CRU

January 8, 2021

CRU: U.S. Zinc Demand Starts 2021 on a More Solid Footing

Written by Helen O’Cleary

By CRU Analyst Helen O’Cleary, from CRU’s Zinc Monitor January 2021

After a turbulent start to 2021 for U.S. politics, President Biden begins his term with the unenviable task of bringing the Covid-19 outbreak under control and supporting the nascent U.S. economic recovery. He plans to start with a $1.9 trillion Covid relief plan and will then seek approval for a second spending initiative, including the Build Back Better infrastructure bill. Biden has reportedly confirmed that he will not immediately remove tariffs imposed by Trump on steel imports in 2018, which should mean that the U.S. steel industry can continue to benefit from current high prices on the back of capacity cutbacks last year and restocking in recent months as the auto sector has started to recover.

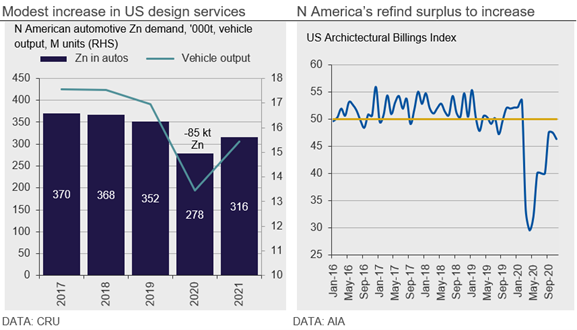

Daily Covid-19 cases in the USA are beginning to decrease, but remain at high levels. However, the manufacturing sector continues to recover well. We estimate that almost 80,000 t of zinc-related auto demand was lost in North America in 2020, the majority of which was in the USA. And, while the auto sector will continue to recover this year, we only expect around half of these losses to be regained. However, the construction sector continues to perform strongly and the long-awaited infrastructure bill, if passed, should also be positive for zinc demand later this year.

We hear that the start to the year has been positive in terms of spot demand. However, we believe that this strength is partly due to some consumers having concluded 2021 long-term contracts for lower volumes in order to gain sourcing flexibility in what is expected to be a better-supplied market. That said, there is a good deal of optimism for demand this year and order books are beginning to look fuller for future months, suggesting that growth momentum could be sustained going forward. Our Steel Sheet team is forecasting a 10.4% y/y increase in U.S. galvanized sheet output this year, following 2020’s 13.2% y/y contraction, reflecting the expectation that vehicle output will not fully recover this year and that the construction sector may falter. The forward-looking Architectural Billings Index signaled that the construction sector was recovering at a different pace across sections and regions in September-November 2020 and this suggests that the recovery this year could be bumpy, although construction-related demand in H1 is expected to remain firm.

North America Refined Output is Expected to Outpace Demand Growth in 2021

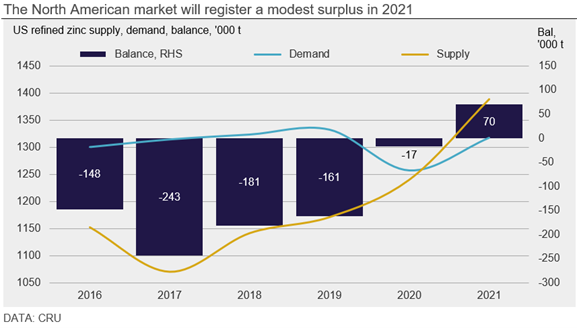

We estimate that North American smelter output grew by 6.0% y/y in 2020, to 1.24 Mt, with growth in the USA and Mexico more than offsetting a 4.0% y/y decline in Canadian refined production. The expectation of stronger growth in 2021 with Peñoles and AZR lifting utilization rates has put downward pressure on U.S. metal premia. We hear that at the end of 2020, some long-term contract premia fell towards 6.0 ¢/lb, having started closer to 8.0¢/lb at the beginning of negotiations. We assessed 2020 long-term premia to be around 8.0 c/Ib, but believe that the average for 2021 was closer to 7.0¢/lb.

As in previous periods of global metal surplus, metal shipments to the USA have picked up. U.S. refined zinc net imports increased by 14% y/y in January-November 2020, with lower imports from Canada and Peru being more than offset by higher imports from Brazil, Belgium, Australia and South Korea. Some of this metal may account for the ~67,000 t of off-warrant metal in the USA, as reported by the LME in November 2020.

Imports aside, we expect the North American market to be in a structural surplus in 2021, for the first time since 2010. If this 70,000 t surplus stays within North America, it will decrease the region’s reliance on imports, although it is likely that surplus metal from other regions will still find a home in U.S. warehouses.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com