CRU

January 15, 2021

CRU: China Macro Targets Bring Small Surprises

Written by Jumana Saleheen

By CRU Chief Economist Jumana Saleheen and CRU Economist Yingrui Wang

On March 5, the Chinese government announced its macroeconomic targets for 2021 and beyond. It reaffirmed our broad view that China is keen to withdraw policy support gradually and deliver a steady economic slowdown over the next five years. What we learned is that the withdrawal of policy support will be a little slower than we initially expected. We did not expect a growth target to be set for 2021. Our interpretation is that the over 6% GDP target for 2021 was announced to reassure markets that growth has returned to pre-COVID-19 rates, which are well above the low of 2020.

Key Announcements at a Glance

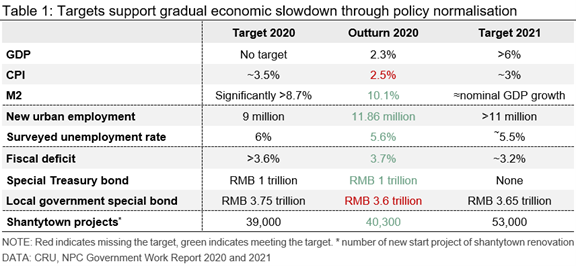

The major macro announcements from the Government National People Congress (NPC) reaffirmed our view that China is keen to withdraw policy support gradually and deliver a gradual economic slowdown over the next five years. By sustainable we mean from an environmental and financial stability perspective. The headline macro targets for 2021 can be seen in the final column of Table 1.

GDP Growth Target Set for 2021, No Targets for the Next Five Years Yet

The announcement of a GDP target of above 6% for 2021 was news to us. In the expectations we set out earlier this week, we did not expect a GDP growth target for 2021, as we believed that such an announcement would be meaningless, given that all major forecasters expect Chinese GDP to grow by ~ 8% in 2021. We interpret the GDP growth rate target for 2021 as reassurance to global markets that China is back to its pre-COVID-19 growth rates. In other words, the low growth of 2.3% in 2020 was a one off. Growth will recover in 2021.

In the draft of the 14th Five-Year Plan (FYP) released separately, China omitted a numerical GDP growth target over the period of 2021 to 2025 (it was set at 6.5% in the 13th FYP). Instead, it states it would keep its average annual growth over the next five years in a “reasonable” range. In our own forecast we have Chinese growth averaging 5.5% over the next five years.

Monetary Policy to Normalize Ahead of Fiscal Policy

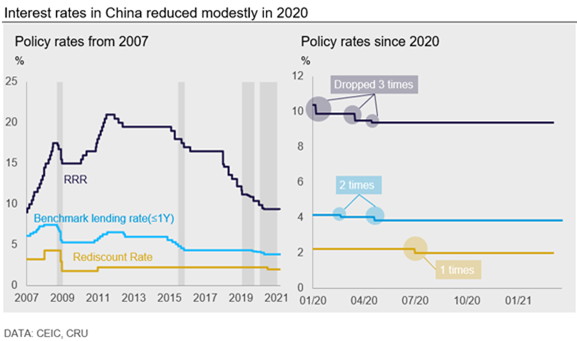

No surprise on the pace of monetary policy normalization: China has several monetary policy instruments that it uses to support credit to the economy. The charts below show that while different policy rates have been eased in China during 2020, the reduction has been small (30 basis points) compared to say the U.S. Fed funds rate (150 basis points) A. Instead, China has moved the dial on monetary easing by increasing the quantity of credit it provides to companies and households. In 2020 it did so by setting a growth target for lending by large commercial banks to micro and small businesses at 40%. The target for 2021 has been lowered to 30%. We expect this to gradually reduce the credit provision and slow down the rate of increase in corporate debt.

Fiscal support reduced, but towards the top end of expectations: We had expected the size of fiscal stimulus to drop in 2021. It has. However, the pace of easing is a little less aggressive than we had thought. We expected the quota on local government special bonds to be set between RMB3 to 3.75 tn, compare to the quota of RMB3.75 tn in 2020. In the event it was set at RMB3.65 tn – towards the upper end of our expected range. The reduction of the quota from last year is small.

The target for fiscal deficit ratio reduced from 3.6% in 2020 to 3.2% in 2021. That is also worth a comment. Prior to COVID-19, a deficit ratio of 3% was a red line that the government did not want to cross. If we look back to pre-COVID-19 the fiscal deficit target was set at 2.6% in 2018, rising to 2.8% by 2019. We interpret the 3.2% fiscal deficit target for 2021 as signaling that stimulus will be withdrawn at a modest pace. As with all economies after COVID-19, a balance needs to be struck between withdrawing fiscal support at a pace that does not compromise the economic recovery.

Minor Surprises from Today’s Announcements

On March 5, we received announcements from China’s top legislature about the direction of policy for 2021. Overall, they were in line with our narrative. We do not expect these findings to have any substantive impact on our China macro and end-use forecasts. One thing we learned today is that the pace of withdrawing policy support will be slower than expected. That is good news for securing a strong and sustained recovery in China.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com