Market Data

December 17, 2020

SMU Energy Analysis through December

Written by Brett Linton

Steel Market Update is please to share this Premium content with Executive members. For more information on upgrading to a Premium level subscription, email Info@SteelMarketUpdate.com.

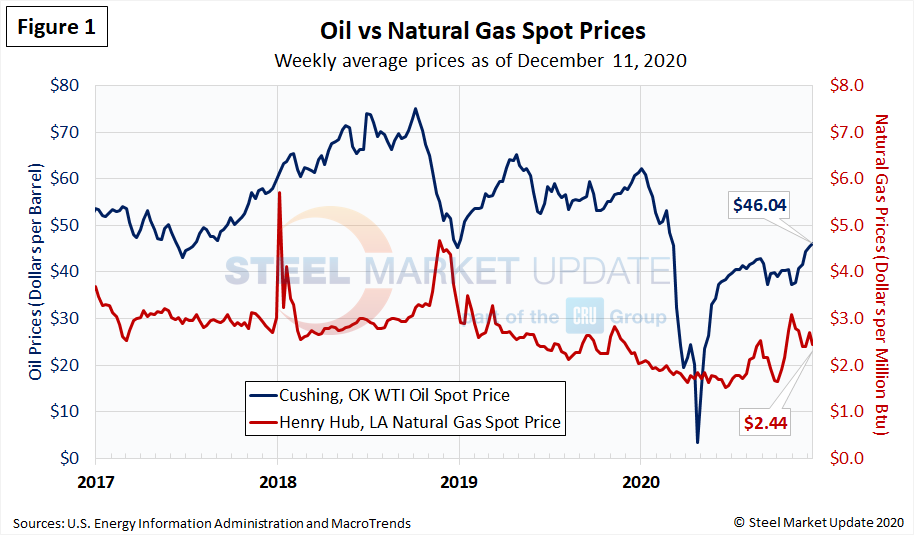

The Energy Information Administration’s Dec. 8 Short-Term Energy Outlook remains subject to heightened levels of uncertainty because responses to COVID-19 continue to evolve. Reduced economic activity from the pandemic has caused changes in 2020 energy demand and supply patterns and will continue to affect these patterns in the future. EIA expects high oil inventory levels and surplus production capacity to limit upward pressure on prices in 2021. U.S. crude oil production is expected to decline in 2021 as declining production rates at existing wells will outpace production from newly drilled wells. EIA expects natural gas spot prices to rise into 2021 due to rising demand, rising exports and reduced production.

Spot Prices

The spot market price for West Texas Intermediate (WTI) has risen since early-November, at $46.04 per barrel as of Dec. 11. Natural gas at the Henry Hub in Oklahoma was priced at $2.44 per MMBTU (million British Thermal Units) as of last week, down from the annual-high previously reported in late-October.

