CRU

January 18, 2021

CRU: Vaccine Spring, Second Wave or Fiscal Tsunami—What Will Define 2021?

Written by Jumana Saleheen

By CRU Principal Economist Alex Tuckett and Chief Economist Jumana Saleheen from CRU’s Global Economic Outlook

This month has brought good and bad news. On the one hand, vaccines are being rolled out, and further U.S. fiscal stimulus looks increasingly likely. On the other hand, the growing severity of the second wave of COVID-19 means the path to recovery will be more volatile and less predictable. The net outcome of these contrasting developments is negative for Q1, but positive further out. We have marginally revised up our 2021 forecast for growth in world GDP to 5.2%, and our 2022 forecast from 3.7% to 4.1%. We now forecast growth in world industrial production in 2021 and 2022 of 6.2% and 3.5%.

This overview discusses the three most important forces currently buffeting growth in either direction: first, progress in vaccinating populations; second, the second set of lockdowns which are currently upsetting the recovery, particularly in Europe; and finally, U.S. political developments, which have already delivered another $900 billion of fiscal stimulus and look likely to deliver a generous third helping.

Vaccination is Progressing—With Some Hiccups

One of the most important of our Top Ten Calls for 2021 was that vaccines would begin to be rolled out in Q1. This is now happening in the UK, the EU and the U.S. A number of emerging markets—including Israel, India and the UAE—have also begun vaccination.

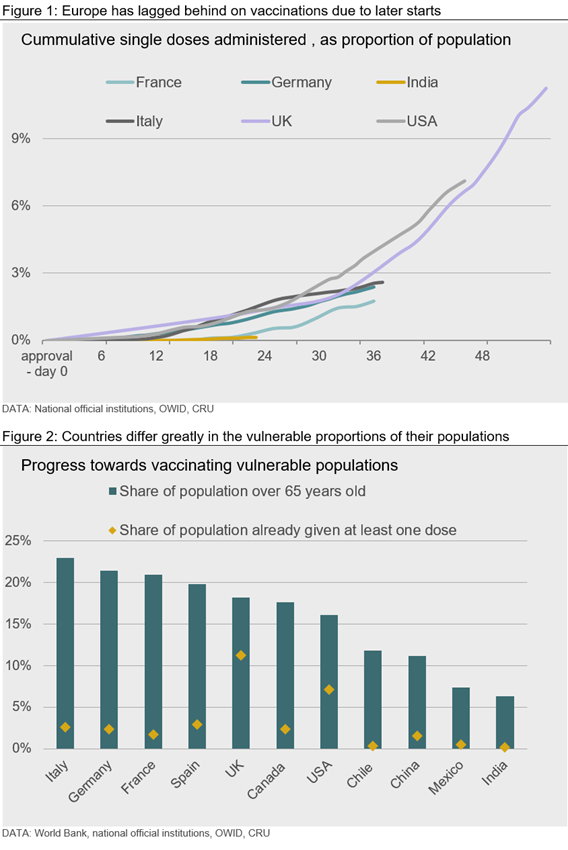

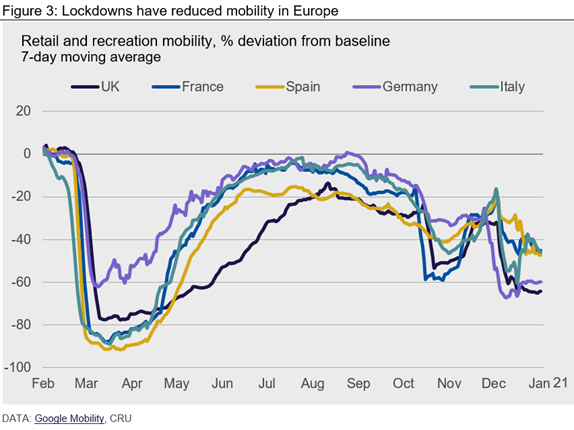

This is good news, because vaccine roll-out is a vital pillar of the global recovery that we forecast in 2021. However, there have been some teething problems in the early stages. EU countries have lagged behind the UK and the U.S. So far, this mainly reflects a later start, because the EU took longer to approve the vaccines (Figure 1). More worryingly, production delays may impede the ability of countries to ramp up vaccination rates. However, the economic and political benefits of vaccination are so huge that we expect advanced economy governments to mobilize the necessary resources to increase the pace dramatically, allowing social distancing restrictions to be lifted through Q2 and Q3. Furthermore, to re-open economies, governments do not necessarily need to achieve herd immunity. Once they have vaccinated the vulnerable proportion of the population (Figure 2), hospitalization and mortality rates should fall dramatically, and there will be strong political pressure to re-open. Nonetheless, slow roll-out does remain a risk to the forecast, as does the possibility that vaccines are less effective against new strains.

