CRU

January 8, 2021

CRU: More Scrap Markets Hit Record-High Levels as Prices Soar

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley, from CRU’s Steel Metallics Monitor

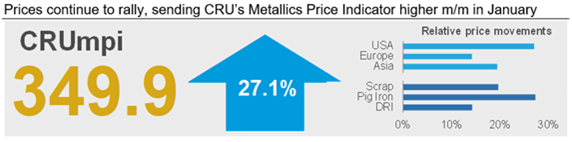

The CRU metallics price indicator (CRUmpi) rose by 27.1% m/m in January to 349.9 after metallics prices rose notably in every market we cover. As this is the second month of large price increases, many markets are now at, or nearly at, record highs. While there is still some upside price momentum moving into February, we expect that many markets have either reached a peak or will do so soon.

Metallics prices across the globe again rose substantially m/m in January, hitting either decade-long or all-time highs in many regions. Rising prices for metallics have been driven by continued strength in end-use steel demand and seasonally tighter scrap markets. After climbing strongly in the U.S. in December, a subsequent price hike in January has resulted in an increase, in some cases, of over $200 /l.ton compared to November, which is the largest 60-day price increase on record. Prices in Europe are now also at their highest levels since 2011. Both Brazilian and Russian domestic prices are again at all-time highs, while those across Asia also rose notably m/m. Pig iron prices are up, but Chinese buyers are now redirecting cargoes to the U.S. market to take advantage of the high-price environment there.

With prices and demand high, competition between U.S. domestic mills has increased and this has been compounded by rising scrap prices abroad. As a result, any material that was not sold locally in regions like Pittsburgh was quickly sent to the U.S. East Coast for export. On the supply side, higher prices are translating into increased flow into dealers’ yards. In Europe, supply is less available to northern mills than it is for southern mills because of cargoes shipped to the latter from the UK. As such, Spanish mills were unwilling to pay the for scrap on the higher end of offered ranges, but overall pricing was up notably m/m.

Brazilian and Russian domestic scrap prices hit another all-time high in January. In Brazil, end-use construction demand remains robust, which allowed steel mills to push for another 12% increase in long steel prices in January. Steelmakers are working with extended lead times and full order books for the months ahead and continue to demand high scrap volumes. In Russia, typical difficulties for scrap collection and delivery during winter were further exacerbated by a two-week holiday. Domestic mills were also pressured to pay more for scrap given increased competition from exporters.

In Asia, scrap prices continued to rise due to market tightness. However, demand conditions have been mixed depending on country. Japanese mills are lifting steel production levels, but mills elsewhere are mulling cutbacks amid rapidly rising costs and lukewarm demand conditions. In China, the Lunar New Year holiday, transportation restrictions, and a cold snap across much of the country is limiting scrap supply while underlying demand remains firm.

Ore-based metallics markets have been quite active in December/January as U.S. buyers continued to make purchases and Chinese traders took advantage of the high price environment. While Chinese buyers themselves were largely away after having secured more than enough volume for 2021 Q1, traders are diverting most available prompt shipments to the U.S. market and are trying to sell low-priced pig iron inventories sitting in China to the USA.

Outlook: Price Rallies are Starting to Lose Steam

With prices in many regions at, or nearly at, multi-year highs, suppliers are now well incentivized to bring scrap into the market. Flows in the U.S. are rapidly rising and may place downside pressure on February pricing. We expect a similar situation to occur in Europe. Chinese steel demand may cool in the near future, and we expect this to help loosen markets globally.

Still, there is some upside price pressure in other parts of the world like Russia and Brazil where construction demand is likely to stay strong. Overall, while we do not forecast a price crash for February, we do think that metallics markets are at or are close to a peak.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com