Market Data

January 12, 2021

SMU Market Trends: Opinions on Steel’s Highs and Lows

Written by Tim Triplett

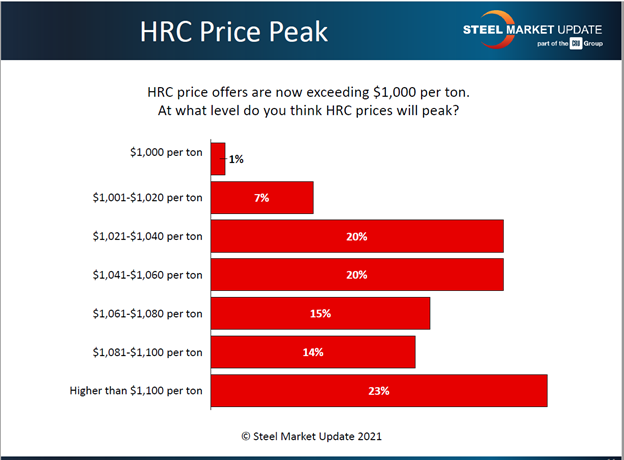

Hot rolled steel prices are venturing into uncharted territory as an unprecedented combination of variables—idled capacity, short supplies, limited imports and an economy that’s surprisingly strong despite the pandemic—keep pushing them higher. Assuming that today’s record-high prices are unsustainable for the long-term, Steel Market Update asked in its survey last week: At what level do you think HRC prices will peak?

Responses from service center and OEM executives were all across the board. Calculated as a weighted average, the group was predicting a peak around $1,065 per ton as of last week. That prediction is already out of date, as SMU’s check of the market this week puts the price for HRC at a record $1,080 a ton–and rising. Nearly one-quarter said they believed prices will top $1,100 a ton. The consensus of steel buyers polled by SMU this week points to a peak closer to $1,200 a ton.

“Multiple steel mill reps have informed us that their HRC base is $1,100 when they open up their order books,” said one buyer last week. “Right now, the mills can charge whatever they want. They are off in their own world,” commented another.

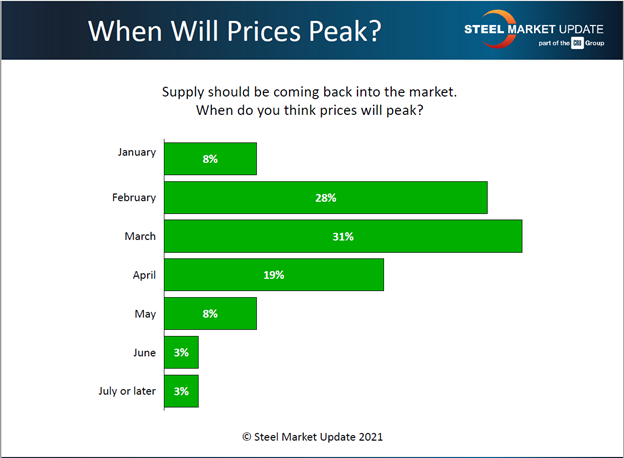

When Will Prices Peak?

SMU also asked: When do you think HRC prices will peak? The majority of respondents put the beginning of the correction in the February/March timeframe, though nearly one-third predict it won’t happen until April or later. “The higher the numbers go, the sooner they will peak,” observed one steel executive.

How Low Will They Go?

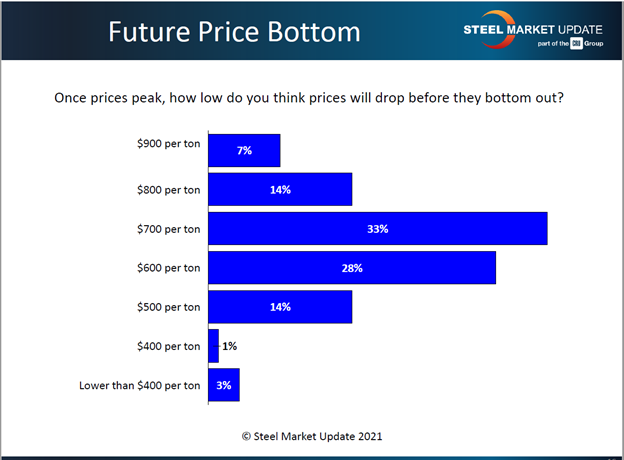

While there’s much speculation about how much higher steel prices can possibly go, and when they will begin to turn around, there’s been little discussion about the magnitude of the likely correction.

SMU’s questionnaire last week asked: Once prices peak, how low do you think they will go before they bottom out? Very few, less than 20 percent, believe prices are likely to descend from the current record high levels of nearly $1,100 to unprofitably low levels of $500 per ton or less. Another 20 percent expect prices to moderate to a still healthy range from $800-900 a ton. The majority, the remaining 60 percent, put the next bottom at an optimistic $600-700 a ton, in line with historical averages.

As one respondent noted: “There are a still lot of upward price drivers in the market—global demand is greater than active supply, raw material supplies are constrained, etc.” Added another: “Raw material costs will decline but still be historically high. Distributors will try to keep prices from falling too fast to save inventory values. But ultimately, prices will fall to more traditional market levels.”