Market Segment

January 26, 2021

Upbeat Outlook at Steel Dynamics

Written by Sandy Williams

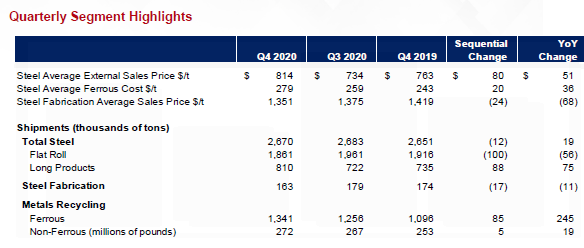

Steel Dynamics Inc. turned in a remarkable fourth quarter and 2020 results despite a year fraught with challenges from the COVID-19 pandemic. SDI posted its second highest record for yearly steel shipments at 10.7 million tons. The company’s fabrication platform shipped a record 666,000 tons. Metals recycling posted operating income of $45 million in 2020 compared to $28 million in 2019.

“The team delivered a tremendous operational and financial performance during 2020 within an unprecedented health and economic crisis, achieving strong net sales of $9.6 billion, operating income of $847 million, and adjusted EBITDA of $1.2 billion,” said President and CEO Mark Millett. “Numerous individual operating and financial records were also attained during the year–an amazing achievement during a period in which many steel consuming businesses were temporarily idled or severely impacted by the social and economic effects of the coronavirus pandemic.”

Underscoring SDI’s performance is the highly anticipated start-up of its Sinton, Texas, mill in summer 2021. Construction is on time and on budget. The $1.9 billion EAF mill will include two value-added coating lines: a 500,000-ton galvanizing line and 250,000-ton paint line. Millett said the coating lines are expected to begin production in May or June, before the full mill start-up, using substrate supplied from SDI Columbus and from third parties.

Steel production will commence with a simultaneous start-up of the two EAFS this summer, with a strong ramp-up period expected. Three customers have committed to locating on site representing 1 million tons of annual processing and consumption capacity, said Millett, while other customers are considering on-site or nearby facilities.

Millett said new flat roll capacity coming online at SDI and at other steel producers will not cause a supply imbalance in the industry. “As a result of the pandemic, an estimated 15 million tons of higher cost, domestic blast furnace flat-roll steel production was idled in early 2020. Since that time, we believe between 5 million to 6 million tons of net production capacity has resumed.

“We believe some of the idle capacity will be kept permanently offline due to the high cost required to restart and maintain their operations. We believe this supports our flat roll supply demand balance thesis that the impending additional flat roll capacity will not cause the material supply side imbalance, as there are only approximately 6 million tons of new capacity that is planned to start in the next 12 months. Combined with the capacity already restarted, it still doesn’t match the tons taken offline in early 2020.”

Demand for flat rolled steel rebounded quicker than anticipated causing an extreme tightening of the market. Millett noted that SDI “can’t even supply our internal operations to the extent they would like.” The market is expected to remain tight. Customers are not yet building inventory due to lower availability and potentially higher costs, said Millett, and imports will continue to be moderated by trade policies currently in place.

SDI’s fabrication business ended the year at record backlogs of six months and about 2.5 months of steel inventory on the ground. “As steel prices increased quickly, it’s likely we’ll see near term margin compression for the fabrication platform,” said Millett. “However, the strong steel pricing environment will obviously benefit our steel operations to a much greater degree. This is one of the strengths of the symbiotic nature of the vertical integration of our primary operating platforms. Another is the ability to keep utilization of our steel mills at the highest level.”

SDI’s flat roll steel mill utilization rate was at 84 percent in the quarter and was supported by internal purchases of steel by the fabrication facilities. Flat roll shipments of 1.9 million tons included 729,000 tons of hot roll, 139,000 tons of cold roll, and 973,000 tons of coated steel.

Scrap prices took off during 2020 along with higher steel prices. The metals recycling business reported a 60 percent increase in operating income. The recycling business was able to keep SDI supplied with necessary raw material even during the severe reduction in the second quarter. “We believe scrap generation will be strong in 2021 and that pricing will stabilize at moderately lower levels than we have today,” said Millett.

The export market for scrap is likely to remain relatively soft even with the import restrictions by China. So far, the ferrous scrap market has not been affected dramatically and there is a higher demand for nonferrous scrap such as copper, aluminum and Zorba.

Millett expects the U.S. scrap supply to be sufficient without any long term issues. CFO Theresa Wagler added that scrap supply is likely to increase quicker than capacity coming online and also noted that HBI and DRI entering the market will enhance raw material supply. Millett added that it is possible that integrated producers may begin producing pig iron as well.

Markets are looking good. Automotive has rebounded to pre-COVID levels, nonresidential construction has been steady with record structural and rail division shipments. Online retail purchasing is driving construction of warehouses for distribution as well as cloud computing. Residential construction has propelled demand for HVAC, appliance and garage doors. The energy sector remains weak but has been showing some signs of revival, said Millett. The cancellation of the Keystone XL pipeline project is not expected to impact the market since most of the steel pipe has been produced and is on site. Solar is a surprisingly large market. Truck trailer material handling was anticipating a flat to down year, but has changed its forecast to up 20 percent or more. Order books are up for yellow and green goods.

“We see a very, very positive perspective out there. Our order books are incredibly strong. I wish we could make a lot more steel today because we could certainly sell a lot more steel,” said Millett. “And we see it sustaining or persisting through the year.”

He concluded: “People are focused on price, and it’s not price that matters; we’re a metal spread business. And again, we anticipate a very strong demand year that’s going to support pricing on the market side. Supply side, inventories remain very, very low. We expect import activity to remain very moderate. A significant portion of the idled blast furnace capacity we expect to remain down, and lead times are extended.

“So, you couple that with a moderating scrap environment and we see that metal spreads themselves are going to persist higher than the normal through-cycle levels, which should be very, very helpful for us. We’re anticipating a remarkable year, in all honesty.”

By Sandy Williams, sandy@steelmarketupdate.com