CRU

January 18, 2021

CRU: Sheet Galvanizing Key to Zinc Demand Recovery in 2021

Written by Sam Grant

By CRU Analyst Sam Grant, from CRU’s Steel Sheet Products Monitor

Galvanized steel sheet equates to around 30% of refined zinc demand, making it the most significant first use for zinc globally. China is by far the world’s largest producer, responsible for 33% of the global total, with North East Asia, North America and Europe constituting a further 45%. Most of this sheet is ultimately consumed in the construction and automotive sectors as well as a smaller proportion in consumer durables, other engineering, and transportation infrastructure. In absolute terms, sheet galvanizing equated to almost 4 Mt of refined zinc demand in 2020. In this Insight, we will explore the sheet galvanizing sector, looking at the impact of COVID-19 on output and trade and discuss the outlook for 2021.

Automotive Sector Demand Hit Hardest by COVID-19

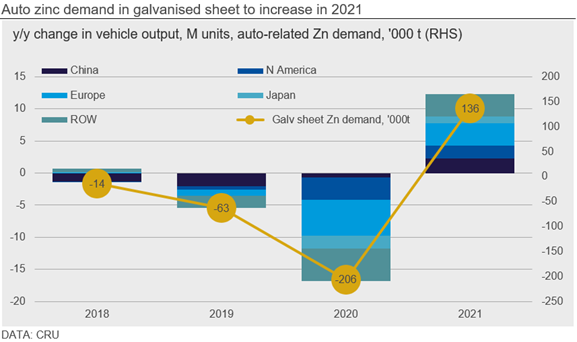

The implementation of COVID-19 lockdowns around the world had a dramatic impact on heavy industry throughout 2020 H1. The automotive sector was particularly hard hit by lockdowns and many lines were forced to halt operations. Galvanized sheet is used widely in vehicle doors, frames and panels, especially in higher-end models common in more developed and high-income regions. In North East Asia, CRU’s Economics team estimate that combined Japanese and South Korean automotive production declined 17.4% last year. In North America, where vehicles are often large and therefore use more galvanized steel, production declined by around 20.7%. The sharpest fall was in Europe, where automotive output fell a staggering 27.4%, down over 5.5 M units y/y, even from a cyclically weak base year. However, China’s auto sector outperformed the rest of world following a strong end to the year, with output contracting only a modest 2.6% in 2020. Overall, global vehicle output fell by an estimated 18.1% last year, a sharper decline than was experienced in 2009 during the GFC. This is equal to a loss of over 200,000 t of zinc demand, most of which is in galvanized sheet.

In general, construction activity was less affected, partly because most building work is outside and social distancing can be implemented relatively easily. Construction output declined by 2.5% in Japan, by 3.2% in the USA, and by 8% in Europe. In China, strong levels of stimulus resulted in growth in this sector of 1.7% in 2020. The consumer durables sector also saw robust demand as construction projects continued to be completed and lockdowns encouraged many to invest in home improvements. For example, Chinese exports of dishwashers and refrigerators to the USA almost doubled year-on-year to October.

Galvanized Sheet Output Contracted Sharply in 2020, But Not in China

CRU’s Steel Sheet team estimates that global galvanized sheet output contracted by 6.3% in 2020 (to 151 Mt) due to the impact of COVID-19 disruptions on the industrial sector. In terms of refined zinc demand, this contraction equates to a fall of approximately 300,000 t. Galvanized sheet output in the world ex-China contracted 11.7% in 2020, a fall of around 380,000 t of zinc demand, as measures to control the spread of COVID-19 impacted key end-use sectors, most notably automotive. In North East Asia, output of galvanized sheet contracted 13.6% last year, even from a low base in 2019, while North American production declined 14.8% and European output fell 12.0%. In general, Q2 2020 was the weakest quarter for production, as strict COVID-19 lockdowns were implemented around the world, with output gradually recovering throughout the remainder of the year.

Remarkably, Chinese galvanized sheet output increased 5.2% in 2020, limiting the global decline, supported by the fact that COVID-19 was brought under control by the end of Q1, coupled with major government stimulus. This helped drive strong end-use sector demand in China, which also benefitted from a rise in export demand for steel sheet containing goods, fueling the robust recovery in H2. The strong growth in Chinese galvanized sheet output in 2020 equates to an increase in refined zinc demand of around 80,000 t.

