our range increased by $70 compared to one week ago, while the upper end decreased by $20. Our overall average is up $25 from one week ago. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 6-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.