CRU

December 17, 2020

CRU: Russian Scrap Export Tariffs to Up Pressure on EU, U.S. Scrap Markets

Written by Chris Asgill

By CRU Principal Analyst Chris Asgill, from CRU’s Steelmaking Raw Materials Monitor

Russia will impose tariffs of 5% ferrous scrap exports, with a minimum rate of €45 /t ($55 /t), for a period of six months. The country states that these are to protect the domestic metallurgical industry from supply shortages and high prices. As shown in the latest CRU Steel Metallics Monitor (here, for subscribers of this service), Russian domestic scrap prices have reached record highs in recent months. Large scrap procurement plans from domestic steel mills, seasonally restricted supply due to winter weather and surging international steel prices have all played a part in these price gains.

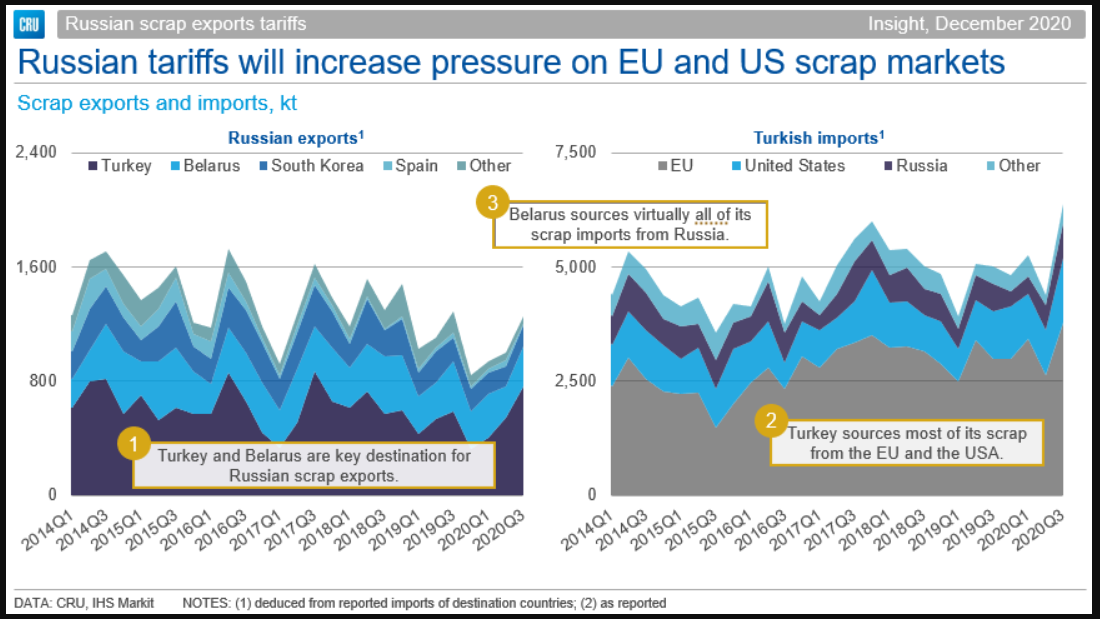

Russian scrap exports are mostly destined for Turkey and Belarus (see chart below). While Belarus sources virtually all of its scrap imports from Russia, Turkey imports mostly from the EU and the U.S. Buyers in both markets will need to look elsewhere for their scrap, as such a tariff will make Russian material uneconomical. To put this into context, the size of the minimum rate is around 12% of current international CFR scrap prices. Because the minimum is a fixed level, this percentage will increase sharply when international prices come off unsustainable highs.

As these imports seek volumes elsewhere, this will place increasing strain on other scrap markets, most notably in the EU and the U.S., and will likely provide greater support for global scrap prices. Even before these tariffs were announced, scrap markets globally had tightened due to the ongoing recovery from the depths of the Covid-19 pandemic. Additionally, following recent announcements that China will be allowing scrap imports again, we understand that Chinese buyers are actively in the market seeking volumes – though it is not entirely clear yet what will be required for imports to actually take place there. Russia was the eighth largest scrap exporter in 2019, exporting nearly 4 Mt (~5% of global scrap trade), so its effective exclusion from the international market will tighten conditions further.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com