Global Trade in Galvanized Sheet Hit by the Pandemic

Outside of China, lockdown restrictions and weaker demand weighed on global galvanized sheet trade flows last year. In North East Asia, Japanese total net exports fell 18.3% year to date in November. Exports to South East Asian countries declined 25.6% during this period, while exports to Mexico and India declined 22.9% and 26.5%, respectively. Exports to China were less affected, falling 4.3%, while those to neighboring Taiwan increased 32.3%, helping limit the fall. South Korean net exports declined by 10% in 2020. Exports to South East Asia, India, Mexico, and neighboring Japan all fell sharply, while exports to Australia, Bangladesh, and Argentina increased. The latter increase of over 2,000% from a very low base may be related to the recent shifting of Ford’s Automotive production from Brazil to Argentina.

In North America, the United States remained a large net importer of galvanized sheet in 2020, although net import volumes declined 5.9% year to date November. Even with a weak base year in 2019 due to Section 232 tariffs, which have since been lifted, U.S. imports from Canada and Mexico contracted 3.4% and 12.4%, respectively. The decline was even more severe for imports from Vietnam, in part due to anti-dumping duties, which fell 54.7% and are still subject to Section 232 tariffs. The vast bulk of U.S. galvanized sheet exports are to Canada and Mexico, which declined 22.4% and 18.7%, respectively, year to date in November.

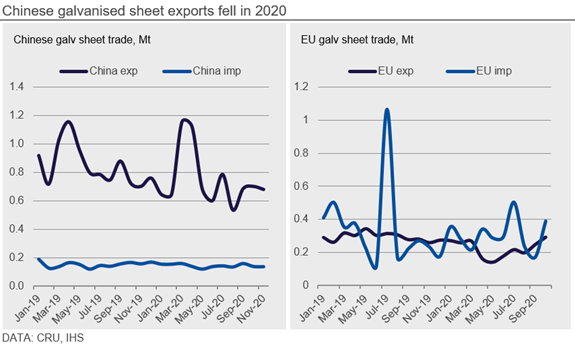

Last year Western Europe remained a net exporter of galvanized steel sheet. According to external trade data, the EU saw net imports of over 840,000 t year-to-date in October. Most of these imports (approximately 68%) came from Turkey, South Korea, China and India. As has been the case over the last couple of years, imports appeared to increase sharply in July, when tariff-free quotas opened for Chinese origin galvanized sheet. The main EU countries importing from outside the bloc were Belgium, Spain, Greece, Italy and Slovenia last year. Exports of galvanized sheet from the European Union fell by 25.3% year to date in October, while imports rose 11.9% during the same period.

In China, net exports of galvanized sheet fell 14.0% year to date in November, highlighting the strength of the recovery and domestic demand. Total exports contracted 12.4% during this period, with a sharp fall in shipments to South Korea, Chile, Vietnam and Indonesia. In contrast, Chinese exports to the Philippines, Thailand and Brazil rose 10%, 19.8% and 35.4%, respectively. Chinese imports fell by 4.8% in the year to November, with volumes from Europe and Japan down sharply. In contrast, volumes from Taiwan and South Korea increased 11.5% and 1.7%, respectively.

Galvanized Sheet Important for Zinc Demand Growth

This year is widely expected to be a year of recovery for the global economy as COVID-19 vaccines are rolled out and restrictions are lifted. Automotive production, which was so badly affected in 2020, is expected to recover to 16.2% growth this year. However, the absolute number of units produced globally is expected to remain significantly below the cyclically high peak of 2017 and 2018. This recovery will translate to improved demand for galvanized sheet from the sector and we expect global output to increase 4.4% globally in 2021. This equates to an increase of almost 200,000 t contained zinc. We calculate that the rebound in the automotive sector should equate to an increase of 136,000 t of end-use sector zinc demand in the form of galvanized sheet.

In ex-China, galvanized steel sheet production is expected to increase 10.6% in 2021. The automotive industry is expected to be a key driver of demand growth, with output increasing 19.8%. This will be key to the recovery in ex-China zinc demand this year, but risks remain. If vaccine rollouts are slower than expected and lockdowns are extended, vehicle sales will be impacted. In addition, recent microchip shortages, caused by freight container tightness, may cause temporary shutdowns at major automotive production lines, highlighting the continued threat of disruptions to supply chains and global trade.

In China, we do not expect sheet demand growth to be sustained through 2021, even with automotive output forecast to increase 8.9%. This is due to global economic rebalancing in 2021, as activity elsewhere increases, and sheet containing goods exports from China will weaken, though direct sheet exports will rise. As a result, we forecast a contraction in Chinese galvanized sheet output of 6.6%. Steel sheet will therefore be less important to overall zinc demand growth in China this year, compared with other first-use segments.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com