Emerging markets were always likely to find it more difficult to secure western-developed vaccines. However, there are increasing signs that many emerging markets will press ahead with vaccination drives, using the Chinese, Russian or Indian vaccines. Although clinical data on efficacy is less complete for these vaccines, many countries will take the view that the benefits of their use outweigh the risks. Wider vaccination could boost emerging market growth.

Lockdown-Shaped Potholes on the Road to Recovery

Q4 last year saw rapidly rising numbers of COVID-19 cases in Europe. New, more infectious strains of the virus have made the situation worse. Although infections have fallen or stabilized in most countries, healthcare systems are under enormous pressure and lockdown measures have been deepened and extended into Q1. The U.S. is also seeing a third wave of infections. Though there are fewer restrictions than in Europe, weakening labor market data show that the threat of infection is again taking its toll on consumer services. Outbreaks in parts of Northern China show that COVID-19 remains a risk elsewhere.

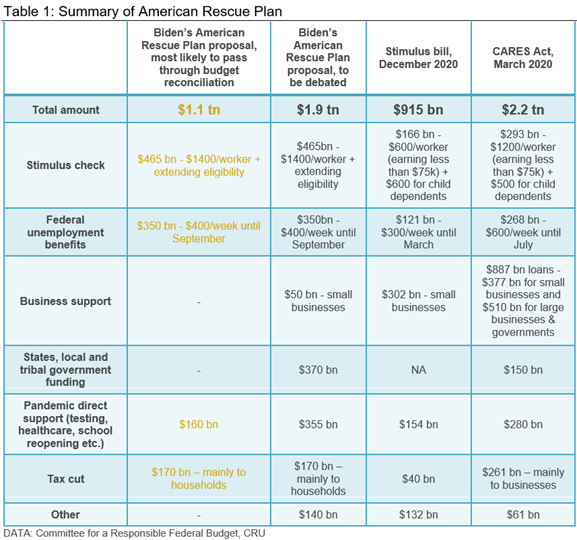

In response to this bad news, we have marked down our Q1 forecast for Europe (more detail in the Europe section). Our own analysis of mobility data suggests that the impact on the retail sector and other consumer services will again be serious (Figure 3). However, we do not expect this lockdown to reduce economic activity as much as the first lockdown did. Last year, we predicted that the manufacturing and construction sectors would be resilient to a second lockdown, and the data so far have supported this judgement (see Europe section for more detail).

We have reduced our forecast for Q1 growth in Europe. But provided vaccination speeds up, economies should be in a position to bounce back strongly from Q2 onwards. This will be a recovery delayed, not cancelled.

Further U.S. Fiscal Stimulus will Boost Growth

After much wrangling, a new COVID-19 stimulus package of $915 billion (4.2% of GDP) was signed into law on Dec. 28. Since then, victories for Democratic candidates in both Senate elections in Georgia on Jan. 5 have given President Biden a narrow majority in Congress. This opens the door to further spending. On Jan. 15, Biden announced his proposals for a further round of support for the economy in the form of a $1.9 trillion package, equivalent to 8.9% of GDP and almost as large as the CARES Act of March 2020 (Table 1). Although it is highly unlikely that all this will be passed into law, Democrats should be able use the budget reconciliation process to achieve much of it. Our best estimate is that a further package worth around $1.1 trillion (5.1% of GDP) will pass in Q1, and there is potential for more.

If realized, this will mean that 2021 will see almost as much U.S. fiscal stimulus as 2020. This is undoubtedly good news for growth—at least in the short term—and we have revised up our U.S. forecast for 2021 and 2022 (more detail in the U.S. section). Cyclical end-use sectors such as construction and autos are likely to benefit from the boost to consumer demand. Further spending increases may follow if Biden seeks to pursue his broader agenda. However, the filibuster means that some of his other plans will be less easy to get through Congress, and any further package may also include tax rises as well as spending increases.

Such heavy spending has increased concerns about stronger inflationary pressures in the future. U.S. bond yields have risen in response, although they are still well below pre-COVID-19 levels. In the long-run, large twin (fiscal and external) deficits will depress the dollar. However, in the shorter run, higher rates and growth prospects dominate, and the U.S. dollar has reversed some of the falls it has suffered since late November. Although we don’t expect inflation to be a major issue in 2021, we will continue to monitor this risk, which would have far-reaching global implications.

2021 Still a Year of Recovery, But With a Bumpier Path

The continuing high number of COVID-19 cases and deaths has reminded us that exiting from the virus will not be a smooth ride. However, the fact that vaccines are now being rolled out in advanced economies means that the fundamentals remain in place for a strong economic recovery later this year. This recovery could draw further support from an aggressive U.S. fiscal stimulus. Risks remain to this outlook, not least the possibility that new strains of the virus could prove more dangerous, or even resistant to vaccines. But this has not stopped investor optimism propelling prices of assets and raw materials, including oil, higher, in the expectation of a commodity-thirsty “old economy” cyclical upturn. Overall, we maintain our view that 2021 will be a year of recovery, but with a more volatile path than we had hoped.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com