Prices

December 23, 2020

SMU Price Ranges & Indices: Flat Rolled Up Another $35-40

Written by Brett Linton

Steel Market Update has heard reports of buyers paying well over $1,000 a ton to secure much-needed hot roll, but the average from respondents to SMU’s poll this week puts the HR price at around $985 per ton (among those who have managed to find available steel). With demand persisting despite year-end seasonality and mill lead times continuing to extend, hot rolled prices are widely expected to surpass $1,000 in the coming weeks. As a point of reference, hot rolled hit a record high of $1,070 per ton in July 2008 (before plummeting to just $390 by May 2009 during the Great Recession). Overall, flat rolled steel prices rose by another $35-40 per ton in the past two weeks. Recent price hikes announced by the plate mills appear to be gaining traction as plate prices rose by an additional $25 per ton. SMU’s Price Momentum indicators continue to point toward higher steel prices over the next 30 days.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $950-$1,020 per net ton ($47.50-$51.00/cwt) with an average of $985 per ton ($49.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to one week ago, while the upper end increased $40. Our overall average is up $35 from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 6-10 weeks

Cold Rolled Coil: SMU price range is $1,040-$1,100 per net ton ($52.00-$55.00/cwt) with an average of $1,070 per ton ($53.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $60 per ton compared to last week, while the upper end increased $20. Our overall average is up $40 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 7-12 weeks

Galvanized Coil: SMU price range is $1,050-$1,120 per net ton ($52.50-$56.00/cwt) with an average of $1,085 per ton ($54.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $50 per ton compared to one week ago, while the upper end increased $20. Our overall average is up $35 from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,119-$1,189 per ton with an average of $1,154 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 8-13 weeks

Galvalume Coil: SMU price range is $1,100-$1,150 per net ton ($55.00-$57.50/cwt) with an average of $1,125 per ton ($56.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to last week, while the upper end increased $30. Our overall average is up $35 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,391-$1,441 per ton with an average of $1,416 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-12 weeks

Plate: SMU price range is $840-$910 per net ton ($42.00-$45.50/cwt) with an average of $875 per ton ($43.75/cwt) FOB delivered to the customer’s facility. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $50. Our overall average is up $25 from last week. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 5-8 weeks

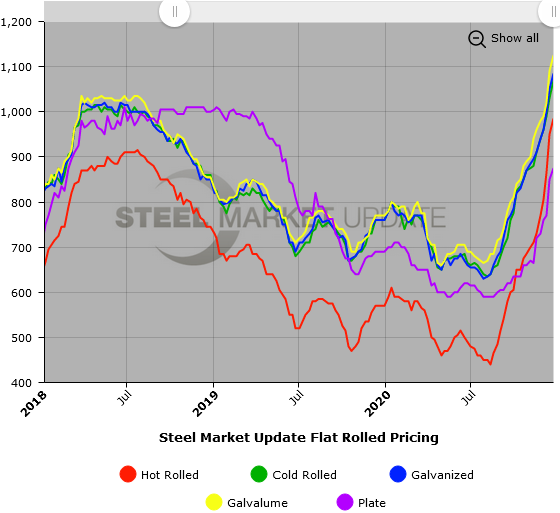

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.