Market Data

February 15, 2021

Service Center Shipments and Inventories Report for January

Written by Estelle Tran

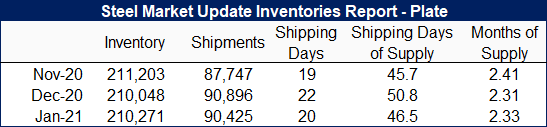

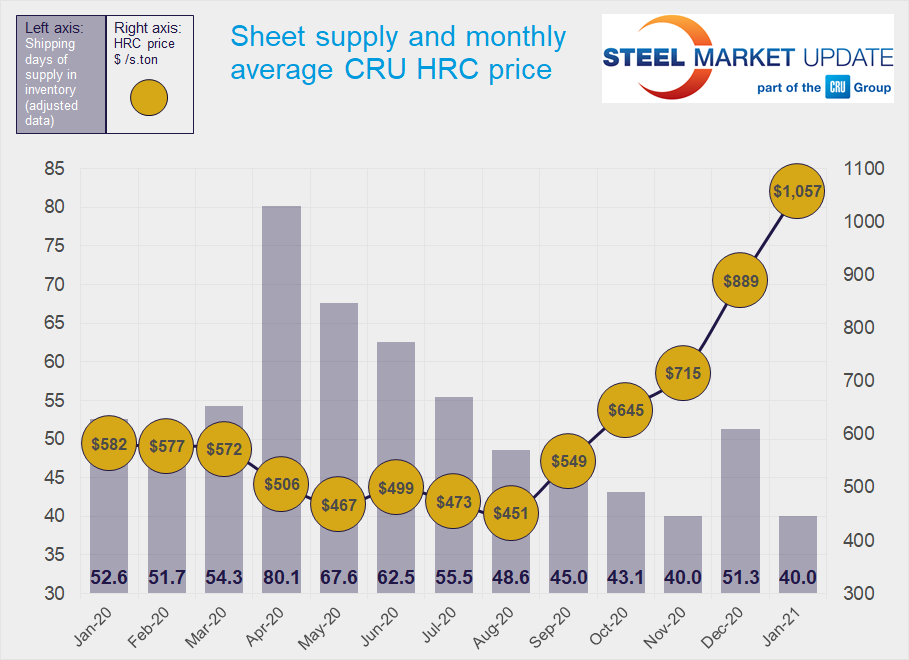

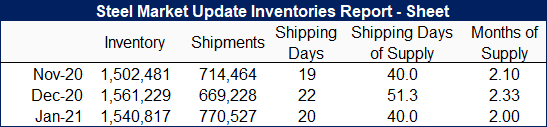

Flat Rolled = 40 Shipping Days of Supply

Plate = 46.5 Shipping Days of Supply

Flat Rolled

End-of-January service center flat rolled steel inventories fell back to levels seen in November 2020. At the end of January, service centers carried 40 shipping days of supply – tied with November for the lowest inventory level in the last two years. January supply was down from 51.3 shipping days in December; the 22 percent drop in supply month on month was more than the 16 percent seen in the year-ago period. In January 2020, service centers carried 52.6 shipping days of supply.

The drop in supply last month can be attributed to higher seasonal shipments, continued supply tightness, and the shorter shipping month. January had 20 shipping days, compared to December’s 22. In terms of months on hand, inventories at the end of January represented 2 months of supply, down from 2.33 months of supply in December.

The amount of material on order declined month on month but appears elevated for the time of year. The elevated level of material on order last month speaks to long domestic mill lead times, shipment delays, imports on the way, and continued strong demand, however, it may also indicate some duplicate ordering by service center customers.

Though the sheet market remains very tight with contacts still reporting that they are unable to purchase all the steel they need, there have been some anecdotal signs that supply may be loosening slightly, particularly for HRC. While we believe that the market is nearing the peak, the low inventories and more restrained buying at these high levels should help to support the market in the coming weeks. We are watching the impact of the global semiconductor shortage, which we expect will result in lower auto production in North America and allow service center inventories to rebuild at a faster rate.

Plate

Plate inventories also fell back to levels similar to what was seen in November. Service centers carried 46.5 shipping days of supply at the end of January, down from 50.8 days in December. Though inventories declined month on month, they did not fall as much as the year-ago period, as shipments in January 2021 were lower. In the December 2020-January 2021 period, the number of shipping days of supply fell 8 percent. In the December 2019-January 2020 period, supply fell 20 percent to 48.4 shipping days.

Plate supply at the end of January represented 2.33 months, close to December’s 2.31 months.

Market participants report that the market continues to be tight. SMU has reported plate lead times longer than 7.5 weeks in its last two market surveys. At the same time, market participants have been concerned about buying too much material with prices seen near the peak.

The volume of plate supply on order decreased slightly month on month.

Market participants expect pricing for plate to peak shortly and probably plateau. Similar to sheet, plate mills have been controlling order entry.