Market Data

February 18, 2021

Steel Mill Negotiations: Buyers Still at the Mercy of the Mills

Written by Tim Triplett

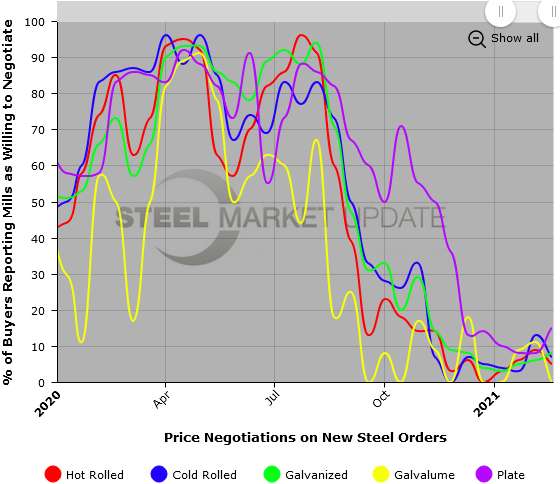

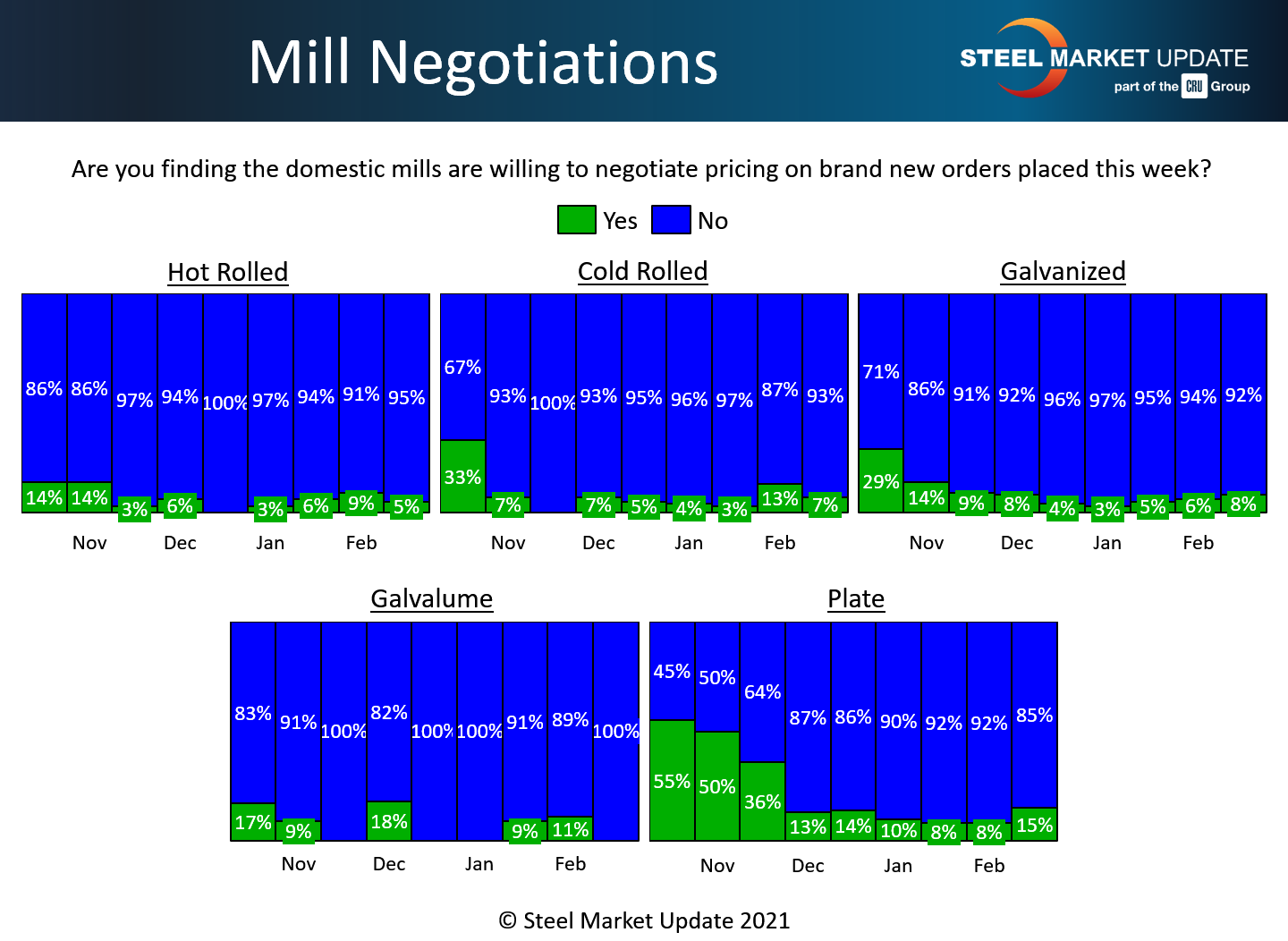

Steel Market Update data shows no significant change in the negotiating position of steel buyers, who remain largely at the mercy of the mills. More than nine out of 10 buyers responding to SMU’s questionnaire this week reported the mills unwilling to discuss price concessions—which has been the mills’ attitude for the past five months.

Steelmakers continue to enjoy the dominant negotiating position because of market conditions characterized by strong demand and limited supplies. In competition for needed materials, buyers have bid up steel prices to record heights. SMU’s latest check of the market puts the average hot-rolled coil price at $1,200 per ton ($60/cwt).

Steel prices are likely to remain elevated, and the mills in the driver’s seat, until more capacity comes online and more imports come ashore later this year, say the experts. SMU will be watching the data closely for signs that price talks are beginning to loosen up between spot buyers and their mill suppliers. But it hasn’t happened yet.

Note: These negotiations are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. To see an interactive history of our Negotiations data, visit our website here.

By Tim Triplett, Tim@SteelMarketUpdate.com