CRU

January 15, 2021

CRU: Longs Prices Up as China Policy Changes Tighten Supply

Written by James Campbell

By CRU Principal Analyst James Campbell, from CRU’s Steel Long Products Monitor

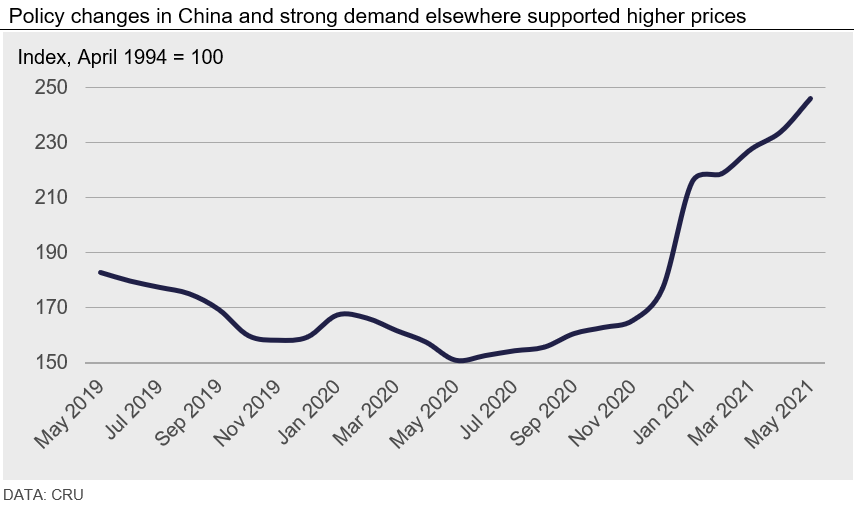

Global long product prices have increased to the highest level since 2008. Global supply has tightened due to production cuts and changes to export tax rebates in China. Demand is strong in many regions, but Covid-19 outbreaks and seasonal patterns mean some weakness is seen. High prices are a concern for future demand as finance is limited, pushing buyers some to lobby for price controls.

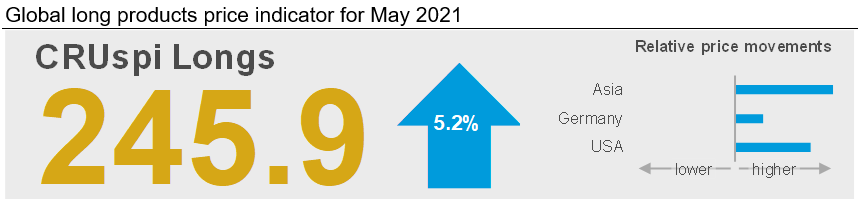

Overall, the Global Long Products Price Indicator (CRUspi Longs) increased by 5.2% m/m to 245.9 in May 2021. This is the highest level for CRUspi Longs since October 2008. Higher prices in Asia and the USA were the driver for the rise.

Changes to Chinese Policy Have Pushed Prices Higher

The rise in long products prices has not stopped or reversed as forecast, with Chinese policy changes the major factor in the continued rise. Production cuts in Tangshan city, which were highlighted last month, affect sheet products output more than longs, but their effect on sentiment has been universal across products. Even with these restrictions, longs output increased m/m as mills elsewhere in the country increased production; margins were high enough to push EAF output to a multi-year high. However, output restrictions may intensify. There are new rumors of further production cuts in Handan city and the provinces of Shandong and Jiangsu. This can push prices higher still.

The other major change in China has been the cancellation of export tax rebates. This will increase the cost of exporting and discourage export volumes, which will help loosen a tight domestic market. Initially, due to high flat products prices elsewhere in the world, the greatest impact on trade volumes will be for carbon steel long products.

China is Now Uncompetitive in Global Markets

The effects of these policies can now be felt across the global longs market. Chinese export prices have increased significantly to account for the VAT rebate removal. For now, Chinese material is priced at a premium and is uncompetitive in the export market. This hit high carbon wire rod and structural prices in Southeast Asia as China is a key supplier of those products in the region. For low carbon wire rod, Chinese prices are now $100 /t more expensive than from local Southeast Asian producers and effectively out of the market. For rebar, Turkey is now the most competitive.

Strong Demand Has Supported Global Prices

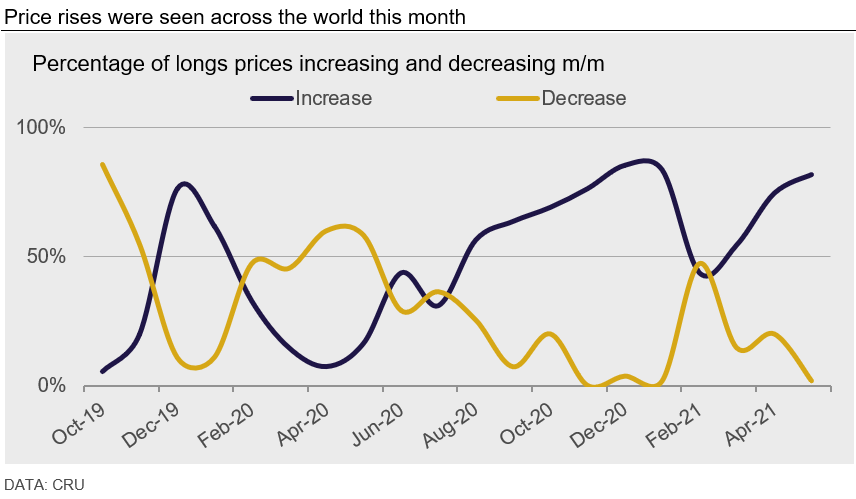

Higher Chinese export prices have translated into rising prices elsewhere. Of the prices we publish, around 82% have increased while just 2% of prices fell. The biggest price rises were for Chinese export prices and Asia import prices, where most products increased by between 10-20%.

Outside Asia, strong demand supported higher prices. In Europe, buying activity has increased as buyers who deferred purchases expecting lower prices have been forced back to the market. Imports are too expensive, especially where safeguard quotas have filled. In the USA, demand is extremely strong and broad based. Similar to Europe, imports are hard to find, increasing the reliance on domestic mills and strengthening their pricing power—particularly for wire rod.

Outlook: Forward China Policy to Play a Big Role

The future direction of supply cuts in China is critical to global prices. If the policy expands to other regions and/or the Tangshan cuts are continued at the current level in 2021 H2, high prices will be supported around the world for longer.

India is potentially a source of increased supply to export markets in the short term. Construction demand is being affected by the Covid-19 wave across the country and domestic producers are re-focusing on export markets in the short term to keep stocks balanced. However, Indian steel production may be affected if oxygen supplies continue to be diverted to medical facilities.

A final concern is around the high price levels observed in the market. This is starting to affect demand as some budgets are limited, especially for private construction projects. Finance is becoming constrained and some end users have started to lobby governments for price controls. The most notable though is the Chinese government, which is concerned high commodity prices may overheat the economy. Any new Chinese policy designed to cool commodity prices could cause steel prices to fall.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com