Product

January 6, 2021

SMU Price Ranges & Indices: Hot Rolled Tops $1,000

Written by Brett Linton

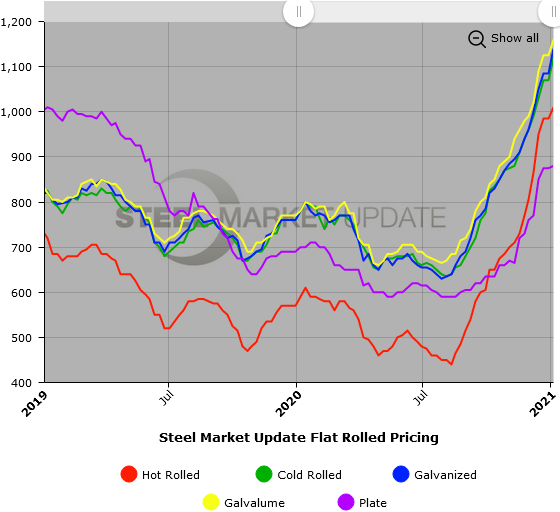

Flat rolled steel prices have started the new year strong, jumping by another $25-55 per ton and taking the benchmark hot rolled price above $1,000, within sight of the record high of $1,070 per ton seen in 2008. With steel still in tight supply and ferrous scrap prices likely to increase again in January, Steel Market Update’s Price Momentum Indicators continue to point toward higher prices in the next 30 days.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $990-$1,030 per net ton ($49.50-$51.50/cwt) with an average of $1,010 per ton ($50.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to one week ago, while the upper end increased $10. Our overall average is up $25 from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 6-10 weeks

Cold Rolled Coil: SMU price range is $1,080-$1,160 per net ton ($54.00-$58.00/cwt) with an average of $1,120 per ton ($56.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to last week, while the upper end increased $60. Our overall average is up $50 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 7-12 weeks

Galvanized Coil: SMU price range is $1,100-$1,180 per net ton ($55.00-$59.00/cwt) with an average of $1,140 per ton ($57.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $50 per ton compared to one week ago, while the upper end increased $60. Our overall average is up $55 from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,169-$1,249 per ton with an average of $1,209 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 8-13 weeks

ARTICLE CONTINUES BELOW

{loadposition reserved_message}

Galvalume Coil: SMU price range is $1,120-$1,200 per net ton ($56.00-$60.00/cwt) with an average of $1,160 per ton ($58.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week, while the upper end increased $50. Our overall average is up $35 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,411-$1,491 per ton with an average of $1,451 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-12 weeks

Plate: SMU price range is $850-$910 per net ton ($42.50-$45.50/cwt) with an average of $880 per ton ($44.00/cwt) FOB delivered to the customer’s facility. The lower end of our range increased $10 compared to one week ago, while the upper end remained unchanged. Our overall average is up $5 from last week. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 6-9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.