Rig Counts

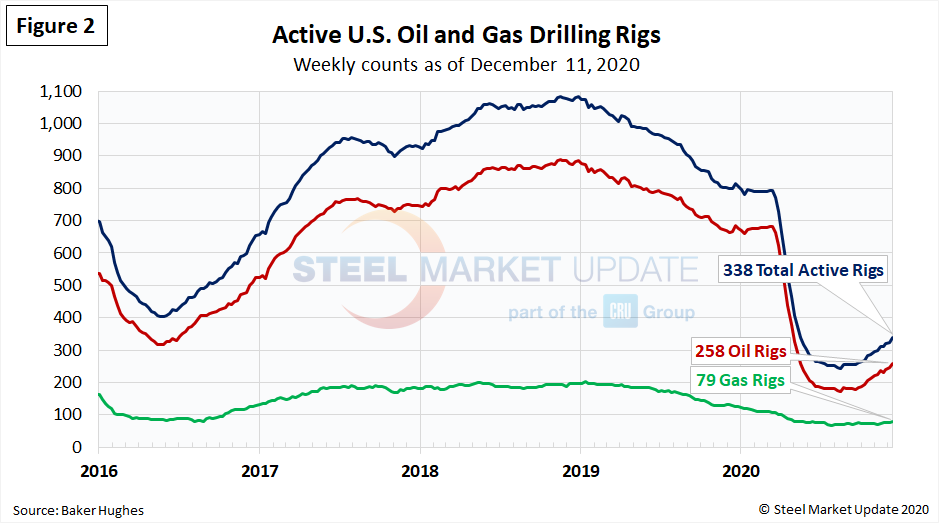

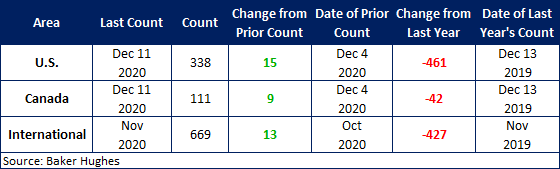

The decline in active U.S. rigs drilling for oil and gas flattened in late-August and has continued to improve each week since. Last week there were 338 active drill rigs, comprised of 258 oil rigs, 79 gas rigs and 1 miscellaneous rig, according to the latest data from Baker Hughes (Figure 2). While up over recent months, active drill rigs are down 57 percent from the March peak of 793 rigs, just prior to the coronavirus shutdowns. The table below compares the current U.S., Canada and International rig counts to historical levels.

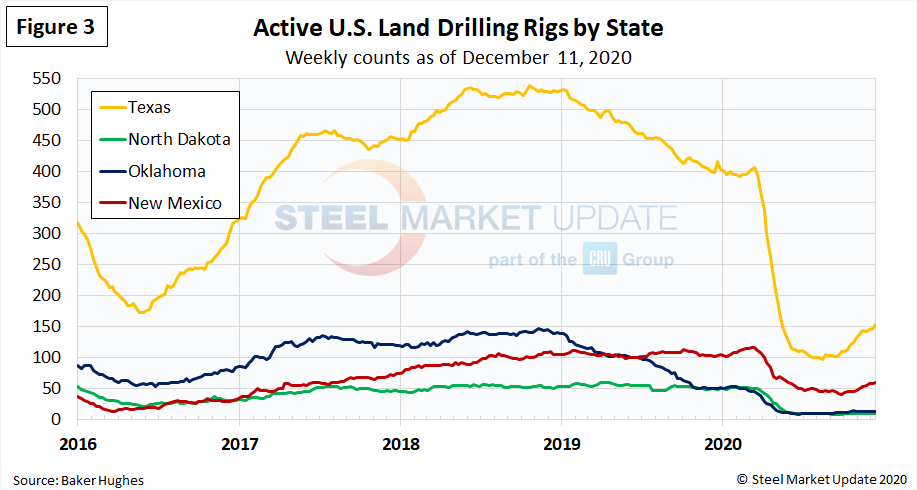

U.S. oil and gas production are heavily concentrated in Texas, Oklahoma, North Dakota and New Mexico, which have all seen declines of 49 to 78 percent since mid-March. The most active state, Texas, now has 154 active rigs in operation, the highest level seen since early May 2020. Texas rigs had plummeted from 407 in mid-March to 97 rigs in mid-August (Figure 3).

Stock Levels

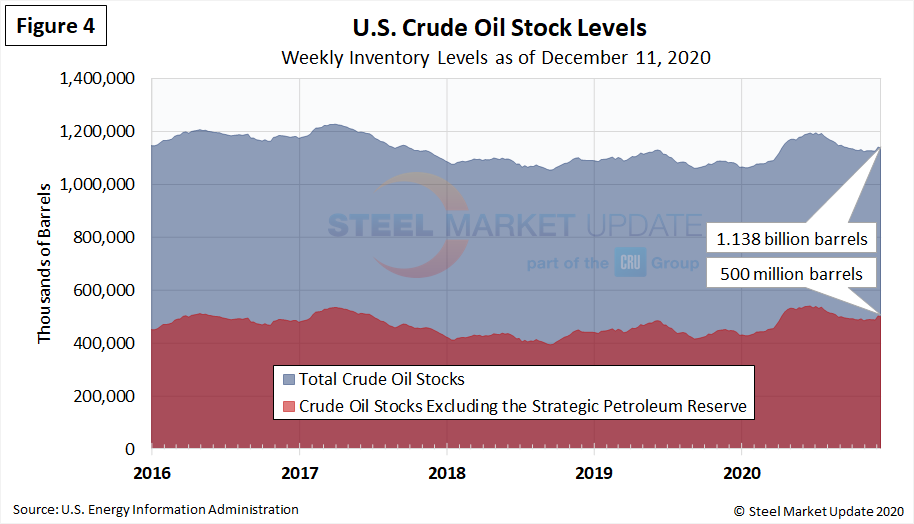

U.S. total crude oil stocks in 2020 had surged from mid-March through July, then steadily declined through October. The latest level is 1.138 billion barrels as of Dec. 11, up from 1.066 billion barrels at the beginning of the year (Figure 4).