Market Segment

January 28, 2021

Cleveland-Cliffs Commits to Greenhouse Gas Reduction

Written by Sandy Williams

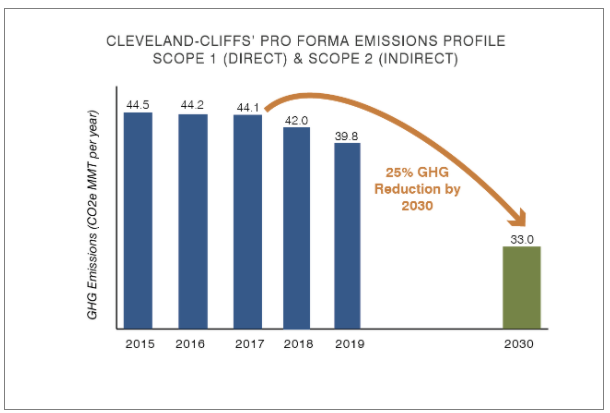

Cleveland-Cliffs has committed to reducing its greenhouse gas emissions 25% by 2030. In a detailed plan, Cliffs plans to lower combined direct and indirect gas emissions on a mass metric tons per year basis compared with 2017 baseline levels.

The company has already made progress toward emission reductions, achieving six years early its 2025 target to reduce emissions by 26% in its mining and pelletizing businesses. In 2019, Cliffs reduced its combined Scope 1 (direct) and Scope 2 (indirect) GHG emissions by 42% on a mass basis from 2005 baseline levels, the company claims.

Cleveland-Cliffs’ plan is based on its execution of the following five strategic priorities:

- Developing domestically sourced, high quality iron ore feedstock and utilizing natural gas in the production of hot briquetted iron (HBI);

- Implementing energy efficiency and green energy projects;

- Investing in the development of carbon capture technology;

- Enhancing its greenhouse gas emissions transparency and sustainability focus; and

- Supporting public policies that facilitate carbon reduction in the domestic steel industry.

“We at Cleveland-Cliffs acknowledge that one of the most important issues impacting our planet is climate change,” said Chairman, President and CEO Lourenco Goncalves. “The American steel industry is one of the cleanest and most energy efficient in the world, and therefore the utilization of steel Made in the USA is a decisively positive move to protect the planet against massive pollution embedded in the steel produced in other countries.”